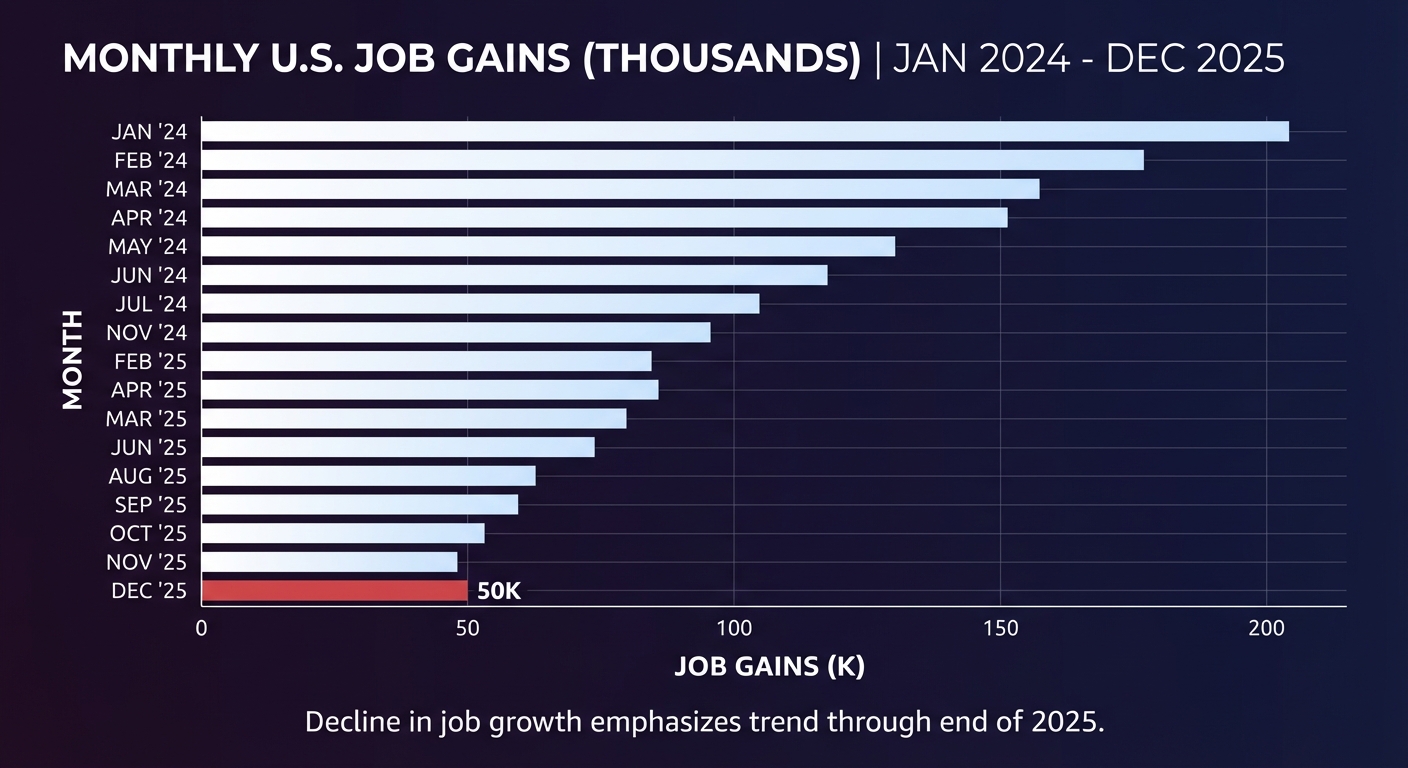

The U.S. labor market just sent a warning shot that economists can’t ignore. December’s jobs report landed Thursday morning with a thud: just 50,000 new jobs added, the weakest monthly gain since the pandemic recovery began in earnest back in 2021. If you’ve been nervously watching headlines about layoffs and economic uncertainty, this report validates those concerns in hard numbers.

The Bureau of Labor Statistics data paints a picture of an economy that’s cooling faster than the Federal Reserve anticipated. While unemployment technically held steady at 4.1%, the underlying trends suggest something more troubling is underway. Hiring has slowed across nearly every major sector, from technology to healthcare to retail. The question isn’t whether the job market is weakening, but how much further it has to fall.

For the millions of Americans who lived through the whiplash of pandemic-era job losses and the subsequent hiring boom, December’s numbers feel like a reckoning. The “soft landing” that Fed Chair Jerome Powell has been promising suddenly looks a lot less certain. Here’s what you need to know about what’s happening and what it means for your financial future.

What the Numbers Actually Show

Let’s break down what 50,000 jobs actually means in context. During the peak of the post-pandemic recovery in 2022, the economy was adding an average of 400,000 jobs per month. That pace gradually slowed throughout 2023, 2024, and 2025, but economists had expected a more gradual decline. December’s report represents a cliff, not a slope.

The sector breakdown reveals where the pain is concentrated. Professional and business services, a category that includes everything from lawyers to consultants to IT workers, shed 15,000 positions. This sector had been a reliable source of job growth throughout the recovery and its contraction signals that corporate belt-tightening has moved beyond tech into the broader white-collar economy. Manufacturing lost another 8,000 jobs, continuing a decline that began when interest rates first started rising in 2022.

Healthcare, typically recession-proof, added just 12,000 jobs compared to its 2025 average of 45,000 per month. Hospitals and medical practices have been struggling with reimbursement pressures and the lingering effects of pandemic-era staffing burnout. When healthcare stops hiring, it’s a sign that even the most stable industries are feeling the squeeze.

The one bright spot, if you can call it that, was leisure and hospitality, which added 25,000 jobs. But even that number represents a significant slowdown from the sector’s typical pace, and many of those jobs are part-time or seasonal positions that don’t offer the stability workers need.

Why This Matters for the Fed

The Federal Reserve has been walking a tightrope for the past three years, trying to bring inflation down without triggering a recession. December’s jobs report makes that balancing act considerably more difficult. The Fed cut interest rates at its December meeting, bringing the federal funds rate down to 4.25%, but markets are now questioning whether the central bank acted too slowly.

Here’s the problem the Fed faces. Inflation, while lower than its 2022 peak, remains stubbornly above the 2% target. The most recent Consumer Price Index showed prices rising at 2.8% annually. Under normal circumstances, that would argue for keeping rates elevated. But with job growth collapsing, maintaining high rates risks pushing the economy into an outright recession.

Fed officials have maintained their projection for two additional rate cuts in 2026, but Wall Street is now pricing in a more aggressive response. Futures markets show traders betting on four or even five cuts this year, a dramatic shift from just a month ago. The December jobs report adds ammunition to those calling for the Fed to move faster.

The complication is that the labor market often acts as a lagging indicator. By the time job losses show up in the data, the economic damage may already be done. Companies make hiring decisions months in advance, which means the December slowdown reflects decisions made in October and November when corporate confidence began to waver. If the Fed waits for more data, it might be waiting too long.

The Soft Landing Debate

For the past year, economists have been debating whether the U.S. can achieve a “soft landing,” where inflation comes down without causing a recession. The December jobs report has reignited that debate with new urgency.

Soft landing optimists point to several factors. Consumer spending remains relatively healthy, supported by wage gains that have outpaced inflation for most workers. The housing market, while slow, hasn’t collapsed. Corporate earnings, especially in the technology sector, continue to grow. These aren’t the hallmarks of an economy in freefall.

But the pessimists have ammunition too. Job losses typically accelerate once they begin, as weakening consumer confidence leads to reduced spending, which leads to more layoffs. The unemployment rate’s stability at 4.1% masks some concerning trends. The number of people working part-time who want full-time work increased by 200,000 in December. The labor force participation rate ticked down, suggesting some workers have given up looking.

History offers mixed guidance. The Fed has achieved soft landings before, most notably in 1995 when Alan Greenspan engineered rate cuts that extended the economic expansion for another five years. But the central bank has also misjudged conditions, as it did in 2007 when officials dismissed early signs of the housing crisis. Which historical parallel applies today depends largely on what happens over the next few months.

What This Means for Workers

If you’re currently employed and nervous about job security, December’s report doesn’t offer much comfort. But context matters. A hiring slowdown is not the same as mass layoffs, and the economy is still creating jobs, just fewer of them. The question is whether your industry and skill set make you vulnerable.

Technology workers have already experienced the sharpest correction. The industry shed roughly 150,000 jobs in 2025, following similar losses in 2024. But the latest data suggests tech layoffs may be stabilizing as companies complete restructuring efforts. If you work in AI, cloud computing, or cybersecurity, demand remains strong despite the broader slowdown.

Healthcare workers should pay attention to which part of the sector employs them. Hospitals and large health systems are cutting costs, but outpatient care, home health, and medical technology continue to expand. The aging population ensures long-term demand, even if short-term hiring has slowed.

Retail and hospitality workers face the most uncertainty. These sectors are highly sensitive to consumer confidence, which tends to weaken when job market headlines turn negative. If people start worrying about their own job security, they spend less, which leads to reduced hours and headcount in customer-facing industries. It’s a feedback loop that can accelerate quickly.

For job seekers, the message is clear: the market has shifted from a seller’s market to something more balanced. Expect longer search times, more competition for positions, and less negotiating leverage. The days of multiple competing offers and signing bonuses have largely ended outside of specialized technical roles.

The Bigger Picture

December’s jobs report arrives at a peculiar moment in American economic history. The economy has defied predictions of recession for three consecutive years, powered by consumer resilience and corporate adaptability. But each month of defied expectations raises the stakes for when the eventual slowdown arrives.

The structural changes from the pandemic era haven’t disappeared. Remote work has permanently altered commercial real estate and urban economies. Supply chain reshoring continues to shift where goods are produced. The AI revolution is just beginning to affect hiring patterns across industries. December’s weakness may reflect these longer-term adjustments as much as cyclical concerns.

What happens next depends heavily on factors beyond the labor market. The new Trump administration’s economic policies, particularly around tariffs and tax cuts, will shape business confidence and investment decisions. The Federal Reserve’s response to weak data will determine whether credit remains available. Global economic conditions, especially in China and Europe, will affect demand for American exports.

For now, the appropriate response is watchful concern rather than panic. December’s 50,000 jobs represent a significant deterioration, but they don’t yet signal recession. The labor market has proven remarkably resilient over the past few years. Whether that resilience continues will become clearer in the next few monthly reports. Until then, prudent financial planning, building emergency savings, networking actively, and keeping skills current, remains the best defense against economic uncertainty.

The Bottom Line

December’s jobs report marks a clear inflection point for the U.S. economy. After years of surprisingly strong employment growth, the labor market is finally showing meaningful weakness. The 50,000 jobs added represent the slowest growth since the pandemic recovery, and the sector breakdowns suggest the slowdown is broad-based rather than confined to any single industry.

For the Federal Reserve, this data adds urgency to the case for rate cuts, even as inflation remains above target. For workers, it’s a reminder that job market conditions can shift quickly and that financial preparation matters. For the broader economy, December’s numbers raise questions about whether the much-discussed soft landing is still achievable.

The next few months will be critical. January’s jobs report, due in early February, will show whether December was an aberration or the start of a trend. Corporate earnings season will reveal how businesses are responding to economic uncertainty. And the Fed’s late January meeting will provide clues about how aggressively policymakers will act.

What we know today is that the labor market has weakened significantly. What we don’t know yet is how much further it has to fall. That uncertainty is perhaps the most honest assessment anyone can offer right now.

Sources

- Bureau of Labor Statistics, Employment Situation Summary, January 2026

- Federal Reserve, December 2025 FOMC Meeting Minutes

- Wall Street Journal, “December Jobs Report Analysis”

- Bloomberg Economics, Labor Market Indicators