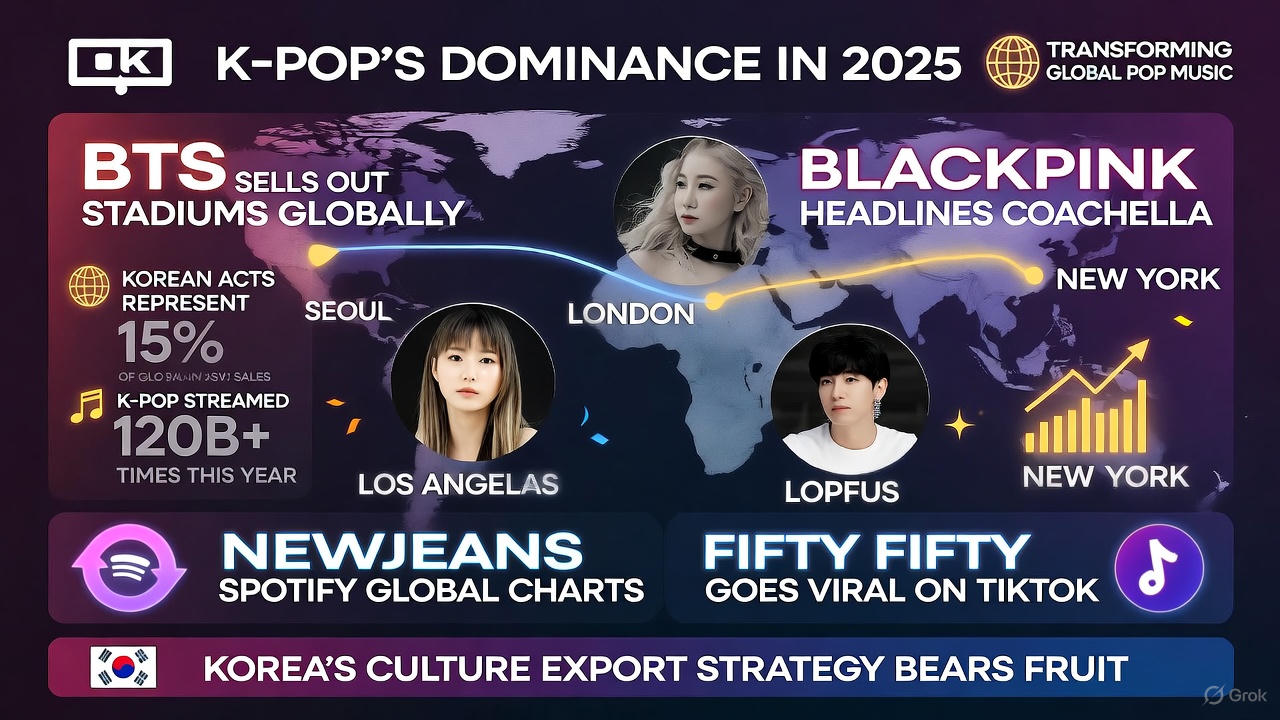

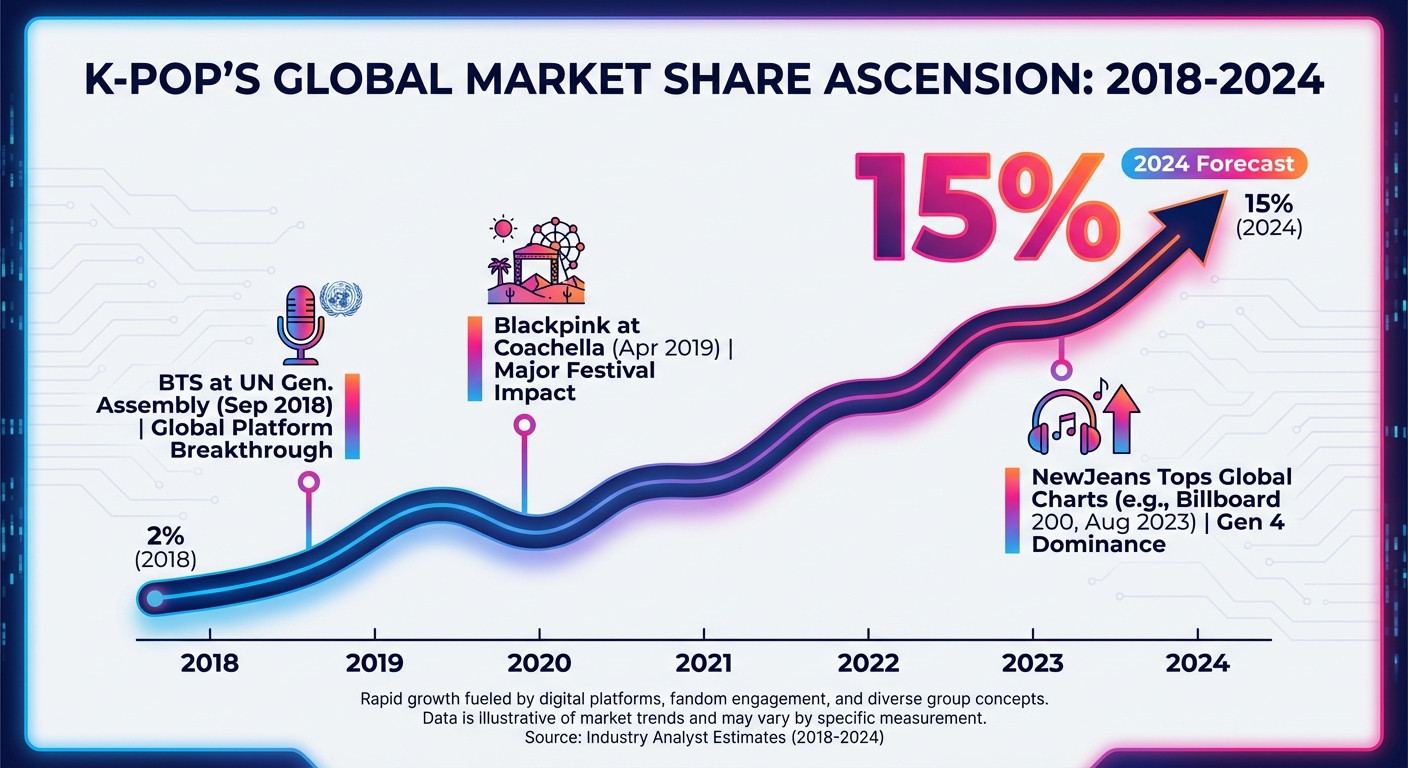

BTS sold out stadiums on six continents. Blackpink headlined Coachella. NewJeans dominated global streaming charts. Concert tickets have become precious commodities, and K-pop tours are among the most sought-after. Korean acts now represent 15% of worldwide music sales, up from just 2% in 2018. If you mentioned K-pop a decade ago, most Americans would have drawn a blank. Today, it’s not niche. It’s just pop music.

This didn’t happen by accident. South Korea spent decades building an industrial-scale music export machine backed by government funding, ruthless training systems, and strategic global expansion. And they’re nowhere near done.

The Numbers Behind the Takeover

The K-pop industry generates $10 billion annually in export revenue. Six of the top 10 most-followed musicians on Instagram are Korean acts. Concert tours sell out globally in seconds, not minutes. When BTS announced their 2023 hiatus, South Korea’s stock market actually dropped.

These aren’t random viral hits. This is strategic cultural export treated as national infrastructure. The Korean government has invested billions through the Korean Creative Content Agency, subsidizing production facilities and offering tax incentives. It’s industrial policy applied to boy bands, and it’s working better than anyone imagined.

The Factory System That Produces Stars

K-pop’s success runs on a talent development machine that makes Western record labels look amateurish. Scouts identify kids as young as 10. Selected trainees enter multi-year programs involving 12 to 16 hours of daily training in vocals, dance, foreign languages, and media handling. Every aspect of their lives gets controlled: diet, appearance, behavior, even dating.

Only a tiny fraction ever debut. The ones who make it are insanely polished from day one. Western pop stars develop over albums. K-pop idols arrive fully formed, dancing in perfect synchronization and speaking three languages fluently. The system is brutal, but the results are undeniable.

How They Conquered the Globe

The expansion wasn’t organic. It was methodical. First, dominate Asia. Second, leverage social media to build organic international fandoms. Third, collaborate with Western artists for crossover credibility. Fourth, release English-language tracks to crack radio playlists. Fifth, localize the model by opening training centers in the US and Europe.

The engine driving all of this? The fans. K-pop stans aren’t passive listeners. They’re organized activists who run streaming parties, crowdfund Times Square billboards, and translate content for global audiences. This participatory culture creates emotional investment that Western pop rarely achieves. The music itself is designed for universal appeal: visually spectacular, genre-blending, and produced to absurdly high standards.

The Cost of the Machine

The industry’s success comes with serious ethical problems. Idols face crushing mental health pressure. Depression and suicide rates have sparked calls for reform. “Slave contracts” binding trainees for years with minimal pay are being challenged in court. Many artists have zero creative freedom and face invasive personal control, including dating bans.

The industry is slowly reforming under public pressure, but the human cost remains dangerously high. For every group that makes it big, hundreds of trainees wash out after years of sacrifice with nothing to show for it.

The Bottom Line

K-pop figured out how to industrialize stardom and export it worldwide. It’s backed by government strategy, perfected production systems, and mobilized fanbases that function like unpaid marketing teams. While the industry wrestles with its treatment of creators, its global dominance shows no signs of slowing. The next phase? K-pop groups with international members performing in multiple languages, but still built on Korea’s proven model. Western labels are watching nervously as Seoul beats them at their own game.

Sources: Global music industry data, Korean cultural export statistics, entertainment market analysis.