Hours before Jensen Huang took the stage to unveil NVIDIA’s Vera Rubin platform, AMD CEO Dr. Lisa Su delivered her own message at CES 2026: the AI race is far from over, and AMD is playing to win. In a two-hour keynote that touched everything from gaming CPUs to government supercomputers, Su made clear that AMD sees NVIDIA’s dominance as a challenge to overcome, not a fait accompli to accept.

The presentation, held at the Palazzo Ballroom in the Venetian, covered an ambitious range of announcements. New Ryzen processors for gamers. New AI accelerators for data centers. New partnerships with the federal government. And perhaps most pointedly, direct performance comparisons between AMD’s upcoming MI450 and NVIDIA’s just-announced Vera Rubin. If NVIDIA’s keynote was about expanding into new markets, AMD’s was about competing fiercely in existing ones.

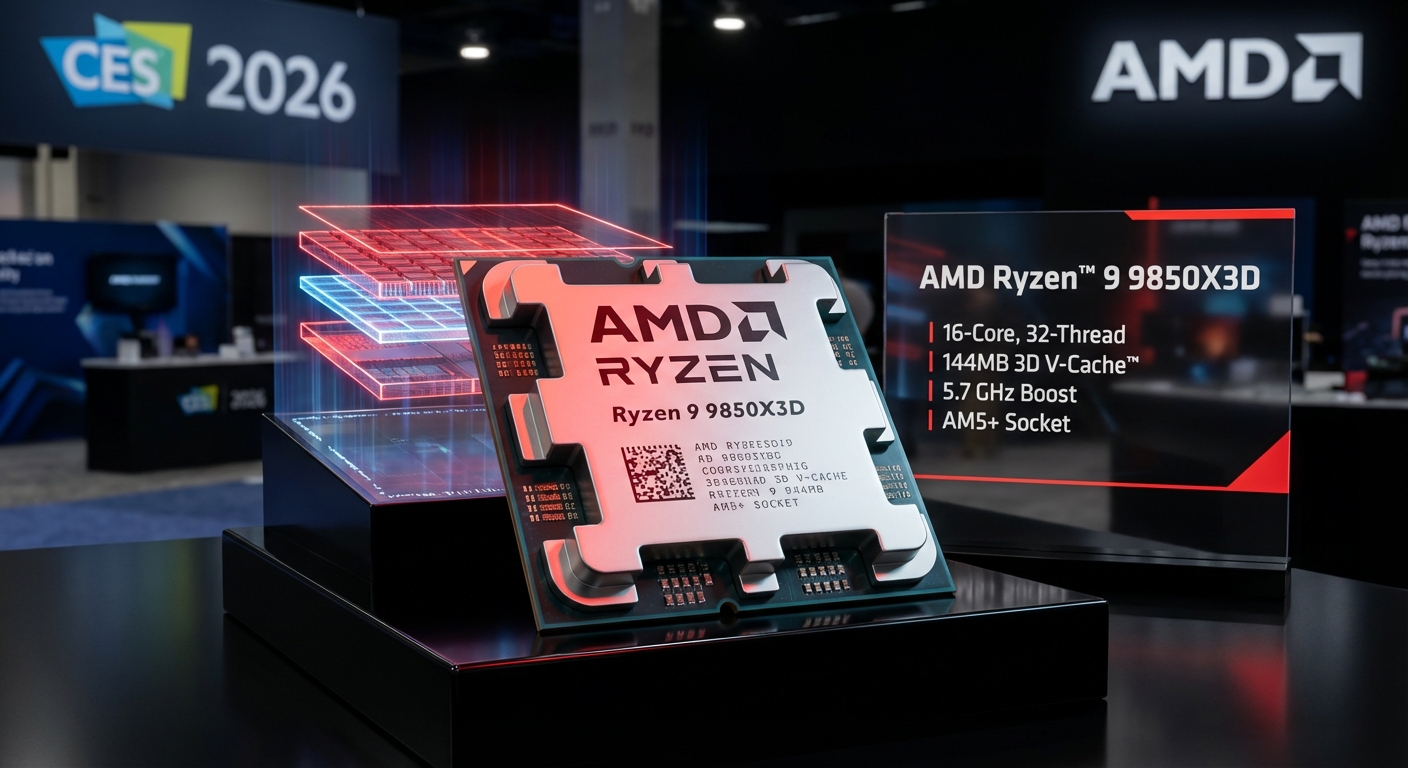

The Ryzen 9850X3D: Gaming’s New Champion

For PC gamers, the headline announcement was the Ryzen 7 9850X3D, the long-awaited successor to AMD’s dominant gaming processor line. The chip uses 3D V-Cache technology to vertically stack additional cache memory, a approach that has made AMD’s X3D processors the undisputed leaders in gaming performance.

The 9850X3D features 8 cores reaching boost speeds up to 5.6GHz, with a combined 104MB of L2 and L3 cache. That represents roughly a 400MHz clock speed improvement over the previous 9800X3D, which AMD says translates to approximately 2-3% better gaming performance. The improvement sounds modest, but when you’re already at the top, incremental gains matter.

The chip arrives at an interesting moment for PC gaming. Console generations are stretching longer, making high-end PCs increasingly attractive for serious gamers. Cloud gaming services are improving but still can’t match local hardware for latency-sensitive titles. And the rise of AI upscaling technologies like DLSS and AMD’s own FSR means that even mid-range GPUs can push high resolutions. The 9850X3D ensures AMD keeps its crown in the one market where it has consistently outperformed NVIDIA’s partner Intel.

Ryzen AI Max+ and the Laptop Push

Beyond desktop gaming, AMD unveiled the Ryzen AI Max+ series for laptops, a new line designed to bring serious AI processing power to mobile devices. The chips combine 40 compute units with lower core count CPUs, optimizing for AI workloads that benefit more from parallel processing than raw clock speeds.

The Ryzen AI 400 Series processors feature NPUs delivering up to 60 peak TOPS (trillion operations per second), a figure AMD highlighted repeatedly as competitive with anything else in the laptop market. For creative professionals running AI-assisted tools, developers testing machine learning models locally, or anyone who wants cutting-edge AI capabilities without cloud dependencies, the AI Max+ line promises desktop-class AI in a laptop form factor.

The laptop focus makes strategic sense. While NVIDIA dominates data center AI and maintains a strong position in gaming GPUs, the laptop market remains more competitive. Apple’s M-series chips have proven that integrated AI acceleration matters for mobile devices. AMD’s response is to ensure Windows laptops can match or exceed Apple’s AI capabilities, at least on the hardware side.

Taking on NVIDIA in the Data Center

The most aggressive portion of Su’s keynote came during the data center segment, where AMD presented preliminary performance comparisons between the AMD Instinct MI450 AI Rack and NVIDIA’s Vera Rubin Rack. The comparison, based on AMD engineering projections, suggested that AMD’s upcoming hardware could compete directly with NVIDIA’s flagship platform.

The MI450 represents AMD’s answer to NVIDIA’s dominance in AI training and inference. While NVIDIA controls an estimated 80%+ of the AI accelerator market, AMD has been steadily gaining ground with its Instinct line. Major cloud providers including Microsoft Azure and Google Cloud now offer AMD-based AI instances, and the company’s ROCm software stack has matured significantly.

Su highlighted that Absci, a drug discovery company, is moving to MI355X accelerators, with the extra memory expected to improve the rate of drug discovery. Healthcare and pharmaceutical AI represents a growing market where AMD can compete on specialized workloads rather than general-purpose training, where NVIDIA’s ecosystem advantages are strongest.

Government Partnerships and the Genesis Mission

Perhaps the most surprising segment of the keynote involved government partnerships that positioned AMD as a critical infrastructure provider for American scientific advancement. Su was joined on stage by Michael Kratsios, director of the White House Office of Science and Technology Policy, to announce AMD’s involvement in the Genesis Mission.

The public-private initiative aims to use AI for scientific discoveries across energy, climate, biotech, and aerospace. In collaboration with the U.S. Department of Energy, AMD is helping deliver two groundbreaking American supercomputers: Lux, expected to come online early this year, and the next-generation flagship Discovery system. These join existing AMD-powered supercomputers including El Capitan and Frontier.

The government angle serves multiple purposes for AMD. It provides revenue diversification beyond commercial data centers. It creates reference installations that validate AMD’s capabilities at extreme scale. And it positions AMD as a patriotic choice during a period of increasing concern about technology competition with China. When Su mentioned that Blue Origin was able to get the chips it needed for new flight computers within two months of starting a partnership with AMD, the message was clear: AMD delivers for America.

Healthcare AI and Drug Discovery

The keynote pivoted to healthcare, with three AI CEOs joining Lisa Su on stage to discuss how AMD hardware is accelerating medical breakthroughs. Sean McClain, CEO of AbSci, discussed how AI is transforming drug development, with AMD accelerators enabling faster screening of potential drug candidates.

Healthcare represents a strategic market for AMD’s AI ambitions. The workloads often require massive amounts of memory for processing genomic data, an area where AMD’s hardware architectures can offer advantages. The regulatory environment creates switching costs that favor established relationships. And the mission-driven nature of healthcare makes it less purely about benchmark numbers, allowing AMD to compete on factors beyond raw performance.

The Bigger Picture: AI Is Different

Su concluded her keynote with a statement that encapsulated AMD’s strategic vision: “This moment in tech not only feels different. AI is different. AI is the most powerful technology that has ever been created. And it can be everywhere for everyone.”

The “everywhere for everyone” framing deliberately contrasts with NVIDIA’s approach of premium platforms for premium customers. AMD is betting that AI will follow the pattern of previous computing revolutions, where technology initially concentrated in a few hands eventually democratizes. If that happens, the company offering capable hardware at accessible price points could capture enormous market share.

Whether AMD can execute on that vision remains uncertain. NVIDIA’s software ecosystem, particularly CUDA, creates significant switching costs. The company’s partnerships with hyperscalers are deep and expanding. And the Vera Rubin announcement suggests NVIDIA isn’t standing still on hardware either.

But CES 2026 made clear that AMD isn’t accepting runner-up status. From gaming CPUs to government supercomputers, Lisa Su presented a company attacking on every front. The AI race may have a clear leader, but it doesn’t have a predetermined winner. For AMD investors and customers, that competitive pressure is exactly what they want to see.