Mark Zuckerberg just spent $2 billion in about 10 days. That’s roughly $8.3 million per hour of negotiations, which sounds absurd until you realize what Meta actually bought: an AI startup that’s already making money, something most of its AI competitors can’t claim.

Manus, a Singapore-based developer of general-purpose AI agents, became the latest addition to Meta’s growing portfolio of AI acquisitions on December 29. The deal represents a fourfold jump from the company’s April 2025 valuation of $500 million, but for Meta, it solves a problem that’s been haunting Zuckerberg all year: how do you justify $60 billion in AI infrastructure spending when none of it is generating revenue?

The answer, apparently, is to buy something that already is.

What Manus Actually Does

If you’ve been following the AI industry’s obsession with “agents,” you’ve probably heard the pitch: software that doesn’t just answer questions but actually does things for you. Manus is one of the few companies that’s turned that pitch into a product people are paying for.

The startup launched its first general AI agent earlier this year with demonstrations that, according to multiple reports, “outperformed OpenAI’s Deep Research” in certain benchmarks. Within eight months of launch, Manus claimed to have reached $100 million in annual recurring revenue from its subscription service, serving millions of users who use the platform to automate tasks like screening job candidates, planning vacations, and analyzing stock portfolios.

Those numbers are remarkable in an industry where most AI companies measure success in user growth rather than actual dollars. To put it in perspective, many well-funded AI startups haven’t generated $100 million in revenue across their entire existence, let alone in eight months. Manus achieved that figure while processing more than 147 trillion tokens of text and data and supporting over 80 million virtual computers.

The China Question

Here’s where the story gets complicated. Manus was originally established by Butterfly Effect, a company founded in Beijing in 2022. The founders relocated to Singapore in mid-2025, but the Chinese origins have created exactly the kind of scrutiny that’s become standard for any tech deal with connections to mainland China.

Senator John Cornyn previously criticized Benchmark’s April investment in Manus due to concerns about Chinese ownership. The bipartisan anxiety about Chinese AI companies gaining access to U.S. technology, or vice versa, has only intensified throughout 2025.

Meta’s solution? A clean break. According to a company spokesperson, “There will be no continuing Chinese ownership interests in Manus AI following the transaction, and Manus AI will discontinue its services and operations in China.” All existing investors, including early backers Tencent, ZhenFund, and HSG (formerly Sequoia China), have been bought out entirely.

This total divestiture approach mirrors strategies other American tech companies have adopted when acquiring AI firms with Chinese roots. The alternative, attempting to maintain any connection to China, would almost certainly trigger regulatory scrutiny that could delay or doom the deal entirely. In the current geopolitical climate, the path of least resistance runs through complete separation.

Why Meta Needed This Deal

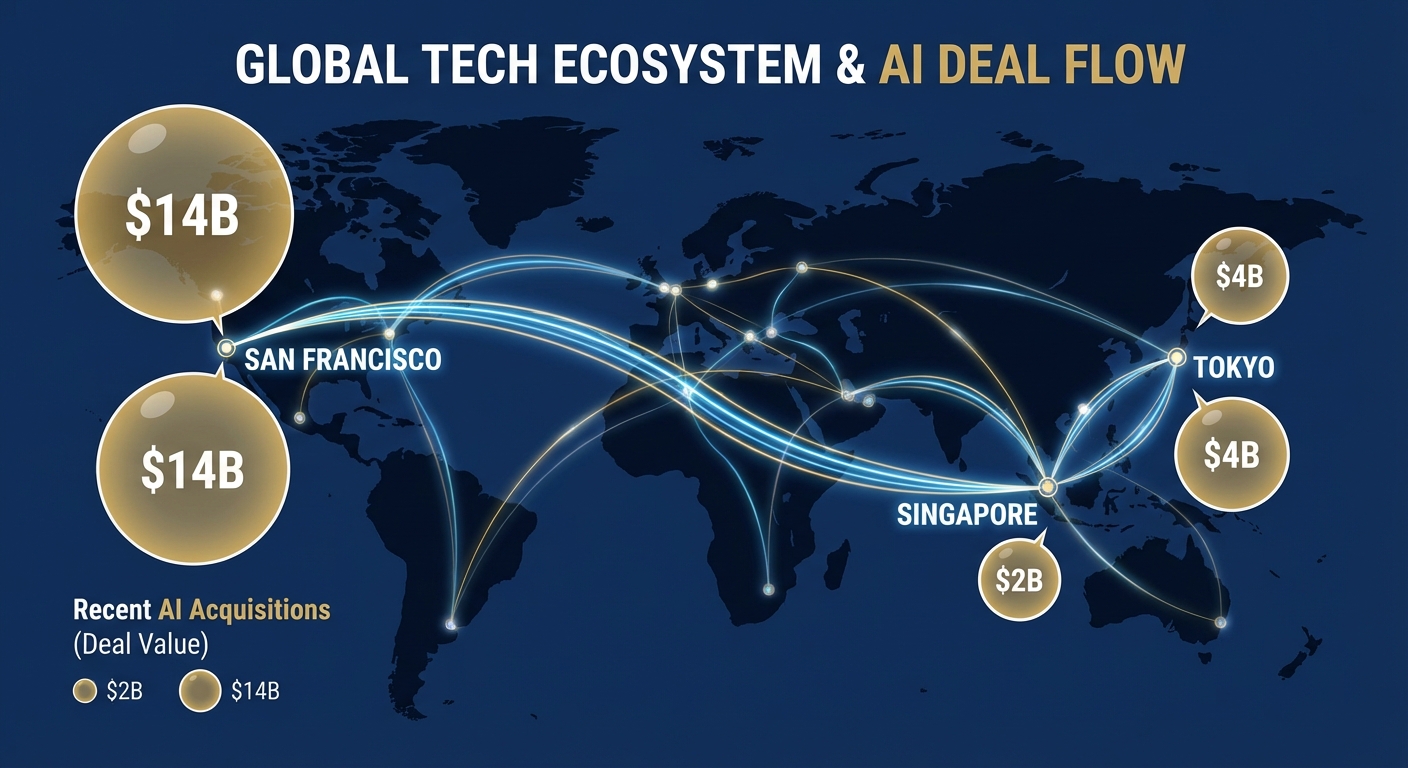

Meta has spent the past two years in what can only be described as an AI spending spree. In June, the company invested $14.3 billion in Scale AI. Earlier this month, Meta acquired Limitless, an AI wearables startup. The company established Meta Superintelligence Labs (MSL), a dedicated research division focused on achieving artificial superintelligence. And throughout it all, Meta has been pouring money into data centers, custom chips, and the infrastructure needed to train massive AI models.

The problem is that all this spending hasn’t translated into obvious new revenue streams. Meta’s AI chatbot exists, sure, but it’s essentially a free feature bolted onto existing products rather than a standalone business. Investors have been asking, with increasing urgency, when all this infrastructure investment will start paying off.

Manus provides an immediate answer. Here is an AI product with proven commercial traction, actual paying customers, and a revenue figure that, while modest by Meta’s standards, demonstrates that someone has figured out how to monetize AI agents. For Zuckerberg, that’s worth a lot more than $2 billion.

The Integration Plan

Meta plans to keep Manus operating independently while integrating its AI agents into Facebook, Instagram, and WhatsApp. Manus CEO Xiao Hong will report to Meta COO Javier Olivan, and the project’s headquarters will remain in Singapore. The entire workforce of about 100 employees is being absorbed into Meta.

The distribution opportunity here is enormous. Facebook alone has nearly 3 billion monthly active users. WhatsApp has more than 2 billion. If even a small fraction of those users start paying for AI agent services, Manus’s $100 million revenue suddenly looks like a rounding error compared to what it could become.

That’s the bet Zuckerberg is making: that Manus has built something genuinely useful, and Meta’s scale can turn a successful startup into a dominant platform. Whether users actually want AI agents integrated into their social media experience remains to be seen. But if the answer is yes, Meta will have bought its way to the front of the line.

The Bigger Picture

This acquisition caps a remarkable year for AI deals. SoftBank just announced it’s acquiring DigitalBridge for $4 billion to build out AI infrastructure. Stargate, the joint venture between SoftBank, OpenAI, and Oracle, has committed up to $500 billion for AI data centers in the U.S. The numbers being thrown around in AI right now make the dot-com boom look quaint.

The question everyone is asking, from Wall Street analysts to AI researchers, is whether this spending represents a genuine technological revolution or an overheated market waiting to correct. The comparison to previous tech bubbles is unavoidable. But there’s one crucial difference: companies like Manus are actually generating revenue. They’re not just burning cash while promising future profits; they’re building businesses that customers are willing to pay for today.

For Meta specifically, this acquisition signals a shift in strategy. Rather than building everything in-house and hoping users adopt it, Zuckerberg is acquiring proven products and plugging them into Meta’s massive distribution network. It’s a playbook that’s worked before in tech, most famously when Facebook acquired Instagram and WhatsApp. Whether AI agents can replicate that success is the $2 billion question.

The Bottom Line

Meta’s acquisition of Manus represents something more significant than just another tech deal. It’s an acknowledgment that the AI race isn’t just about who can build the biggest models or spend the most on infrastructure. Ultimately, it’s about who can build products that people will actually pay for.

Manus figured that out faster than most, reaching $100 million in revenue in eight months while much better-funded competitors struggled to find business models beyond API access and enterprise licensing. Meta is betting that with its distribution advantage, that $100 million is just the beginning.

The deal closes at a moment when questions about AI’s commercial viability are intensifying. By acquiring a company that’s already answering those questions with actual revenue, Zuckerberg is making a statement: Meta isn’t just throwing money at AI because everyone else is. It’s building a business.

Whether that bet pays off will depend on how well Manus’s AI agents perform when exposed to billions of users rather than millions. But for now, Meta has something most of its AI competitors don’t: an AI product that makes money.

Sources: TechCrunch, Bloomberg, CNBC, PYMNTS