If you’re one of the roughly 12 million people carrying an Apple Card, your credit card issuer is about to change hands. Goldman Sachs announced last week that it has reached an agreement to transfer the Apple Card program to JPMorgan Chase, ending one of the most ambitious and troubled experiments in modern banking history.

The transition, expected to take approximately 24 months, will shift more than $20 billion in card balances from Goldman to Chase. But here’s the detail that tells you everything about how this deal went down: Goldman is taking a $1 billion loss to get rid of the business, according to The Wall Street Journal. When a bank pays someone else to take its customers, you know something went very wrong.

For Apple Card users, the practical impact should be minimal. Your card will keep working, your Daily Cash rewards aren’t changing, and you won’t need to do anything immediately. But the story behind this transition reveals a lot about the gap between Silicon Valley’s fintech ambitions and the messy reality of consumer banking.

What’s Actually Changing

The headline news is straightforward: JPMorgan Chase will become the new issuer of your Apple Card. Goldman Sachs will continue operating the program until the transition completes, which is expected to happen around early 2028. Until then, nothing changes for cardholders.

Once the transition is complete, Chase will handle all the backend banking operations: credit decisions, billing, customer service for account issues, and regulatory compliance. Apple will continue to manage the card’s technology integration, the Wallet app experience, and the Daily Cash rewards program.

The one area of uncertainty involves Apple Savings accounts. Goldman currently offers a high-yield savings account linked to Apple Card that lets users automatically deposit their Daily Cash rewards. JPMorgan is reportedly planning to launch a new Apple savings account, but existing Goldman savings account holders will not be automatically transferred. You’ll need to decide whether to keep your savings at Goldman or open a new account with Chase.

This matters more than it might seem. Goldman’s Apple Savings account offered a 4.4% APY when it launched, significantly higher than Chase’s typical savings rates. Whether Chase will match that rate or offer something competitive remains unclear. If you’ve been parking substantial savings in that account, you’ll want to watch this closely.

What’s Staying the Same

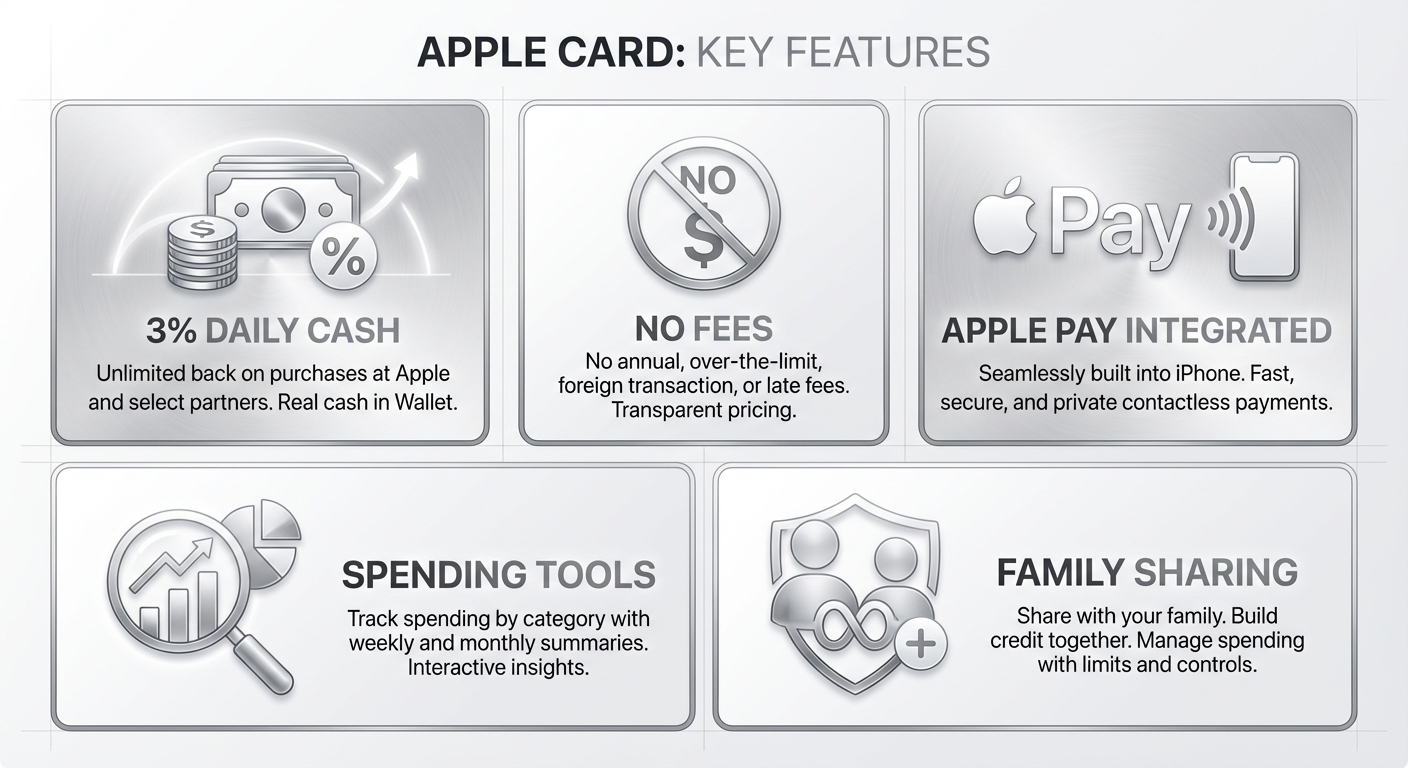

Apple and Chase have emphasized continuity. The core features that made Apple Card distinctive will survive the transition intact. You’ll still earn up to 3% unlimited Daily Cash on purchases, with 3% at Apple and select partners, 2% when using Apple Pay, and 1% on everything else.

The card’s consumer-friendly features, which Apple marketed heavily at launch, will remain: no fees of any kind, including no annual fee, no foreign transaction fees, no late fees, and no over-limit fees. The spending tracking tools in the Wallet app, which categorize purchases and show weekly and monthly summaries, will continue working as before.

Mastercard will remain the payment network, so your card will work everywhere Mastercard is accepted. Apple Card Family, which lets you share your card with family members and set spending limits for kids, will also continue unchanged.

For most cardholders, the day-to-day experience will be identical. You’ll tap to pay with Apple Pay, see your transactions in Wallet, and receive your Daily Cash as usual. The only difference will be the name on your statement.

Why Goldman Walked Away

Goldman Sachs entered consumer banking with enormous fanfare. The Apple Card, launched in 2019, was supposed to be the flagship of a new consumer division that would transform the 150-year-old investment bank into a household name. CEO David Solomon called it “a tremendous opportunity” and predicted consumer banking would become a major profit center.

It didn’t work out that way. The Apple Card business lost money from the start, and the losses accelerated as the pandemic disrupted spending patterns and delinquencies rose. Goldman’s consumer banking division, which also included the Marcus savings accounts and personal loans, reportedly lost more than $3 billion before the bank began winding it down.

The Apple Card had specific problems beyond general consumer banking challenges. Apple’s tight control over the user experience meant Goldman had limited ability to cross-sell other products or build direct relationships with cardholders. The generous rewards and lack of fees, while great for consumers, squeezed margins. And Goldman’s lack of experience with consumer credit meant it made lending decisions that, in hindsight, were too aggressive.

According to CNBC, the Apple Card portfolio had higher-than-average delinquency rates and significant exposure to subprime borrowers, customers with lower credit scores who are more likely to miss payments. This made the portfolio less attractive to potential buyers and forced Goldman to accept unfavorable terms.

Goldman announced in the fourth quarter of 2025 that it expects to take a $2.2 billion provision for credit losses related to the forward purchase commitment with Chase. Combined with the $1 billion discount on the portfolio sale, Goldman is paying roughly $3 billion to exit the Apple Card business. The bank says the transaction will ultimately boost earnings by 46 cents per share once it closes, but that’s because it’s escaping ongoing losses, not because the sale itself was profitable.

What This Means for Cardholders

If you have an Apple Card, here’s what you should know:

Right now: Do nothing. Your card works normally. Goldman Sachs remains your issuer until the transition completes.

Over the next 24 months: Watch for communications from Apple and Goldman about the transition timeline. You’ll receive specific instructions as the handoff date approaches.

Apple Savings account holders: Pay attention to announcements about the savings account transition. You may need to make an active decision about where to keep your money. Goldman has not announced plans to close existing savings accounts, but the terms may change once Apple Card moves to Chase.

Credit score impact: The transition should not affect your credit score. Your account history and credit limit will transfer to Chase. However, if Chase conducts a new credit check as part of the transition, which is not confirmed, that could result in a small, temporary score decrease.

Customer service: Until the transition, Goldman handles account issues. After the transition, Chase will take over. If you have disputes or problems during the transition period, document everything and be prepared for some confusion as systems change hands.

The Bigger Picture

The Apple Card saga reflects a broader truth about fintech disruption: it’s harder than it looks. Goldman Sachs, one of the most sophisticated financial institutions on the planet, with essentially unlimited capital and the partnership of the world’s most valuable company, still couldn’t make consumer credit cards work.

Part of the problem was timing. Goldman launched its consumer push just before a pandemic, a period of economic volatility, and rising interest rates that stressed consumer balance sheets. But the bigger issue was structural. Consumer banking is a low-margin, high-volume business that requires scale, operational excellence, and deep expertise in credit risk. Goldman had none of these.

JPMorgan Chase, by contrast, is the largest credit card issuer in the United States. It has decades of experience managing consumer credit, sophisticated fraud detection systems, and the operational infrastructure to handle millions of customer interactions. What was a stretch for Goldman is routine for Chase.

For Apple, the transition is largely neutral. The company will continue to control the customer experience and collect fees from Chase for each transaction. Apple was reportedly frustrated with Goldman’s customer service and technical capabilities, so Chase’s operational expertise may actually improve the product.

The Bottom Line

Your Apple Card is changing banks, but it’s not changing much else. The transition from Goldman Sachs to Chase will happen gradually over the next two years, and the features that made Apple Card distinctive will survive intact.

The real story is what this deal says about the limits of disruption in financial services. Goldman Sachs tried to reinvent itself as a consumer bank and lost billions in the process. Chase, the boring incumbent, ends up with a profitable portfolio at a discount. Sometimes the old ways of doing things persist because they actually work.

For the 12 million Apple Card holders, the practical advice is simple: keep using your card, watch for updates about the savings account, and don’t worry too much about the corporate drama happening behind the scenes. Your Daily Cash will keep coming either way.

Sources

- Goldman Sachs Press Release: Agreement to Transition Apple Card Program to Chase

- Apple Newsroom: Chase to become new issuer of Apple Card

- CNBC: JPMorgan Apple credit card deal

- TechCrunch: JPMorgan Chase becomes the new issuer of the Apple Card

- MacRumors: Apple Card Will Move From Goldman Sachs to JPMorgan Chase