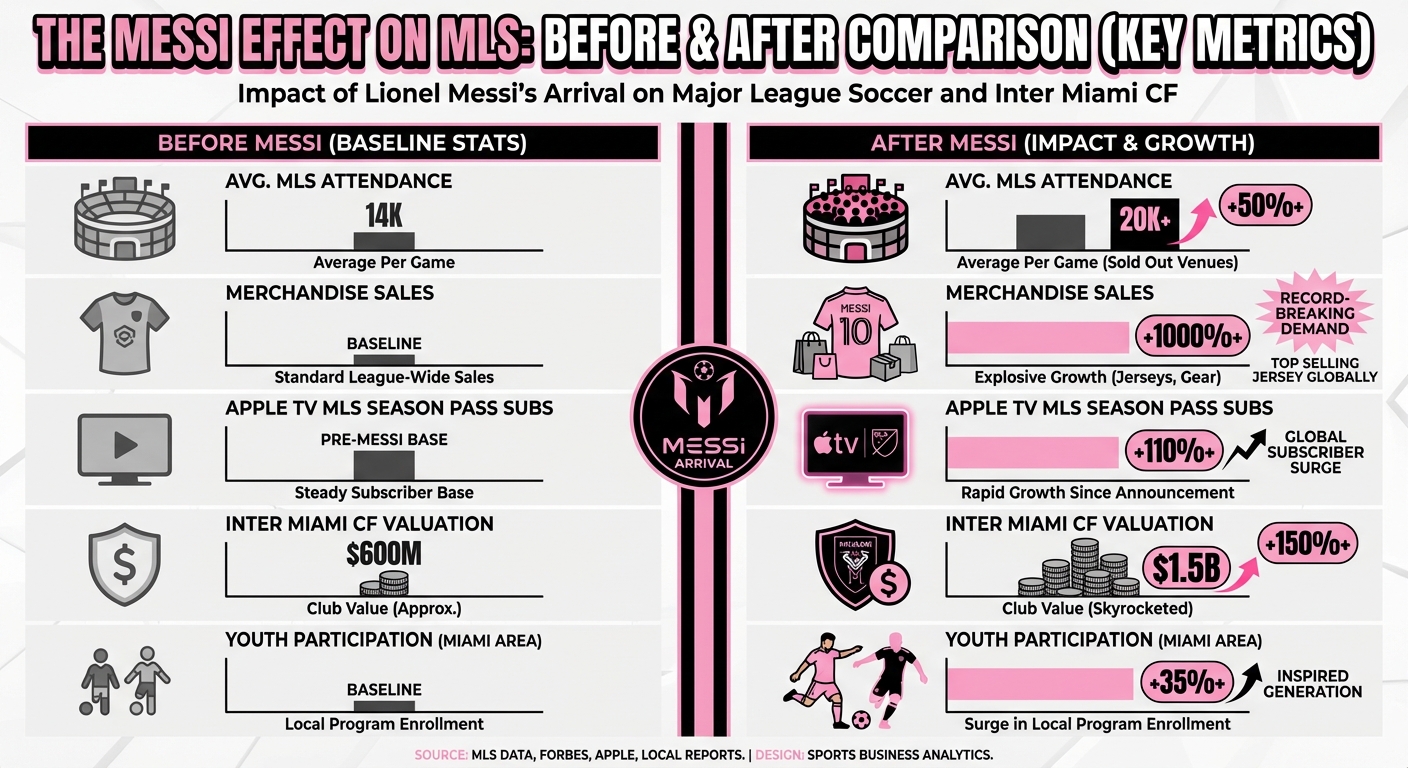

When Lionel Messi signed with Inter Miami in July 2023, it was expected to be a boost for American soccer. Instead, it was an explosion. In his first six months, Messi generated an estimated $1.03 billion in economic impact for Miami and the league. Ticket sales spiked 68%, merchandise sales shattered records (1 million jerseys in three months), and Inter Miami’s franchise value more than doubled to $1.5 billion.

Every team he visited saw record attendance and revenue. Apple TV+ subscriptions for MLS Season Pass surged 110%, justifying Apple’s $2.5 billion investment almost immediately. The “Messi Effect” wasn’t just marketing hype; it was a seismic financial event that transformed the perception and economics of American soccer overnight.

The Numbers Are Staggering

The raw data tells the story. Inter Miami went from averaging 14,000 fans per game to selling out every match at 20,000+. Away games featuring Miami broke attendance records in nearly every city. Teams that rarely sold out were suddenly packing stadiums just to watch Messi warm up.

Merchandise sales exploded across the league. The pink Inter Miami jersey became one of the best-selling sports jerseys in North America, outselling many NFL and NBA teams. Youth soccer participation in Miami spiked 35% within six months. Parents who’d never watched MLS were signing their kids up for soccer leagues because of Messi.

The Cultural Shift

Culturally, the transformation was equally dramatic. Mainstream sports media, which largely ignored MLS for decades, started leading broadcasts with Messi highlights. ESPN, FOX Sports, and even international broadcasters covered Inter Miami matches like major events. The perception of MLS shifted from “retirement league for washed-up Europeans” to “the league where the greatest player of all time chose to play while still elite.”

This perception change lifted the entire league. Franchise values rose across the board as investors recognized MLS’s potential with proven star power. New sponsors like Audi signed $200 million deals. The global visibility of MLS reached unprecedented levels, with Messi’s matches broadcast in over 100 countries.

Apple Won the Bet

Apple’s $2.5 billion bet on MLS streaming rights looked risky when announced. Messi made it look brilliant. The 110% surge in Apple TV+ MLS Season Pass subscriptions in Messi’s first six months validated the entire investment. Apple got exactly what it paid for: a global superstar who drives subscriptions and mainstream attention.

The streaming model also means every Messi match is accessible nationwide, not restricted to local markets. Fans in Seattle can watch Miami play on Wednesday nights. This national accessibility, combined with Messi’s star power, is building a truly national MLS fanbase for the first time.

The Sustainability Question

The big question is what happens when Messi retires. Will fans stay? Optimists point to the infrastructure built: new stadiums being planned, increased media coverage, youth players inspired to take up soccer. Pessimists warn of a post-sugar-high crash when the greatest player ever leaves and casual fans lose interest.

The reality is likely in the middle. MLS will settle at a higher baseline, permanently elevated by the Messi era, even if current hysteria naturally fades. The league gained mainstream credibility and visibility it can build on. Young players saw that MLS can attract the absolute best, changing the perception of the league’s ceiling.

The Bottom Line

Messi’s move to MLS is the most successful sports business transaction in modern history. He didn’t just join a team; he elevated an entire sport in the world’s biggest media market. For a few years, American soccer caught lightning in a bottle, and the landscape will never look the same. Whether the long-term impact matches the immediate explosion depends on what MLS does with this opportunity, but one thing is certain: Messi gave them a chance they never had before.

For more transformative moments in sports, read about LeBron’s billion-dollar business empire and cricket’s push into American markets.

Sources: MLS financial reports, Apple TV+ subscriber data, sports business analysts.