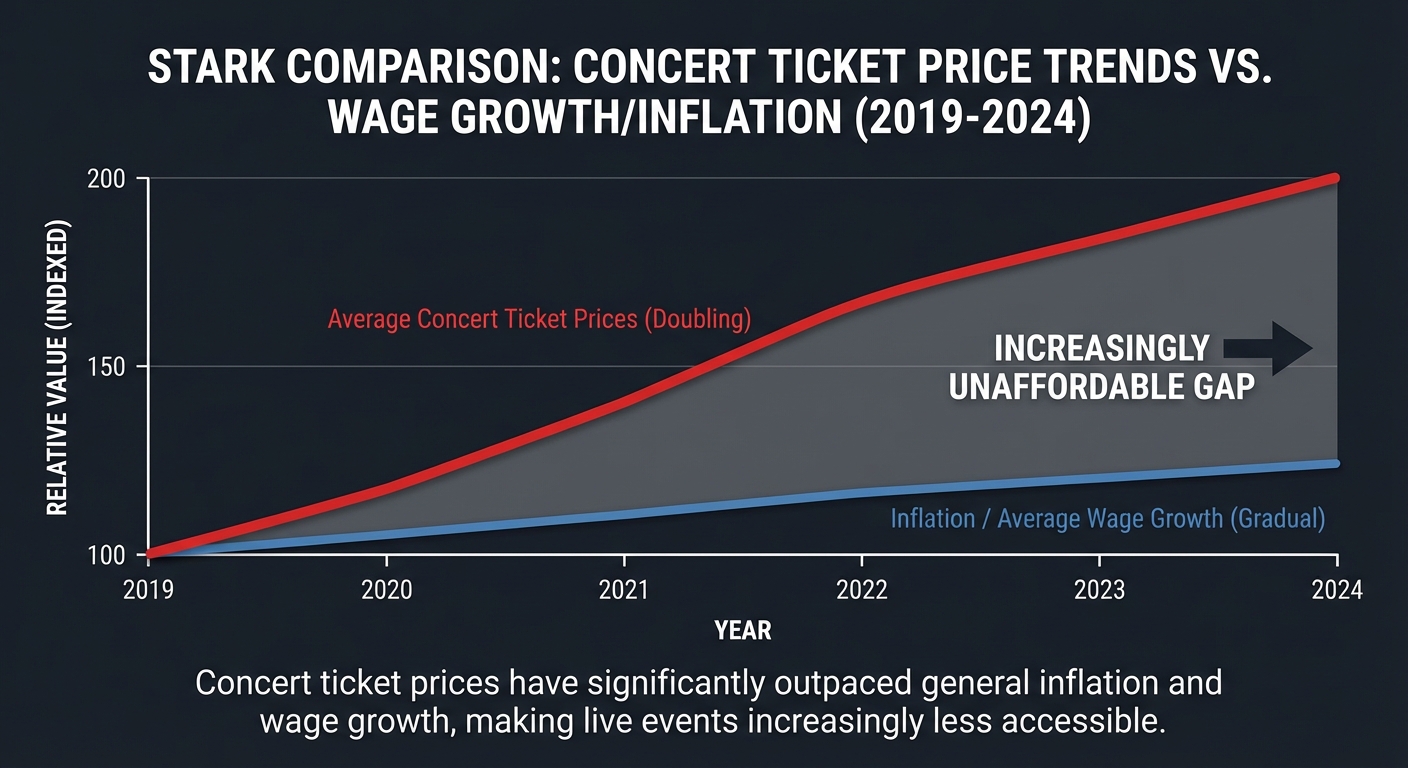

Taylor Swift’s Eras Tour broke the internet and broke the illusion that the live music market functions properly. Tickets listed at $150 were resold instantly for $5,000. The same happened with Beyoncé, Bad Bunny, and virtually every major act. Ticket prices have doubled since 2019, far outpacing inflation. This is yet another example of private equity-style extraction from an industry that used to serve fans.

This crisis results from a perfect storm: monopoly power, predatory technology, and a fundamental shift in how artists make money. And nobody with the power to fix it seems interested in trying.

Why Prices Exploded

When streaming killed album sales, touring became artists’ primary income source. Prices rose to reflect that tours are now the product, not the advertisement for albums. But dynamic pricing, where ticket costs fluctuate like airline seats, has pushed face-value tickets into the stratosphere.

Fans now compete not just with each other but with algorithms designed to extract maximum willingness to pay. Ticketmaster’s “platinum” pricing adjusts in real time based on demand, turning popular shows into auctions where ordinary fans get priced out before they even have a chance.

The Monopoly Problem

Live Nation and Ticketmaster merged in 2010, creating a vertical monopoly controlling venues, artist management, and ticketing. This lack of competition means zero incentive to improve fan experience or lower fees. Fees can add 30% or more to ticket prices, turning a $100 ticket into $130 at checkout.

Despite DOJ scrutiny and multiple congressional hearings, the company remains intact, controlling the infrastructure of live entertainment. Without competition, there’s no market pressure to change. The monopoly extracts maximum value because it can.

The Bot Economy

Automated scalping bots buy thousands of tickets in milliseconds, creating artificial scarcity. While the BOTS Act made this illegal in 2016, enforcement is virtually nonexistent. Platforms often profit from resale fees, creating perverse incentives to look the other way.

Verified fan programs and pre-sales were supposed to solve this. Instead, they’ve become additional hoops that bots navigate better than actual fans. The arms race between ticketing platforms and scalpers is being won by the scalpers, with fans paying the price.

What Needs to Happen (But Won’t)

The solutions are clear but politically unlikely. Break up Live Nation’s monopoly. Strictly regulate resale markets and cap fees. Actually enforce anti-bot laws with real penalties. Require transparent all-in pricing instead of surprise fees at checkout.

None of this is happening. The company has powerful lobbyists. Politicians talk big during hearings but pass no legislation. Until the government forces structural change, this is the new normal. Live music is becoming a luxury good accessible only to the wealthy or those willing to go into debt for a three-hour experience.

The Bottom Line

The concert ticket market is broken by design. Monopoly power, algorithmic pricing, and unchecked scalping have turned live music into an inaccessible luxury. Artists see little of the inflated prices. Fans get gouged. Only middlemen win. Without serious antitrust action or regulatory intervention, expect prices to keep climbing while the experience keeps getting worse. The K-pop industry may have its problems, but at least fans can still afford to see their favorite acts.

Sources: U.S. Department of Justice, Billboard, U.S. Government Accountability Office.