Every December brings a flood of predictions about the year ahead. Most prove wrong. Some prove spectacularly wrong. Yet the exercise of forecasting remains valuable, not because predictions are accurate, but because they reveal how informed observers are thinking about uncertainty. The consensus view of 2026 tells us what the smartest analysts expect, even knowing they’ll be surprised.

This year’s forecasts share a common thread: AI moves from experiment to integration, markets continue their bifurcated rise, and volatility becomes an opportunity rather than a threat for those prepared to exploit it. The specific numbers vary, but the direction is consistent. Here’s what the experts are telling their clients, their investors, and themselves about what comes next.

The AI Narrative Evolves Again

For three consecutive years, artificial intelligence has dominated prediction reports. But the story keeps changing. In 2024, forecasters debated whether AI hype was justified. In 2025, they focused on deployment at scale. For 2026, the conversation shifts to consequences and integration.

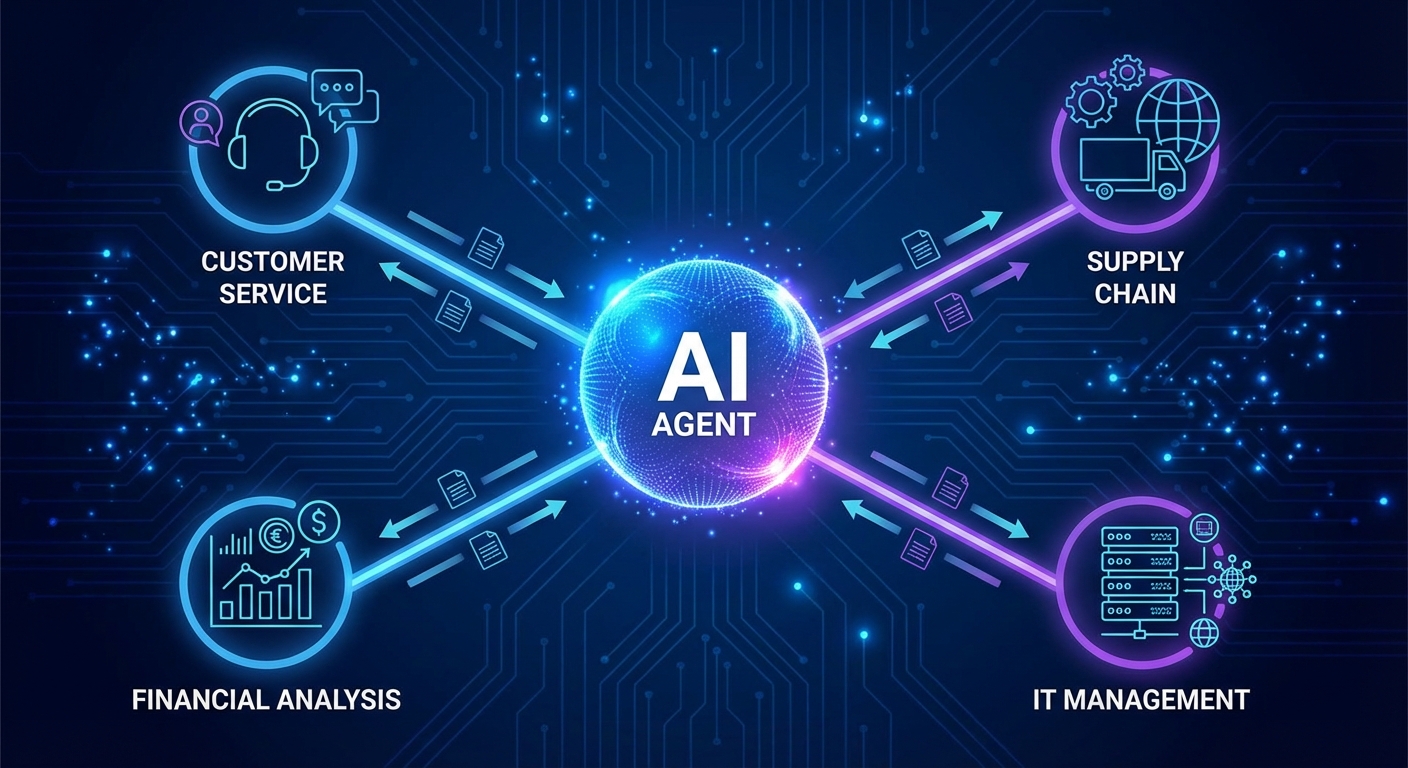

IBM’s Business Value Institute identifies agentic AI as the defining development to watch. These aren’t chatbots that answer questions; they’re autonomous systems that can reason, act, and remember. According to their research, targeted agentic AI pilots from 2025 will expand across entire enterprises in 2026, transforming network management from reactive troubleshooting to autonomous problem resolution. The vision is systems that diagnose problems, implement fixes, reroute traffic, and allocate bandwidth with minimal human intervention.

Deloitte’s Tech Trends 2026 report echoes this theme, predicting that the gap between AI promise and AI reality will narrow significantly. The challenge for 2026 isn’t building AI capabilities; it’s getting them to scale. Companies that figured out pilot programs in 2025 will spend 2026 extending those programs enterprise-wide, encountering the integration challenges that always emerge when technology meets organizational complexity.

The workforce implications remain contested. IBM finds that 81% of employees express confidence in their ability to keep up with technological advances, despite 61% expecting their job roles to change significantly due to AI. That confidence may prove warranted or may prove naive; 2026 will offer data points either way. Almost half of workers surveyed expressed concern that technology could make their jobs obsolete by 2030, a timeline that suddenly feels very close.

Market Outlook: Bulls With Caveats

J.P. Morgan’s 2026 market outlook projects double-digit gains for both developed and emerging markets, driven by the AI supercycle that’s been fueling investment for the past two years. Their analysts expect 13-15% above-trend earnings growth for the S&P 500 over the next two years, a continuation of the expansion that made 2025’s returns possible.

The bullish case rests on AI infrastructure spending, which shows no signs of slowing. The four largest technology companies project combined capital expenditures of approximately $380 billion for data center and infrastructure build-outs. That money flows through the economy, supporting not just chip manufacturers but construction firms, energy companies, and the entire ecosystem that AI infrastructure requires.

Yet the outlook comes with significant caveats. J.P. Morgan assigns a 35% probability to U.S. and global recession in 2026, an elevated risk level that reflects genuine uncertainties. Growth will face headwinds from weak labor demand despite supportive fiscal stimulus in the first half of the year. Inflation remains sticky, with goods price pressures expected to persist through mid-2026. The Fed is projected to cut rates by 50 basis points, but that modest easing may not be enough if economic conditions deteriorate.

The market’s extreme concentration poses another risk. When a small number of mega-cap tech stocks account for most returns, even strong overall performance can mask fragility. A pullback in AI enthusiasm, or disappointing earnings from a few key companies, could cascade through markets in ways that diversified portfolios would not experience.

Specific Predictions Worth Tracking

Some forecasts are precise enough to evaluate by year’s end. J.P. Morgan projects Brent crude oil at $58 per barrel for 2026, a bearish bet that reflects expectations of continued oversupply and moderate demand growth. If correct, energy costs will remain contained; if wrong, inflation pressures could intensify.

Gold receives the most aggressive forecast: $5,000 per ounce by Q4 2026. That would represent a significant jump from current levels, reflecting expectations that central bank buying, geopolitical uncertainty, and inflation hedging will continue driving precious metals higher. Gold bugs have been making such predictions for years, often prematurely. This time may be different, or it may not.

Currency markets expect dollar weakness. The euro is projected to reach 1.20 against the dollar by December, a moderately bullish outlook for European assets. The Bank of Japan is expected to hike rates by 50 basis points, a departure from decades of ultra-loose policy that could strengthen the yen and affect carry trades globally.

Quantum computing may reach a milestone. Recent research indicates that quantum advantage, the point at which a quantum computer provides demonstrably superior solutions to real problems, could emerge by the end of 2026. IBM’s research finds that quantum-ready organizations are three times more likely to belong to multiple ecosystems than the least ready organizations, suggesting that preparation for quantum is already differentiating early adopters.

The Volatility Opportunity

Perhaps the most counterintuitive prediction concerns volatility itself. IBM reports that 74% of executives believe economic and geopolitical volatility will create new business opportunities for their organizations in 2026. This isn’t naive optimism; it’s strategic positioning. Companies that can move quickly when conditions shift, making decisions faster than competitors stuck in analysis paralysis, capture advantages that more stable environments wouldn’t offer.

The research backs this up. Organizations leveraging adaptive AI agents for decision-making are more than twice as likely to see opportunity in volatility. The technology that’s disrupting some businesses is enabling others to thrive amid disruption. The gap between AI adopters and AI laggards may widen further in 2026 as volatile conditions reward adaptability.

Yet only one-third of executives express optimism about the global economy overall, even while 84% feel positive about their own organization’s prospects. This disconnect suggests confidence is concentrated, not universal. Those who believe they’re prepared feel very prepared; those who aren’t prepared have good reason to worry.

Consumer and Worker Dynamics

The predictions extend beyond markets to the humans who participate in them. Consumer attitudes toward AI are evolving in ways that will shape 2026 business strategies. Two-thirds of consumers surveyed said they would switch brands if a company intentionally concealed AI’s involvement in their experience. Transparency isn’t optional; it’s a competitive requirement.

Success in 2026 will require what IBM calls “clear data explanations, removal options, and opt-in rather than opt-out mechanisms.” Companies that treat AI disclosure as a legal requirement to minimize will lose to companies that treat it as a relationship-building opportunity. Customers want to understand how AI affects their experience, and they’re willing to reward honesty.

Worker sentiment presents a more complex picture. The fear of technological unemployment that dominated earlier conversations has evolved into something more nuanced. Workers expect their jobs to change, and most claim confidence in their ability to adapt. Whether that confidence proves justified will depend on the specific changes that emerge and the support workers receive in navigating them.

The Bottom Line

The expert consensus for 2026 combines cautious optimism about markets with recognition that the AI transformation is entering a new phase. The technology is moving from impressive demonstrations to practical integration, from answering questions to taking actions, from one department’s experiment to enterprise-wide deployment.

Key numbers to watch:

- S&P 500 earnings growth: 13-15% above trend projected

- Recession probability: 35% for U.S. and global

- Gold target: $5,000/oz by Q4 2026

- Oil forecast: $58/barrel Brent crude

- Fed rate cuts: 50 basis points expected

- Job role changes: 61% of workers expect significant AI-driven changes

The predictions share a common assumption: that the AI trajectory will continue without major disruption. A breakthrough that dramatically accelerates capabilities, or a setback that undermines confidence in the technology, could invalidate these forecasts entirely. Predictions work best when the future resembles the recent past. Whether 2026 will cooperate remains to be seen.

What’s clear is that the organizations best positioned for 2026 are those treating volatility as information rather than noise, AI as partner rather than threat, and change as constant rather than exceptional. The experts may be wrong about the specific numbers. They’re probably right about the direction.

Sources: IBM Institute for Business Value, J.P. Morgan 2026 Market Outlook, Deloitte Tech Trends 2026, Visual Capitalist Expert Predictions