Just when you thought the streaming wars couldn’t get messier, Paramount Skydance went nuclear. On Monday, David Ellison’s newly combined entertainment company launched a hostile $108.4 billion bid for Warner Bros Discovery, going directly to shareholders after President Trump signaled that Netflix’s proposed acquisition could face antitrust “problems.”

“We’re really here to finish what we started,” Ellison told CNBC, a remarkably blunt statement for what amounts to corporate warfare against one of Hollywood’s oldest studios.

The timing is no coincidence. Netflix had seemingly won a weeks-long bidding war on Friday, securing a $72 billion equity deal for Warner Bros Discovery’s film studios, TV operations, and streaming assets. That victory lasted approximately 48 hours before Trump threw a grenade into the negotiations.

What Trump Said and Why It Matters

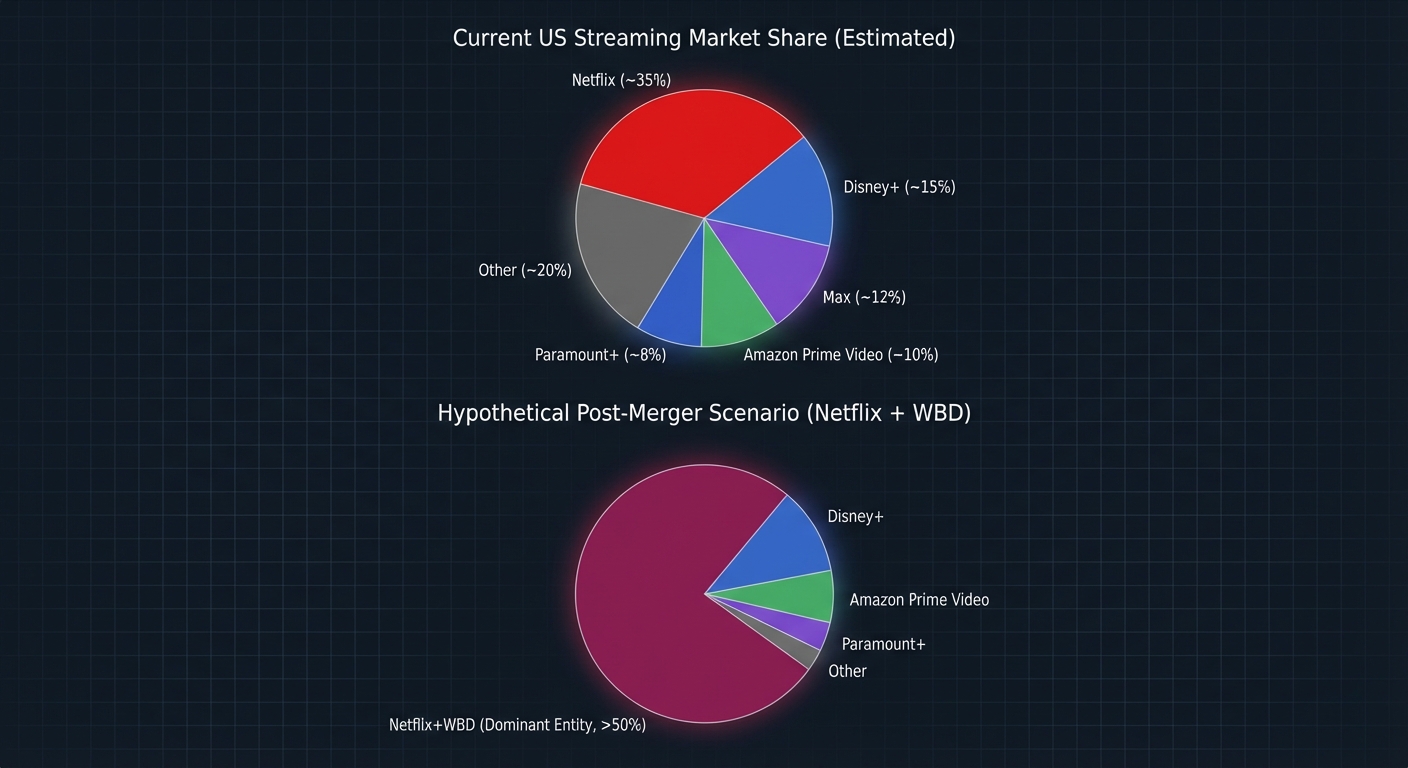

On Sunday, President Trump told reporters that Netflix buying Warner Bros could be an antitrust “problem” and that he would “be involved” in the approval process. “Netflix has a very big market share, and when they have Warner Brothers, you know, that share goes up a lot,” Trump said.

The Justice Department’s antitrust division could argue that a combined Netflix-Warner Bros entity would exceed the traditional 30% market share threshold that often triggers regulatory scrutiny. Whether that argument would succeed in court is debatable, but the uncertainty alone creates an opening for competitors.

Bets on prediction marketplace Polymarket showed the chance of Netflix closing its acquisition by the end of 2026 dropping to 23%, down from around 60% before Trump’s comments. That kind of odds shift tells you everything about how seriously the market is taking the regulatory threat.

Paramount’s Power Play

Ellison isn’t just opportunistically attacking a wounded competitor. He’s betting that his company’s smaller size and friendly relationship with the Trump administration will make his deal the path of least resistance.

“We’ve had great conversations with the President about this, but I don’t want to speak for him,” Ellison said Monday. His father, Larry Ellison, is a billionaire technology magnate with close ties to Trump, a connection that presumably doesn’t hurt when navigating Washington.

The offer itself is straightforward: $30 per share in cash for all of Warner Bros Discovery. Unlike Netflix’s equity-based deal, Paramount’s bid is all cash, backstopped by the Ellison family’s personal fortune. The company has also secured $54 billion in funding commitments from Bank of America, Citi, and private equity firm Apollo Global.

Going hostile means Paramount is bypassing Warner Bros Discovery’s board entirely and appealing directly to shareholders. It’s an aggressive move that signals Ellison believes he can win over investors who might prefer certainty over a Netflix deal that could spend years in regulatory limbo.

Hollywood Unites Against Netflix

Here’s where things get really interesting: there appears to be genuine bipartisan opposition to the Netflix deal that has nothing to do with market share calculations.

The Writers Guild of America, Producers Guild of America, and Directors Guild of America have all publicly criticized the potential Netflix-Warner merger. Their concerns center on what further consolidation would mean for creative workers in an industry already reeling from layoffs and production cutbacks.

That opposition gives political cover to lawmakers from both parties who might want to intervene. When entertainment unions, which typically lean Democratic, align with a Republican administration skeptical of big tech consolidation, the political dynamics shift dramatically.

What Happens Next

Warner Bros Discovery shareholders now face a genuinely difficult choice. Netflix’s offer was higher in total value and came from a company with proven streaming execution. But regulatory uncertainty could mean years of waiting with no guarantee of approval.

Paramount’s offer is lower but comes with the promise of faster regulatory clearance and actual cash rather than Netflix stock. For shareholders who’ve watched WBD’s stock languish for years, the bird in hand argument has real appeal.

The next few weeks will determine whether Warner Bros Discovery’s board engages with Paramount or continues backing the Netflix transaction. If Ellison can demonstrate strong shareholder support for his hostile bid, the board may have little choice but to negotiate.

The Bottom Line

Monday’s hostile bid is the latest chapter in what’s becoming the most dramatic restructuring of the entertainment industry since the original streaming revolution. Just as Hollywood’s reboot obsession reflects a changing industry, these mega-mergers are reshaping who controls the content. Netflix’s dominance created a generation of competitors who are now consolidating out of necessity. Disney bought Fox. Amazon bought MGM. Warner merged with Discovery.

But a combined Netflix-Warner Bros would be something different entirely: a single company controlling roughly half of the streaming content Americans watch, plus the studio infrastructure that creates much of Hollywood’s output.

Whether that combination ever gets approved, or whether Paramount swoops in to create a different media giant, the entertainment industry’s future is being decided in real time. For David Ellison, the son of a tech billionaire who just bought his way into Hollywood earlier this year, this hostile bid is either the move that transforms him into a media mogul or an expensive lesson in corporate overreach. The deal, like many private equity transactions, depends on aggressive financial engineering.

Either way, it’s going to be fascinating to watch.

Sources: CNBC, Polymarket, Writers Guild of America, Producers Guild of America, Directors Guild of America.