Wall Street exhaled on Wednesday after President Trump called off the European tariffs that had sent markets tumbling a day earlier. The S&P 500 climbed 1.2% in its biggest single-day gain since November, clawing back into positive territory for 2026 after Tuesday’s selloff erased the year’s gains. The relief rally demonstrated both how much markets feared the tariff threat and how quickly sentiment can reverse when that threat recedes.

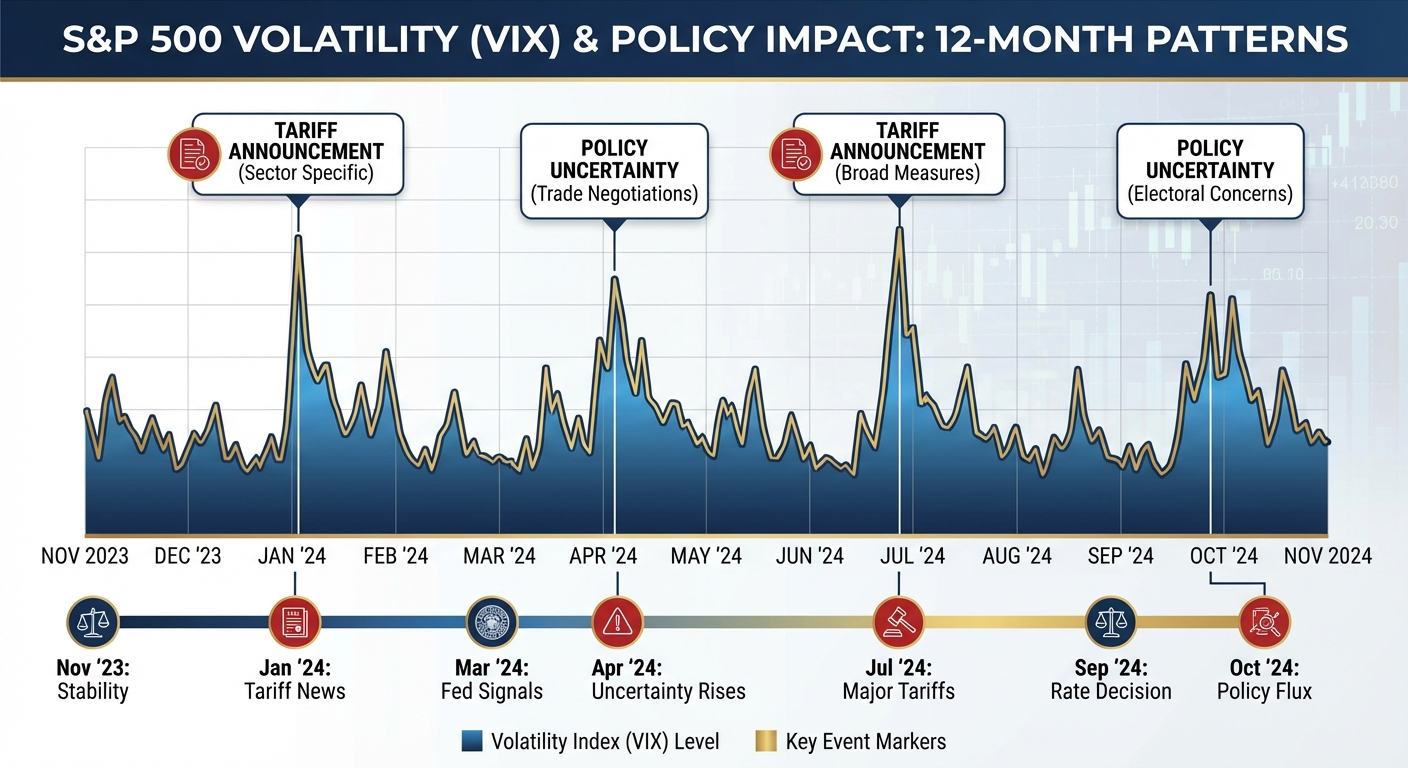

The whipsaw pattern has become familiar during Trump’s second term. Markets drop sharply when tariff threats emerge, then recover when those threats are modified or withdrawn. The net effect is heightened volatility without clear directional trend, creating an environment where investors struggle to position for anything beyond the next presidential statement.

Tuesday’s selloff had erased more than $1.2 trillion in S&P 500 value after Trump threatened tariffs on seven EU countries plus the United Kingdom unless they supported American efforts regarding Greenland. The sudden reversal, announced without detailed explanation, triggered the recovery. Whether the underlying dispute has been resolved or merely postponed remains unclear, contributing to investor anxiety about future surprises.

What Triggered the Reversal

The specific catalyst for Trump’s tariff retreat hasn’t been publicly explained. The announcement came during the Davos World Economic Forum, where European leaders had gathered with prepared responses to potential American economic pressure. Behind-the-scenes conversations between officials may have produced assurances that satisfied whatever the president sought, though no details have emerged.

European Commission President Ursula von der Leyen met with Trump administration officials on the Davos sidelines. French President Emmanuel Macron and Canadian Prime Minister Mark Carney also engaged in discussions about the Greenland situation and broader trade tensions. Whether these conversations produced substantive agreements or simply de-escalated rhetoric temporarily isn’t yet clear.

For markets, the distinction between genuine resolution and temporary pause matters significantly. If tariff threats will resurface whenever the president wants leverage on unrelated issues, businesses cannot plan effectively and investors cannot value companies accurately. The pattern of threat-and-retreat creates permanent uncertainty that suppresses investment and economic activity.

Ken Griffin, the Citadel founder, captured this concern in recent comments: “Investors around the world do not want to see an escalation of the stress of global trade.” The statement reflects widespread frustration among financial leaders who need predictability to allocate capital. Even favorable policy outcomes are less valuable when achieved through processes that nobody can anticipate.

The Broader Market Picture

Wednesday’s rebound notwithstanding, the S&P 500’s gains for 2026 remain modest after volatility wiped out earlier progress. The index had posted three consecutive years of double-digit gains through 2025, creating expectations for continued strong performance that current conditions make difficult to achieve.

Ed Yardeni of Yardeni Research maintains a year-end target of 7,700 for the S&P 500, implying gains of nearly 12.5% from current levels. His outlook assumes “the economy and earnings will remain resilient” with recession odds staying low at around 20%. Those assumptions face testing if trade policy uncertainty continues disrupting business planning and consumer confidence.

Bank of America strategist Savita Subramanian has noted the S&P 500 has “never been more expensive” across multiple valuation metrics. High valuations aren’t necessarily bearish during periods of strong earnings growth, but they leave less margin for error. If earnings disappoint or interest rates rise more than expected, expensive stocks have further to fall.

The AI theme continues supporting technology stocks, which have led market gains over the past two years. Fidelity International calls AI “the defining theme for equity markets” in 2026, and BlackRock suggests the technology will “keep trumping tariffs and traditional macro drivers.” Whether AI enthusiasm can sustain valuations indefinitely remains debatable, but so far it’s been a reliable backstop during broader uncertainty.

Sector Winners and Losers

Wednesday’s recovery wasn’t uniform across sectors. Technology stocks led gains, with Nvidia jumping over 2% following reassuring comments from Taiwan Semiconductor about data center spending. The semiconductor supply chain had been particularly vulnerable to tariff concerns given complex international dependencies, making the relief rally especially strong in that sector.

Small-cap stocks continued outperforming large-caps, extending a streak that has seen the Russell 2000 beat the S&P 500 for ten consecutive sessions, the longest such run since 1990. The small-cap resurgence reflects expectations that domestic-focused companies might benefit from tariff policies that hurt multinationals, though Wednesday’s reversal complicates that thesis.

European stocks recovered alongside American markets, though the relief was tempered by ongoing concerns about Trump’s broader intentions toward the continent. German automakers, which would have been devastated by threatened tariffs, saw significant gains. But the underlying vulnerability remains: policies could change again with little warning.

Financial stocks gained on the theory that reduced trade tensions support economic growth and loan demand. Banks have underperformed broader markets during recent volatility as investors worried about recession risks. If tensions truly ease, financials could see sustained improvement as one of the more economically sensitive sectors.

What Investors Should Watch

The next few weeks will reveal whether Wednesday’s reversal represents lasting de-escalation or merely a pause before new threats emerge. Trump’s statements during his remaining Davos interactions, any formal agreements announced between American and European officials, and the president’s Twitter activity will all provide signals about future direction.

The TikTok sale closing on January 22nd removes one source of technology-sector uncertainty. Whether that transaction proceeds smoothly and what it means for other Chinese technology companies operating in America will affect investment decisions in the sector. The broader US-China technology relationship remains tense regardless of European trade dynamics.

Corporate earnings season is underway, providing fundamental data that could either support or challenge current valuations. Strong earnings might justify elevated prices and reduce sensitivity to policy uncertainty. Disappointing results would compound concerns and could trigger selloffs that policy chaos might otherwise not cause.

The Bottom Line

Markets recovered Wednesday from one of 2026’s worst sessions, demonstrating both the power of presidential statements to move markets and the inherent instability of policy-driven volatility. The S&P 500 is back in positive territory for the year, but the path that got there highlighted how fragile investor confidence has become.

The pattern of threat and retreat creates conditions where markets must constantly price potential scenarios that may or may not materialize. Businesses hesitate to make investments when the rules might change tomorrow. Investors struggle to value companies when their competitive positions depend on unpredictable policy decisions.

For individual investors, the practical implications favor diversification and long-term focus over attempts to time policy-driven swings. Nobody consistently predicts what statements will emerge or how markets will react. The best defense against volatility is a portfolio that can withstand it rather than one trying to outguess it.

Wednesday’s rally was good news. Whether it persists depends on factors that neither investors nor analysts can reliably forecast. In that uncertainty lies both the frustration of current market conditions and the opportunity for those willing to maintain discipline through the noise.