IBM just dropped $11 billion on a company most people outside of Silicon Valley have never heard of, and that might tell you everything you need to know about where enterprise technology is headed.

On Monday, IBM announced it would acquire Confluent, the data streaming platform built on Apache Kafka, for $31 per share in an all-cash deal. That’s a 35% premium over Friday’s closing price, and it represents IBM’s biggest acquisition since it paid $34 billion for Red Hat back in 2019. Confluent shares surged 29% on the news.

So why is IBM betting so big on a company that essentially moves data around? The answer lies in the dirty secret of enterprise AI: your model is only as good as the data feeding it.

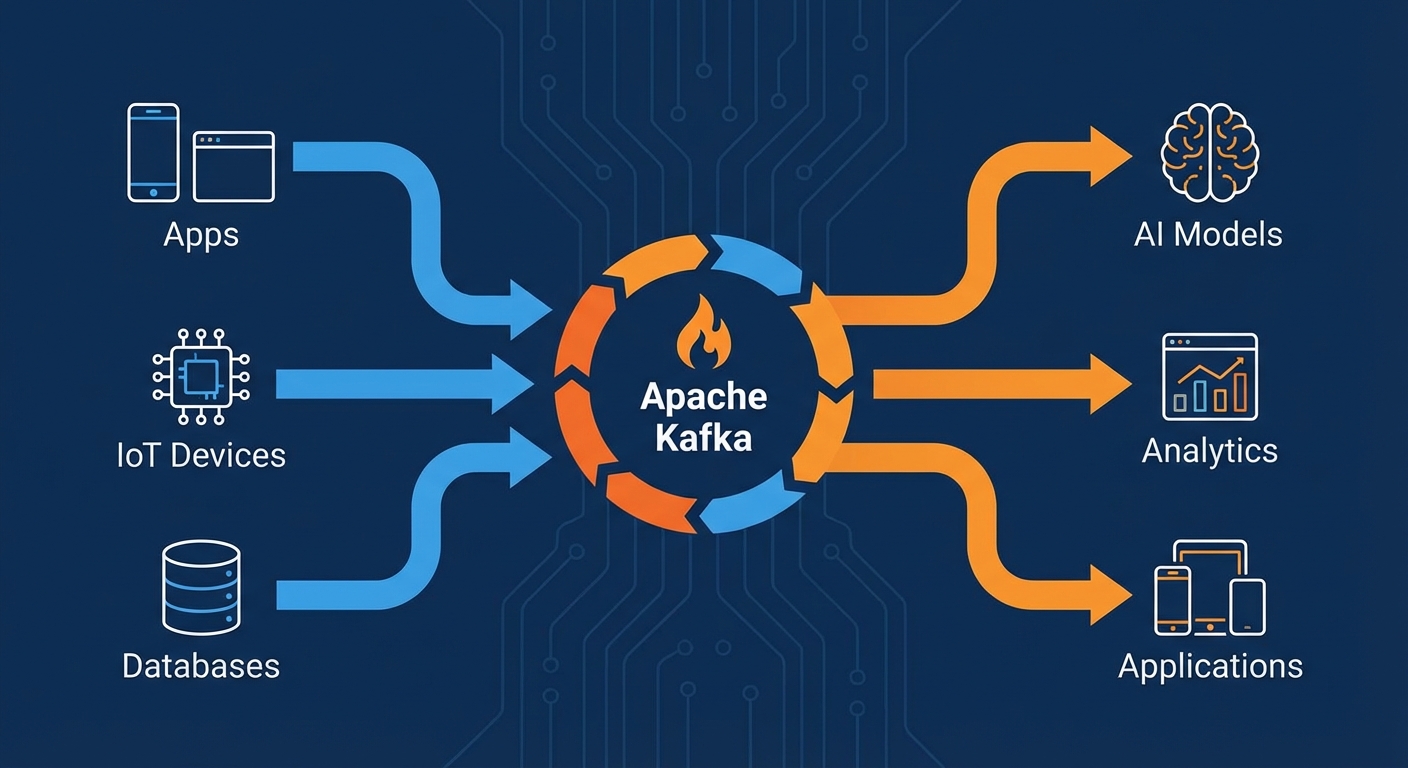

What Confluent Actually Does

If you’ve ever wondered how companies like Netflix know what to recommend you in real time, or how banks detect fraud the moment it happens, the answer often involves something called event streaming. Confluent built its business on Apache Kafka, an open-source platform that processes data as it flows, rather than sitting in static databases waiting to be queried.

Think of it as the difference between a still photograph and a live video feed. Traditional databases give you snapshots. Confluent gives you the continuous stream.

The company has more than 6,500 clients across major industries, including partnerships with Anthropic, AWS, Google Cloud, Microsoft, and Snowflake. In other words, it’s already deeply embedded in the infrastructure that powers modern AI systems.

Why This Deal Makes Sense for IBM

IBM CEO Arvind Krishna framed the acquisition in terms that will sound familiar to anyone following the AI infrastructure race: “With the acquisition of Confluent, IBM will provide the smart data platform for enterprise IT, purpose-built for AI.”

The logic here is straightforward. Generative AI and the emerging wave of “agentic AI,” where AI systems can take actions autonomously, both depend on continuous access to fresh, high-quality data. A large language model trained on last year’s information is already outdated. The systems that will actually transform enterprise operations need to process information as it happens.

IBM has been positioning itself as the enterprise AI company for years, with its watsonx platform targeting the same Fortune 500 customers that already run on IBM infrastructure. But AI without data is like a sports car without fuel. Confluent gives IBM ownership of the pipes that feed the engine.

The Numbers Behind the Bet

The deal values Confluent at roughly $11 billion, a significant premium to its $8.14 billion market cap before the announcement. IBM plans to fund the acquisition with cash on hand, and expects it to close by mid-2026, pending shareholder and regulatory approval.

Here’s the interesting part: Confluent’s largest shareholders, who collectively hold about 62% of the voting power, have already agreed to vote in favor of the deal. That suggests the company’s investors see IBM’s offer as the best outcome, even with the AI-data infrastructure space heating up.

This also marks IBM’s second major acquisition in the past year. The company completed its $6.4 billion purchase of HashiCorp, another infrastructure software provider, just in February 2025 after navigating regulatory review. That deal took over a year to close, which may explain why IBM’s announcement specifically mentioned the mid-2026 timeline.

What This Means for the AI Infrastructure Race

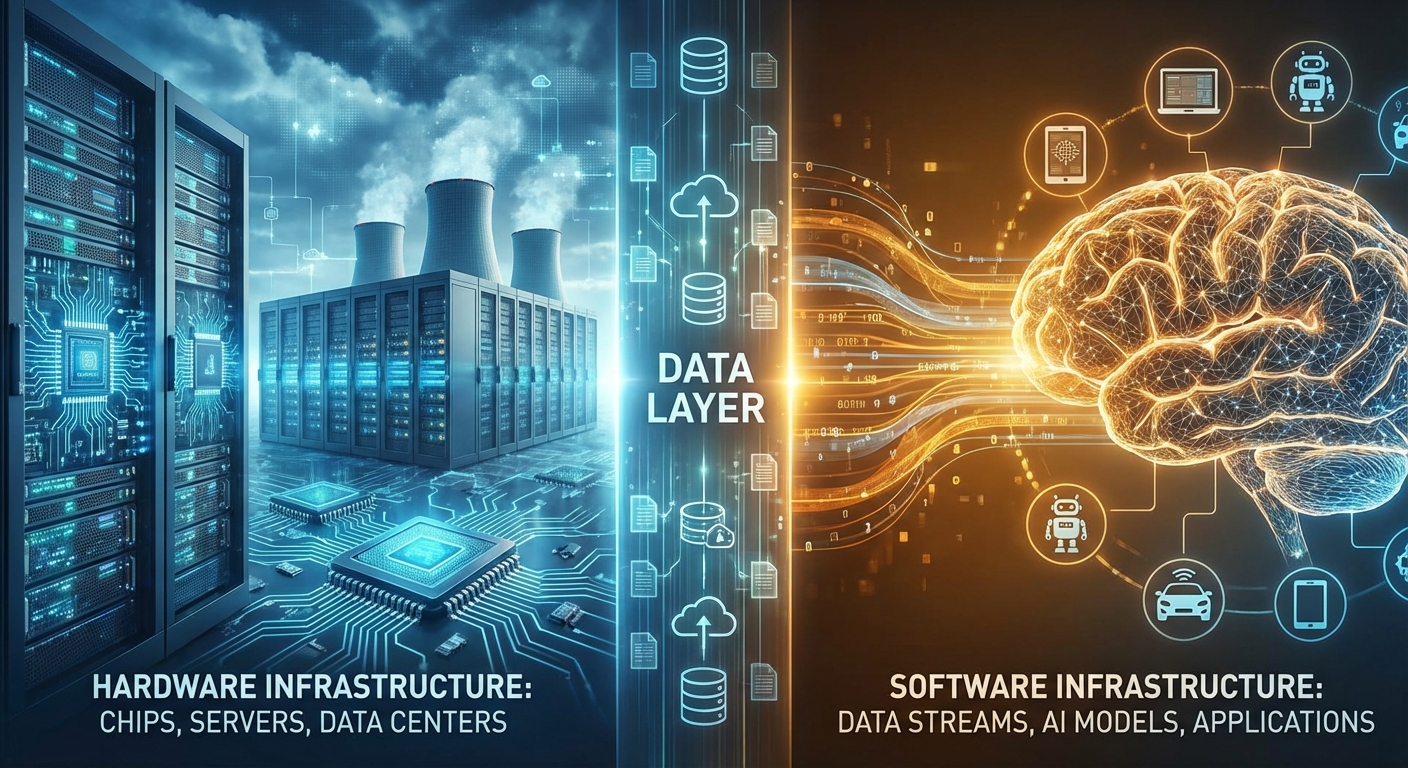

IBM isn’t the only major player recognizing that AI’s future depends on data infrastructure. The broader trend here is a race to own different layers of the AI stack, from chips to models to the data systems that connect everything.

Consider what we’ve seen in just the past few months: Nvidia invested $2 billion in Synopsys for AI-driven chip design tools. AWS unveiled its Trainium3 chips to compete with Nvidia on AI training hardware. And now IBM is paying $11 billion for the company that helps enterprises manage real-time data.

The pattern is clear. Every major technology company is trying to secure strategic positions in the AI supply chain. The question for investors and customers alike is whether these bets will pay off, or whether the AI boom will follow the same consolidation-then-disruption cycle we’ve seen in previous technology waves.

The Bottom Line

IBM’s $11 billion bet on Confluent isn’t really about buying a data streaming company. It’s about positioning for a future where enterprise AI systems need constant access to real-time information, and where the companies that control that data flow will have significant leverage.

Whether this deal transforms IBM’s competitive position or simply adds another integration challenge to its sprawling portfolio remains to be seen. What’s certain is that the infrastructure beneath enterprise AI is becoming just as strategic as the models themselves.

The transaction is expected to close by mid-2026. In the meantime, IBM’s stock rose about 1% on the news, suggesting investors see this as a reasonable price for a strategic asset. The real verdict will come when we see whether IBM can actually turn all that real-time data into real-time AI value for its enterprise customers.