For fifteen years, the narrative was simple: Amazon is eating retail, Walmart is dying, and there’s nothing the old guard can do about it. Except Walmart didn’t die. They adapted. And in some crucial metrics, they’re now beating Amazon at Amazon’s own game. This retail competition reflects broader shifts in how businesses are adapting to AI-driven transformation.

Walmart’s e-commerce sales grew 27% in 2024, faster than Amazon’s 11%. Walmart+ membership is growing faster than Prime. Customer satisfaction scores for Walmart’s delivery and pickup services exceed Amazon’s. And perhaps most surprisingly, Walmart’s third-party marketplace is taking sellers away from Amazon because the fees are lower and the treatment is better.

This isn’t about Walmart replacing Amazon. Amazon remains the dominant e-commerce player. But Walmart proved that physical retail isn’t dead, it’s actually a competitive advantage when combined with digital capabilities. Here’s how they did it.

The Physical Store Advantage

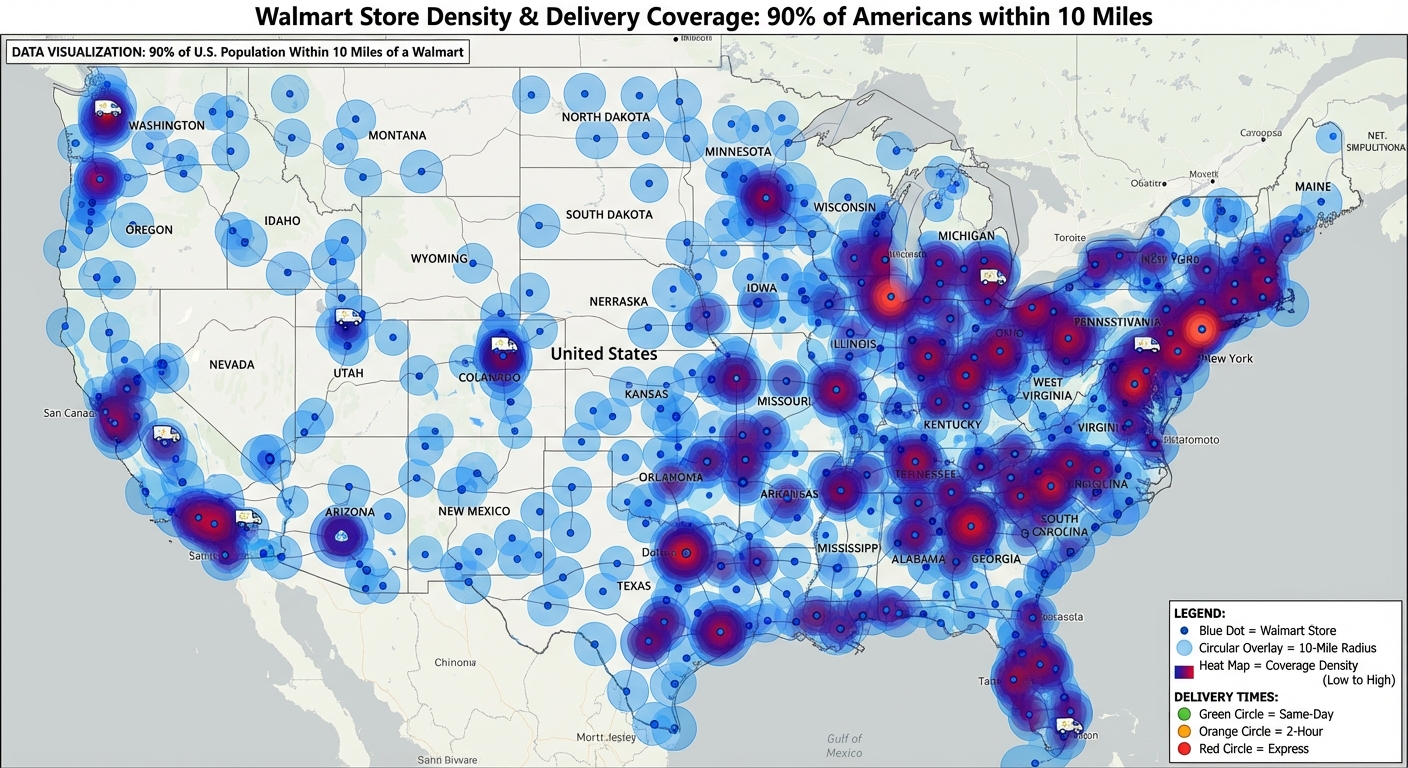

Amazon’s weakness is they don’t have physical locations (Whole Foods aside). That constraint, once considered Amazon’s brilliant efficiency move, is now looking like a limitation. Walmart has 4,700 stores in the US, and 90% of Americans live within 10 miles of one.

Same-day pickup is the killer feature. Order online, drive to the store, someone brings it to your car. No waiting for delivery, no worrying about porch pirates, no shipping costs. For many purchases, especially groceries, this beats two-day Prime shipping. With stores everywhere serving as micro-fulfillment centers, Walmart can deliver orders within hours in most urban and suburban areas.

Returns are easy. Bought something online that doesn’t work? Drive to Walmart and return it immediately. With Amazon, you’re printing labels, boxing things, and hoping the return gets processed correctly. Walmart’s instant returns eliminate friction that Amazon can’t match without physical locations.

Walmart+ vs. Amazon Prime

Walmart launched Walmart+ in 2020 as a Prime competitor. Initial reactions were skeptical, but the membership growth suggests they’re onto something. Walmart+ costs $98/year versus Prime’s $139/year, and includes tangible benefits like fuel discounts (up to 10 cents per gallon) that hit your wallet every week.

Prime has better streaming content, but Walmart+ targets a specific demographic: families who prioritize price and convenience over media entertainment. Walmart+ membership grew 30% in 2024 and now sits around 32 million members. Prime has 180 million members, so Amazon still dominates. But Walmart is growing faster in a segment they understand: budget-conscious families.

The Marketplace Strategy

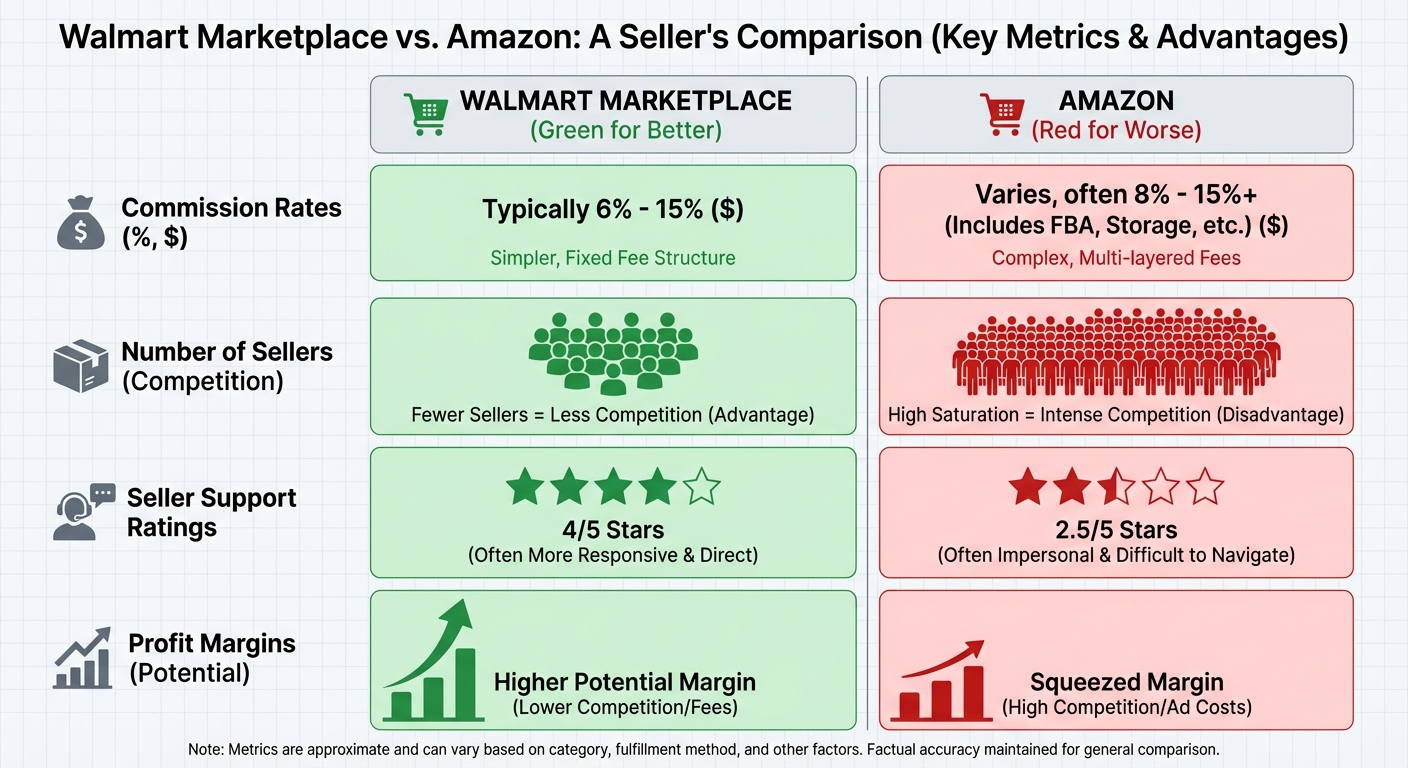

Walmart’s third-party marketplace is taking share from Amazon by offering sellers better economics and treatment. Walmart charges 6-15% commission depending on category. Amazon charges 8-20% plus additional fulfillment fees. For high-volume sellers, that difference translates to significantly more profit.

Amazon has 12 million sellers. Walmart has around 150,000. Your products are more discoverable with less competition. Sellers consistently report that Walmart’s seller support is more responsive and reasonable than Amazon’s, which has a reputation for suspending accounts arbitrarily.

Some premium brands won’t sell on Amazon because of counterfeit concerns and race-to-the-bottom pricing. They will sell on Walmart because the environment feels more controlled. Walmart is positioning as the “seller-friendly” alternative to Amazon’s brutal marketplace culture.

What It Means for Shoppers

The real story isn’t Walmart versus Amazon, it’s that consumers are using both for different needs. Amazon for niche products and fast shipping on general merchandise. Walmart for groceries, household staples, same-day pickup, and lower prices on everyday items.

Price comparison studies consistently show Walmart beating Amazon by 10-15% on comparable baskets of goods. For families watching budgets closely, especially during inflationary periods, that difference drives loyalty. Most families aren’t choosing one or the other. They’re choosing both, strategically.

The retail future isn’t “online kills physical” or “Amazon kills everyone.” It’s omnichannel, where companies that integrate physical and digital win. Unlike boring service businesses that rely purely on local presence, modern retail requires seamless integration of both channels.

The Bottom Line

The Walmart comeback story is one of the most underrated business stories of the 2020s. They were left for dead by analysts who insisted physical retail was finished. Instead, they invested tens of billions in e-commerce, leveraged their existing assets, and built a hybrid model that works.

Amazon is still the king of e-commerce. But Walmart is proof that you don’t need to be king to win. You just need to be really good at what you do and serve your customers better than alternatives. The retail wars aren’t over. They’re just more interesting than the simple “Amazon wins everything” story we were told.

Sources: Walmart and Amazon earnings reports, retail industry analysts, e-commerce market data.