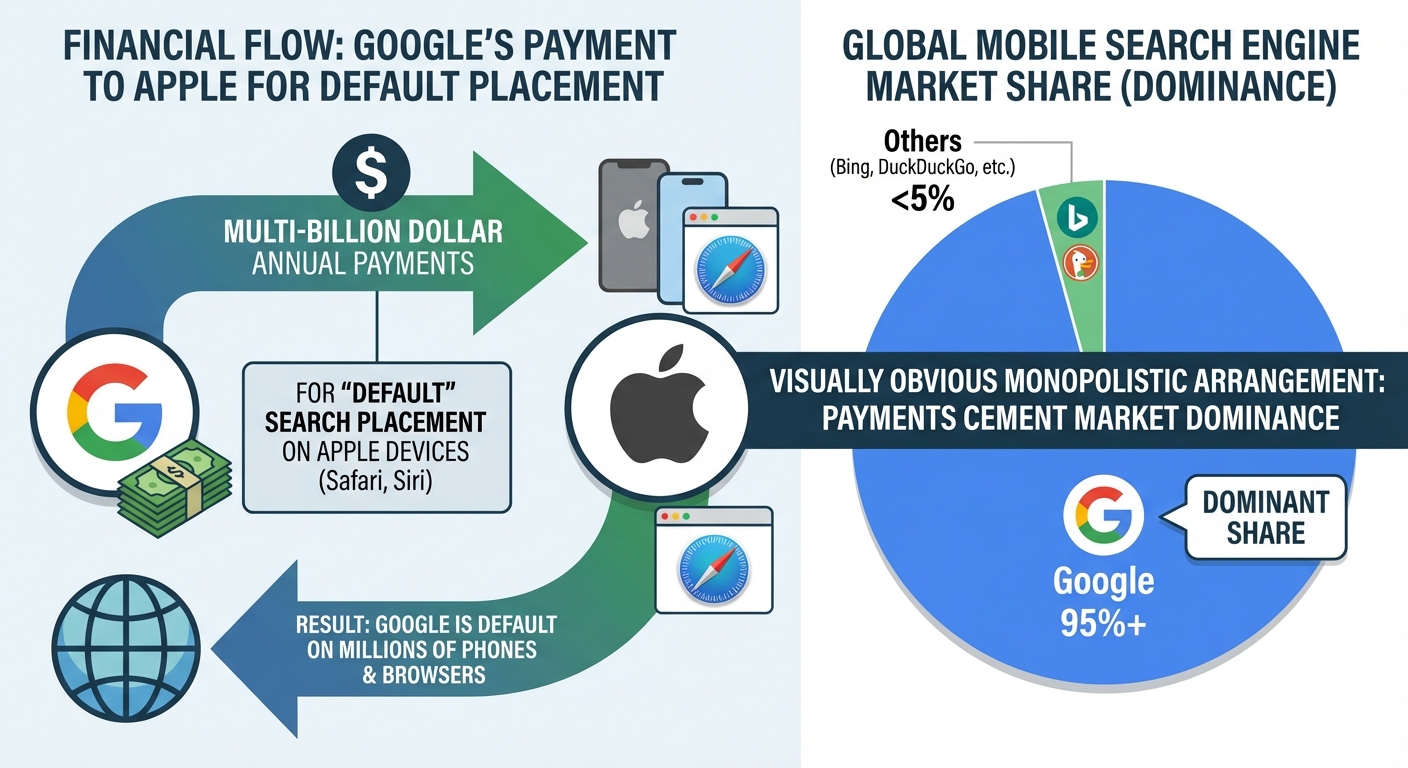

In August 2024, a federal judge ruled that Google is an illegal monopoly in search. The decision found that Google maintained market dominance through anticompetitive agreements, paying billions annually to Apple and others to be the default search engine on devices. Competitors never had a fair shot at the market because Google effectively bought its position.

That ruling was just the first domino. The US government is now pursuing simultaneous antitrust cases against Amazon, Apple, and Meta. For the first time since the Microsoft trial of the late 1990s, Washington is genuinely serious about reining in Big Tech. The potential outcomes range from massive fines to structural breakups of the world’s most valuable companies.

We’re watching the beginning of either the biggest regulatory transformation in tech history or an expensive legal battle that changes nothing. The next five years will decide which.

The Google Precedent

The Google case centered on default placement, a seemingly simple issue with massive implications. By paying Apple $26 billion annually to be the default search on iPhones and browsers, Google effectively bought its market share. Users could technically change the default, but almost nobody does. Google prevented rivals from achieving the scale needed to compete effectively.

The court’s finding that this constitutes illegal monopoly maintenance sets a precedent that threatens every exclusionary contract in the tech industry. If paying for default placement is anticompetitive for search, what about default apps on smartphones? Default stores on devices? Default payment systems in apps?

The remedies being discussed are severe. The DOJ is considering forcing Google to divest Chrome or Android, separating the browser and operating system from the search engine. At minimum, they’ll likely ban payment-for-default deals across the industry. For Google, this could mean losing billions in revenue and facing genuine competition for the first time in over a decade.

Amazon, Apple, and Meta in the Crosshairs

Amazon faces accusations of anticompetitive behavior around its marketplace. The core issue is self-preferencing: Amazon runs the marketplace while also selling its own products on it. Critics argue this creates an inherent conflict where Amazon can use data from third-party sellers to undercut them with Amazon-branded products. The proposed remedy involves potentially separating Amazon’s retail business from its marketplace platform.

Apple’s battle centers on the App Store. The company takes a 30% commission on all app sales and subscriptions, and prohibits alternative payment systems. The European Union has already forced Apple to allow sideloading of apps outside the App Store. The US case could force similar changes domestically, fundamentally altering Apple’s business model and potentially costing the company billions in annual revenue.

Meta is facing pressure to unwind its acquisitions of Instagram and WhatsApp. Regulators argue these were anticompetitive purchases designed to eliminate potential rivals rather than create value. If forced to divest, Meta would lose its dominance in social media and face genuine competition again. As discussed in the context of browser wars, competition tends to drive innovation that benefits users.

The Political Dynamics

This is one of the rare genuinely bipartisan issues in American politics. Democrats worry about corporate power concentrating too much control over information and commerce. Republicans worry about perceived censorship and bias. This unusual political alignment creates real momentum for enforcement.

However, the “national champion” argument remains powerful. Critics of the antitrust push argue that breaking up US tech giants would primarily benefit Chinese competitors like ByteDance, Alibaba, and Tencent. In an era of tech competition with China, the argument goes, we should be strengthening American companies, not weakening them through regulation.

This tension between domestic competition and international competitiveness will likely shape how aggressive enforcement becomes. Policymakers have to balance promoting competition at home with maintaining American technological leadership globally.

The Industry’s Response

Tech companies aren’t going quietly. They’re arguing that their services benefit consumers through innovation and low prices. Google points out that search is free and constantly improving. Amazon highlights how marketplace competition has lowered prices for consumers. Apple emphasizes security and privacy benefits of its controlled ecosystem. Meta argues its platforms connect billions of people at no cost.

These aren’t entirely bad-faith arguments. There are genuine trade-offs between size and functionality. Breaking up these companies could reduce some efficiencies and integration benefits that users currently enjoy. The question is whether those benefits outweigh the costs of reduced competition and concentrated power.

The Bottom Line

The next five years will define the future of the digital economy. If these antitrust cases succeed, we could see a wave of innovation and competition not witnessed since the early internet era when dozens of search engines, browsers, and platforms competed on relatively equal footing. If they fail or result in minor settlements, Big Tech’s dominance will be effectively cemented for decades.

The era of unconstrained growth is clearly over. The era of meaningful regulation has begun. Whether that regulation reshapes the industry or merely creates expensive legal fees remains to be seen. But one thing is certain: the tech giants are facing the most serious threat to their business models since they became giants. The outcome will determine not just the future of these companies, but the future of competition, innovation, and power in the digital age. For context on how this connects to broader tech trends, see the discussion of Web4 and internet infrastructure.

Sources: Department of Justice court filings, Federal Trade Commission antitrust division, SEC financial disclosures.