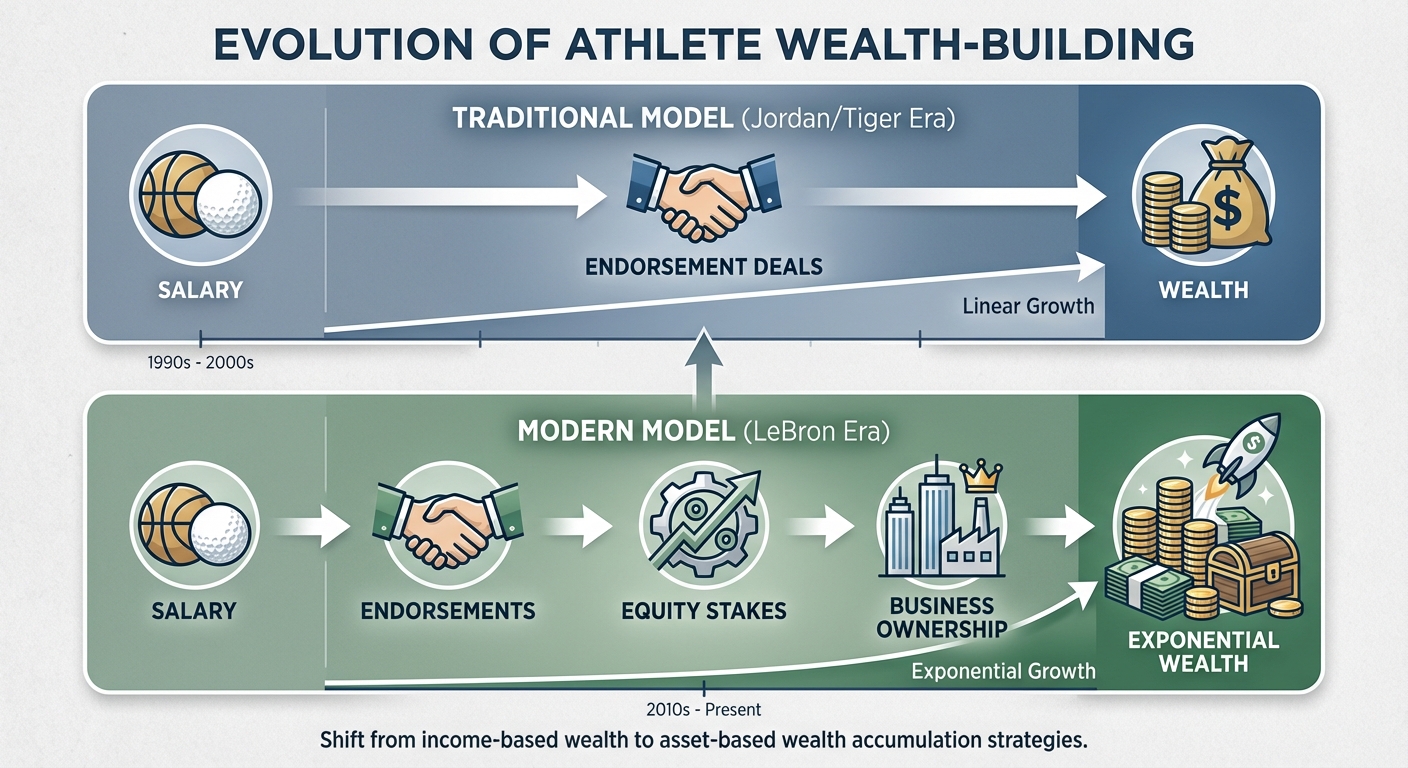

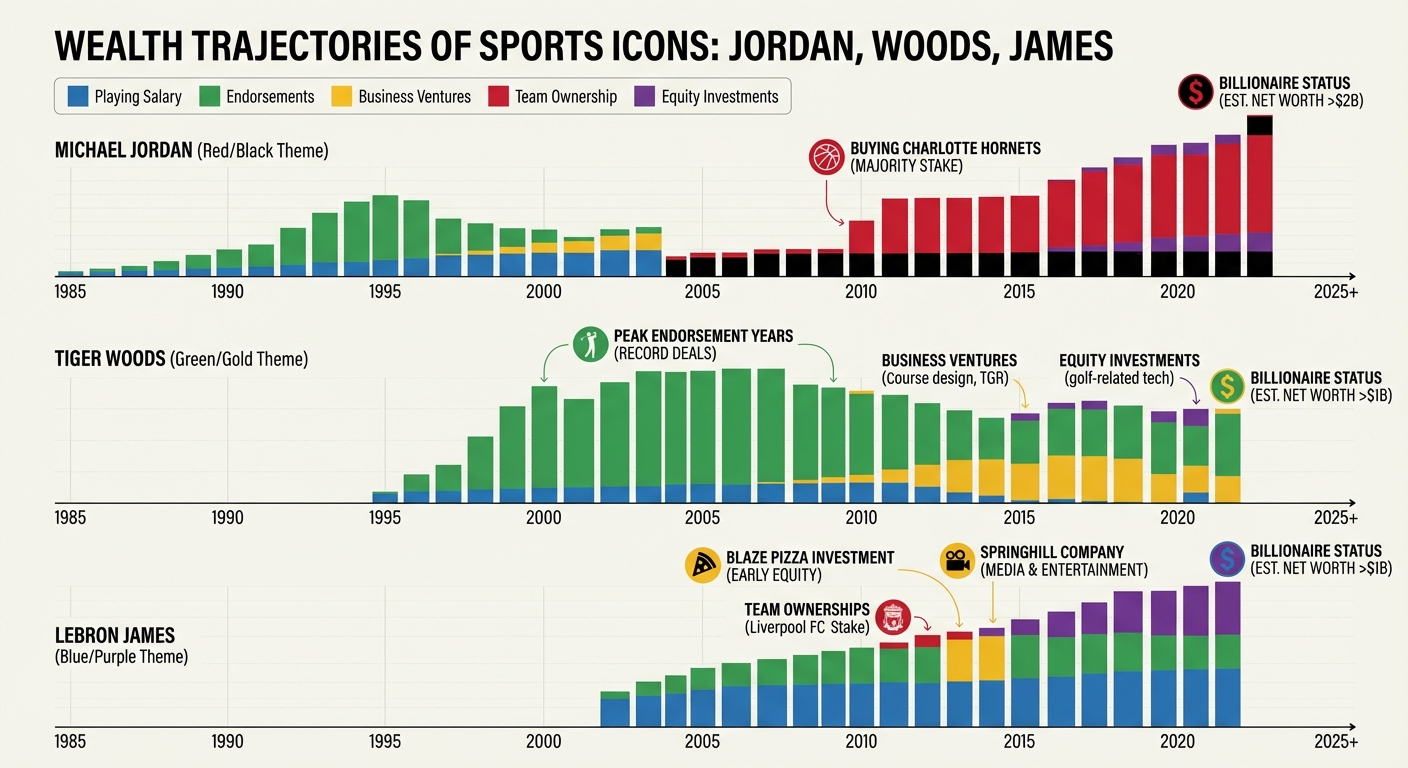

LeBron James became a billionaire in 2022, joining Michael Jordan and Tiger Woods in the exclusive ten-figure club. But his path was fundamentally different. While MJ and Tiger built wealth primarily through dominance in their sports and massive endorsement deals, LeBron built his through equity and entrepreneurship while still playing. This shift from “paid endorser” to “business owner” is the new blueprint for athlete wealth.

The old model was simple: play well, get paid, sign shoe deals. The new model is about ownership. Instead of just taking cash for endorsements, LeBron demanded equity. He turned a $1 million stake in Blaze Pizza into $30 million. He negotiated a lifetime Nike deal with equity components. He built SpringHill Company into a media empire valued at $725 million. This approach leverages an athlete’s platform while it’s most valuable, and a new generation is following his lead.

The Equity Revolution

LeBron’s approach represents a fundamental shift in how athletes think about money. Instead of maximizing short-term endorsement cash, he hired smart advisors early and demanded ownership stakes. This creates wealth that compounds long after playing careers end.

Athletes like Kevin Durant, Serena Williams, and Patrick Mahomes are following suit. They’re venture capitalists who happen to play sports, using their fame to access deal flow traditional investors can’t touch. Their celebrity opens doors, but their business acumen closes deals.

Risks and Diversification

It’s not without risk. For every Blaze Pizza success, there’s an FTX disaster (Tom Brady lost millions) or failed fashion line. Diversification is key. LeBron’s portfolio includes real estate, sports teams (Liverpool FC), media production, restaurants, and tech startups. This protects against individual failures.

Teams and brands are accepting this shift because it aligns incentives. An athlete with skin in the game is a better partner than a hired endorser. It creates long-term relationships rather than transactional ones. When LeBron owns part of a company, he’s genuinely invested in its success.

The Ultimate Prize: Team Ownership

The final frontier is team ownership. LeBron has made clear he wants to own an NBA team. As franchise values skyrocket (teams now sell for $3-4 billion), this is the only way to turn hundreds of millions into billions. It’s also the ultimate status symbol: going from player to owner.

However, this wealth creation is creating a massive divide. The top 0.1% of athletes are becoming tycoons, while the median pro athlete still has a short career and modest earnings. The new model works for superstars with leverage; it doesn’t solve financial precariousness for average players.

The Bottom Line

LeBron didn’t just play basketball; he played business. His billionaire status proves the real money isn’t in salary, it’s in equity. Future superstars won’t just be measured by championships, but by their portfolios. The athlete-as-entrepreneur model is here to stay, fundamentally changing how we think about sports wealth.

For more on athletes changing their sports, check out Messi’s billion-dollar impact on MLS and how European players are dominating the NBA.

Sources: Sports business analysis, athlete wealth data, sports investment research, franchise valuation reports.