Something remarkable happened on Wednesday that hasn’t occurred since before the pandemic, before the iPhone 11, before anyone had heard of ChatGPT. Alphabet, Google’s parent company, surpassed Apple in market capitalization to become the third most valuable company in the world.

Alphabet’s market cap closed at $3.88 trillion after shares rose 2.4% to $321.98. Apple, meanwhile, slipped 0.8% to close at a market cap of $3.84 trillion. The roughly $40 billion gap might seem narrow in a world where trillion-dollar valuations have become routine, but the symbolism is enormous. For years, Apple has been the gold standard of American corporate success. Now, the crown has shifted to a company that many investors had written off as vulnerable to AI disruption.

The reversal marks a stunning turnaround in the narrative around both tech giants. Just two years ago, analysts questioned whether Google’s core search business could survive the rise of AI chatbots. Apple, with its loyal customer base and services revenue machine, seemed invincible. Today, those positions have essentially flipped.

How Google Pulled Ahead

Alphabet’s climb to the top spot among its peers required a combination of strong execution and fortunate timing. The company’s stock surged more than 65% in 2025, making it the best performer among the so-called Magnificent Seven tech giants. That performance wasn’t accidental.

The catalyst was Gemini 3, Google’s latest AI model, which launched in late 2025 to widespread critical acclaim. Industry benchmarks consistently ranked it as the most capable large language model available, surpassing offerings from OpenAI and Anthropic. For a company that had been criticized for falling behind in the AI race, the achievement represented vindication of its research-first approach.

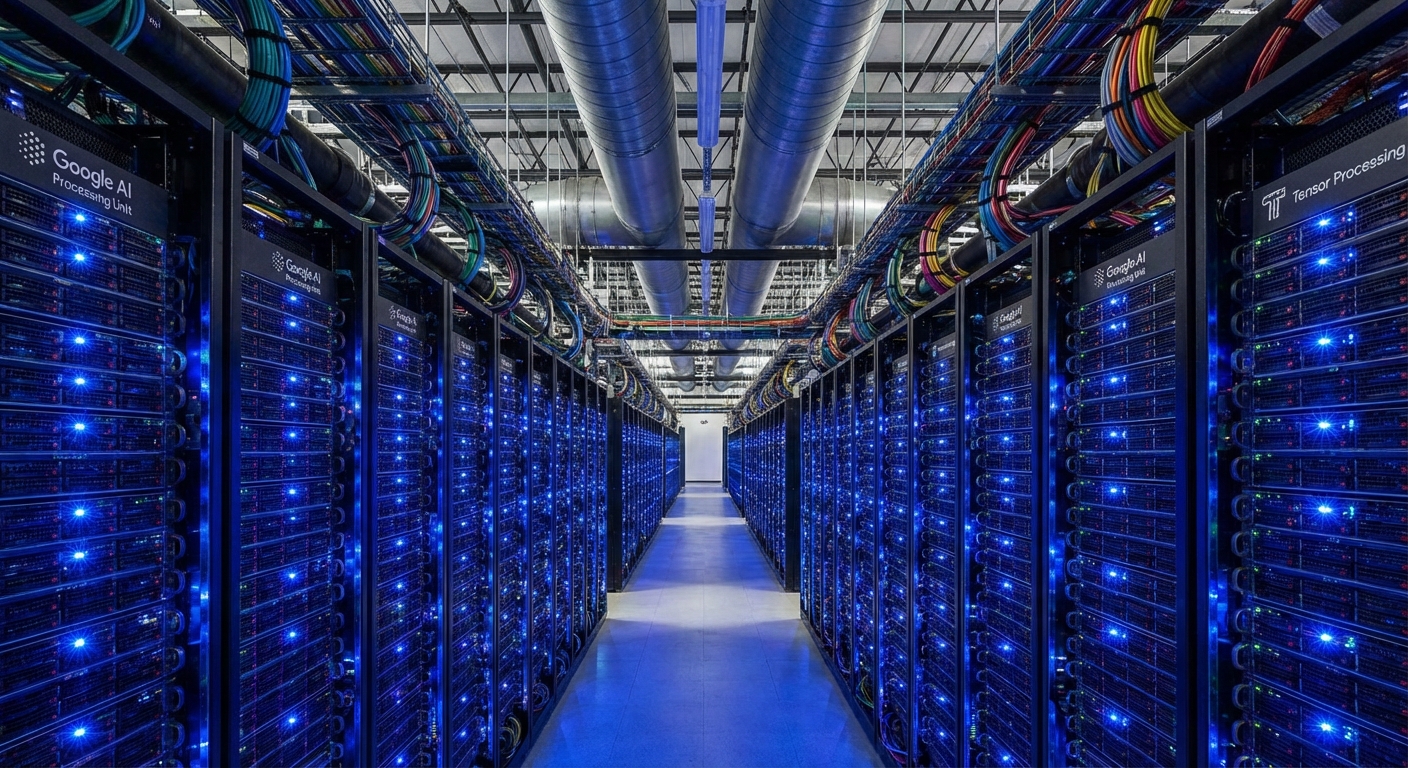

But Gemini 3 was just the most visible success. Google Cloud, which had long trailed Amazon Web Services and Microsoft Azure, has been quietly winning enterprise customers at an accelerating pace. On Alphabet’s October earnings call, CEO Sundar Pichai revealed a striking statistic: the cloud business signed more deals worth over $1 billion in the first three quarters of 2025 than in the previous two years combined. Enterprise customers who once viewed Google Cloud as a distant third choice are now betting their AI futures on Google’s infrastructure.

The advertising business, which still generates most of Alphabet’s revenue, has also proven more resilient than skeptics predicted. AI-powered search results have actually improved ad targeting and user engagement, according to the company’s internal metrics. Rather than cannibalizing the core business, AI appears to be enhancing it.

Apple’s Uncharacteristic Stumble

While Alphabet was soaring, Apple has been experiencing something unfamiliar: a sustained period of investor skepticism. The company’s shares have declined for seven consecutive trading days, a streak that reflects growing concerns about its AI strategy and product pipeline.

The iPhone, which remains Apple’s most important product despite years of diversification efforts, has faced mounting competitive pressure. Chinese smartphone makers like Huawei have staged comebacks in their home market, eroding Apple’s position in the world’s largest smartphone market. Meanwhile, iPhone sales in developed markets have plateaued as upgrade cycles lengthen and consumers struggle to see meaningful differences between annual models.

Apple’s AI initiatives have also disappointed relative to the hype that surrounded them. When the company announced Apple Intelligence in 2024, it promised a transformative integration of AI across its devices. The reality has been more modest. Features have rolled out slowly, functionality remains limited compared to dedicated AI assistants, and Siri still feels a generation behind competitors. For a company that built its reputation on polish and user experience, the stumbles have been jarring.

The services business, which Apple has promoted as its growth engine, continues to expand but at rates that no longer impress investors accustomed to double-digit growth. App Store revenue has faced regulatory pressure in Europe and elsewhere, and subscription services like Apple TV+ have struggled to achieve the cultural impact of Netflix or even newer entrants like Max.

The AI Divide in Big Tech

Wednesday’s market cap flip reflects a broader trend that has been reshaping investor preferences throughout 2025 and into 2026. Companies perceived as AI leaders have commanded premium valuations, while those seen as AI followers have faced persistent skepticism.

Alphabet sits firmly in the leadership camp. Beyond Gemini, the company has integrated AI capabilities across YouTube, Gmail, Google Docs, and essentially every product in its ecosystem. Its research division, DeepMind, continues to produce breakthroughs in areas from protein folding to weather prediction. When businesses think about AI infrastructure, Google Cloud has become a serious consideration alongside the established leaders.

Apple’s position is more ambiguous. The company has significant AI capabilities, particularly in on-device processing and privacy-preserving machine learning. Its custom silicon, including the M-series chips for Macs and the neural engines in iPhones, represents genuine technical achievement. But Apple has historically positioned AI as a feature enhancement rather than a standalone product category, and that approach has made it harder to participate in the AI narrative that has driven tech stock gains.

The contrast extends to hiring and research output. Google publishes influential AI research papers at a prolific pace and attracts top talent from academia. Apple, with its culture of secrecy, publishes far less and has struggled to retain some AI researchers who prefer more open environments.

What the Numbers Actually Tell Us

Both companies remain extraordinarily valuable by any reasonable standard. The fact that Apple is now the fourth most valuable company in the world rather than the third hardly constitutes a crisis. Microsoft and Nvidia continue to occupy the top two positions, both benefiting from their own AI-related momentum.

Still, the trajectory matters. Alphabet’s market cap has increased by 68% over the past year, a remarkable figure for a company of its size. Apple’s stock, by contrast, has essentially been flat, up only about 2% in 2025. For long-term investors who held both stocks, that divergence represents a significant difference in returns.

The fundamentals tell a more nuanced story. Alphabet generates annual revenue of approximately $350 billion, with operating margins that have expanded as AI efficiencies take hold. Apple generates about $400 billion in annual revenue, but faces margin pressure from slowing hardware sales and the cost of building out AI capabilities. Both companies are enormously profitable, but Alphabet currently shows more room for growth.

Free cash flow, the money left after capital expenditures, favors Apple, which continues to generate more than $100 billion annually. The company has used that cash to fund massive share buyback programs that have reduced its share count and supported the stock price. Alphabet has also repurchased shares but at a less aggressive pace.

The Bigger Picture for Tech Investors

This changing of the guard carries implications beyond the two companies involved. It signals that investors are reassessing which tech giants are best positioned for an AI-driven future, and that assessment can shift quickly.

The rotation out of Apple and into AI-focused names has been visible across the market. Nvidia, whose chips power most AI training and inference, has seen its stock price multiply several times over since late 2022. Microsoft, with its partnership with OpenAI and aggressive integration of Copilot across its product suite, has reached a $3.9 trillion valuation. Even companies like Oracle, not traditionally associated with cutting-edge AI, have benefited from their cloud infrastructure positioning.

For individual investors, the lesson is that market leadership in technology is never permanent. Apple displaced Microsoft as the most valuable company a decade ago. Now other companies are challenging Apple’s position. The only constant is change, and the companies that adapt fastest to new technological paradigms tend to be rewarded.

The question for the months ahead is whether this represents a genuine, durable shift in competitive positioning or a temporary divergence driven by AI enthusiasm that may eventually correct. Bulls on Alphabet argue that the company is just beginning to monetize its AI investments and has years of growth ahead. Bulls on Apple counter that the company’s track record of innovation and its deeply loyal customer base will eventually produce its own AI breakthrough.

What to Watch Going Forward

Several developments in the coming months could determine whether Alphabet maintains its new position or Apple stages a comeback.

Apple’s next iPhone launch, expected in September 2026, will be closely scrutinized for meaningful AI capabilities. Rumors suggest the company is preparing a significantly more capable version of Apple Intelligence that could address criticisms about its current AI offerings. If Apple delivers a genuinely impressive AI experience, investor sentiment could shift quickly.

For Alphabet, the risk lies in maintaining momentum. The company’s stock has risen so sharply that expectations are now extremely high. Any stumble in quarterly earnings, any sign that AI revenue is disappointing relative to the massive investments required, could trigger a selloff. The company also faces ongoing antitrust scrutiny from regulators in the United States and Europe, which creates headline risk.

The broader AI market itself presents uncertainty. If the current enthusiasm proves overblown, if AI applications fail to generate the productivity gains and cost savings that proponents promise, the entire sector could face a correction. In that scenario, companies like Apple with diversified revenue streams and proven hardware businesses might look more attractive.

The Bottom Line

Alphabet’s ascent past Apple in market capitalization represents more than just a number on a ticker. It reflects a fundamental reassessment of which technology companies are best positioned for the decade ahead. Google, once dismissed as an aging search giant vulnerable to AI disruption, has emerged as an AI leader. Apple, long considered untouchable, now faces questions about its ability to compete in a rapidly evolving landscape.

For investors, the message is clear: in technology, past success does not guarantee future dominance. The companies that win the next era of computing may not be the same ones that won the last. Right now, Wall Street is betting that Alphabet has the edge, but in an industry defined by innovation and disruption, today’s leader can quickly become tomorrow’s challenger.