President Trump is in Detroit today, touring the Ford factory that builds F-150 pickups and addressing the Detroit Economic Club in what the White House describes as a push to highlight American manufacturing strength. But the timing reveals the tension at the heart of his economic agenda: businesses are nervous, voters are noticing, and the administration is scrambling to change the narrative.

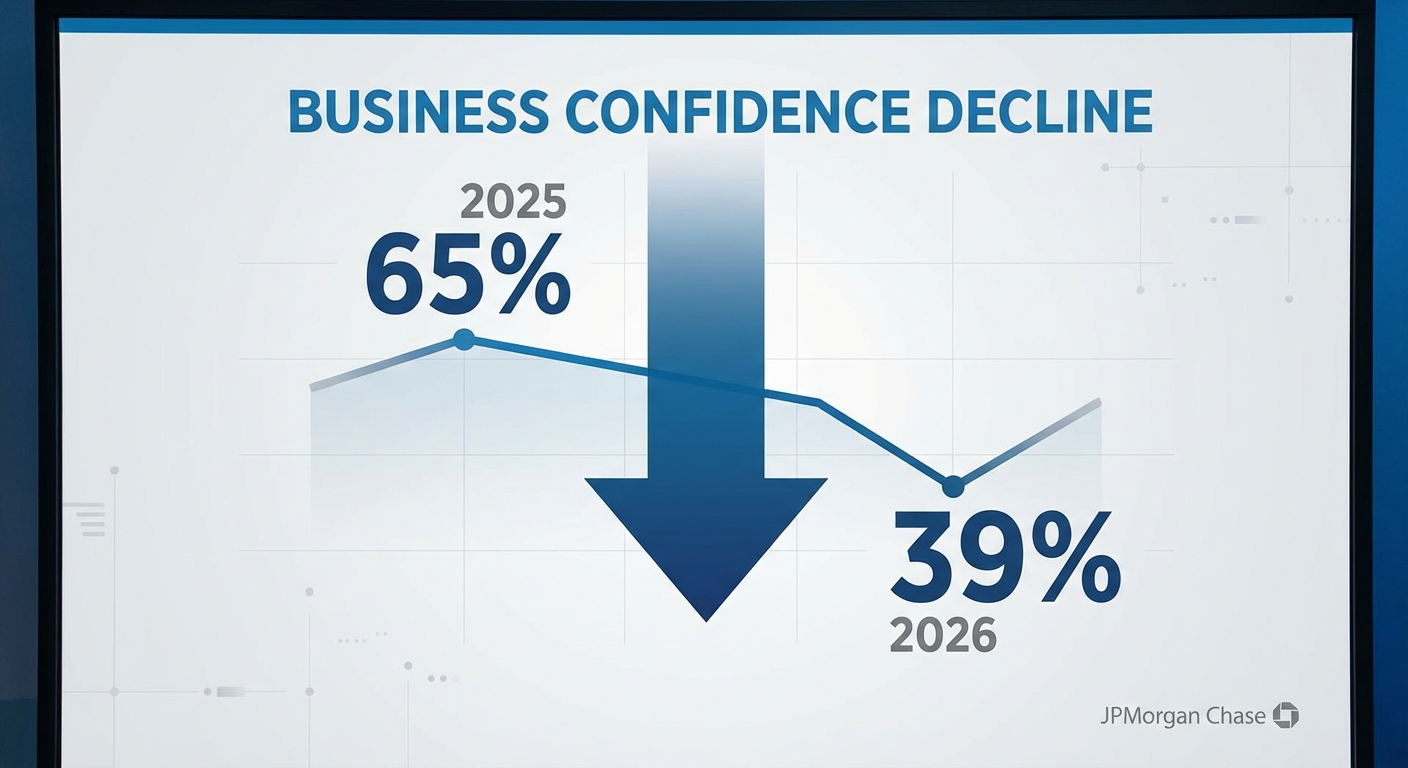

The visit comes as new data from JPMorgan Chase shows business optimism about the national economy has plummeted. Just 39% of leaders at midsize U.S. firms say they’re optimistic about 2026, down sharply from 65% a year earlier. That earlier reading represented a five-year high in business confidence. The current number represents a sharp reversal driven largely by uncertainty about tariffs and their cascading effects.

Trump’s schedule includes a 12:30 p.m. tour of Ford’s Dearborn facility, where workers build the bestselling domestic vehicle in America, followed by a 2:00 p.m. address to the Detroit Economic Club at the MotorCity Casino Hotel. The choice of venue isn’t subtle: manufacturing jobs and the American auto industry remain potent symbols of economic strength, even as the sector faces profound challenges from electrification, global competition, and shifting consumer preferences.

The Manufacturing Message

The White House says Trump will emphasize his administration’s efforts to boost domestic manufacturing, a theme that resonates in Michigan and other Rust Belt states where manufacturing job losses have reshaped communities over decades. The F-150 provides the perfect backdrop: it’s built by American workers, bought by American consumers, and represents the kind of industrial might that politicians love to celebrate.

But the reality is more complicated. Ford announced significant changes to its electric vehicle strategy recently, including ending production of the electric F-150 Lightning after years of losses and billions in investment. The company has faced the same transition challenges as other automakers: consumers want EVs in theory but buy gas trucks in practice, while regulatory requirements and competitive pressure from Chinese manufacturers create pressure to electrify anyway.

Trump has attempted to ease some of this pressure on automakers, extending import levies on foreign-made auto parts until 2030. This gives domestic manufacturers more time to build supply chains and compete without immediate tariff impacts on their component costs. But the broader tariff regime has created different problems, with 61% of business leaders reporting negative impacts on their costs, according to the JPMorgan survey.

Business Sentiment Tells a Different Story

The gap between political messaging and business reality is widening. While Trump touts manufacturing gains, business leaders are increasingly worried. The JPMorgan survey, released in early January, captured the mood: optimism about the national economy has fallen to its lowest level since the survey began tracking sentiment.

Importantly, executives remain confident about their own companies: 71% report optimism for their individual business performance in 2026. This suggests that the pessimism isn’t about business fundamentals but about policy uncertainty and macroeconomic conditions. When business leaders are bullish on their own prospects but bearish on the country, they’re typically hedging against external risks they can’t control.

Tariffs dominate those concerns. The administration’s trade policy has created winners and losers across industries, with some domestic producers benefiting from reduced foreign competition while others face higher input costs that squeeze margins. For manufacturers in particular, the calculus is complicated: tariff protection helps with finished goods competition but hurts when components come from abroad.

The Political Context

November’s off-year elections in Virginia, New Jersey, and elsewhere showed Republicans losing ground as voters focused on kitchen-table economic issues. The White House acknowledged the results by announcing that Trump would put greater emphasis on talking directly to the public about economic policies, doing more events around the country after a relatively quiet period on domestic travel.

The Detroit trip represents this new approach. By visiting a factory, Trump can stand next to tangible evidence of American industrial capacity. By addressing business leaders, he can make the case that his policies benefit them even when polls suggest otherwise. The staging matters as much as the substance.

But the timing creates complications. The visit comes as the administration’s investigation into Federal Reserve Chair Jerome Powell has sparked an outcry, with former Fed chairs warning of damage to economic stability. Markets reacted to that news on Tuesday, with gold surging and mortgage rates dropping on uncertainty about central bank independence. Discussing manufacturing optimism while financial markets price in institutional chaos is a challenging backdrop.

What to Watch

The Detroit Economic Club speech will likely preview the administration’s economic messaging for 2026. Key themes to listen for include how Trump addresses tariff concerns, what commitments he makes on manufacturing investment, and whether he references the Fed controversy or ignores it entirely.

Auto industry specifics matter too. Ford’s EV pivot retreat, General Motors’ own strategic adjustments, and the broader question of how American automakers compete with Chinese manufacturers like BYD will all be relevant. Trump has previously suggested additional tariffs on Chinese vehicles, which could help domestic manufacturers but raise prices for consumers shopping for affordable EVs.

For Michigan specifically, the visit carries electoral significance. The state was crucial in 2024 and will be again in 2028. Connecting with auto workers and business leaders serves both policy and political purposes, reminding voters that the administration takes manufacturing seriously even as other economic indicators flash warning signs.

The Bottom Line

Trump’s Detroit visit is designed to project strength and confidence about American manufacturing at a moment when businesses are increasingly uncertain and voters are focused on economic struggles. The F-150 factory provides compelling visuals, and the Detroit Economic Club offers a friendly audience of business leaders.

But the underlying tensions remain unresolved. Tariffs have raised costs for many businesses even as they protect others. Business confidence has plummeted even as executives remain optimistic about their own companies. And the broader economic picture is complicated by the Fed investigation, which has rattled markets and raised questions about policy stability.

Manufacturing remains a powerful symbol in American politics, and Ford’s Dearborn plant represents everything that symbol evokes: good jobs, American innovation, and industrial might. Whether the administration’s policies actually support manufacturing growth, or merely provide backdrops for political events, will be determined not by today’s photo opportunities but by the economic data that follows.

Sources

- Trump will visit a Ford factory and promote manufacturing in Detroit - ABC News

- Trump visiting Michigan Ford factory, addressing manufacturing to Detroit Economic Club - CBS6 Albany

- 2026 Business Leaders Outlook - JPMorgan Chase

- Trump will visit a Ford factory and promote manufacturing in Detroit - Michigan Public