While everyone’s chasing the next unicorn startup and pitching VCs on revolutionary AI platforms, a quiet wealth-building movement is happening in America’s least sexy industries. Laundromats. Vending machines. Porta-potty rentals. HVAC repair. These businesses won’t get you on magazine covers, but they will make you a millionaire.

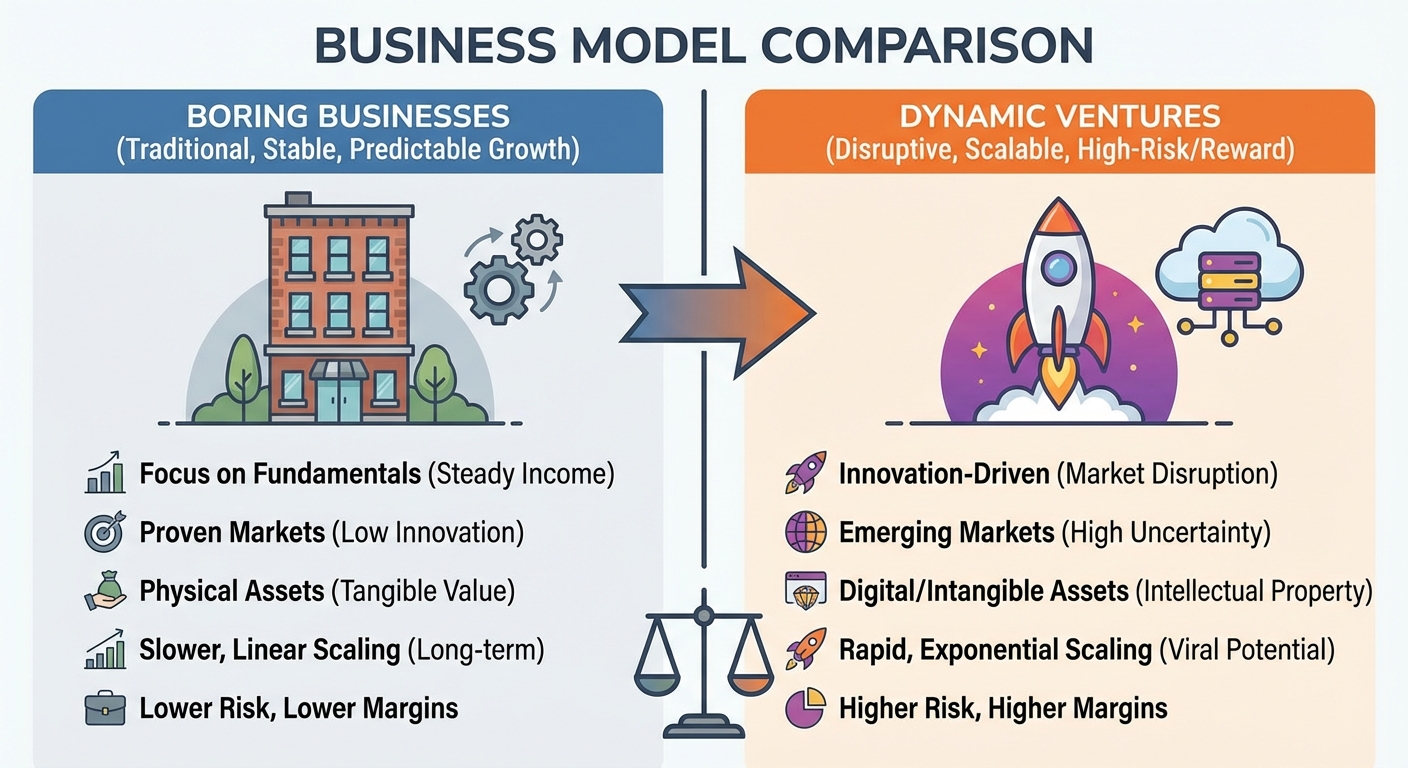

The data is compelling. Boring businesses have 60-70% five-year survival rates compared to 10-20% for VC-backed tech startups. The model is simple: provide essential services that can’t be disrupted by an app. Toilets break, laundry needs washing, and HVAC systems fail regardless of the economy.

The Boring Business Thesis

The investment thesis is straightforward. First, there’s low competition for excellence. Most service businesses are run by tired owner-operators with no succession plan. A modern entrepreneur who answers the phone, uses software for scheduling, and shows up on time is immediately in the top 10% of the market.

Second, recurring revenue and hard assets. These businesses generate predictable cash flow from essential services. They own tangible assets (trucks, equipment, real estate) that hold value. Unlike software where your competitive advantage can evaporate overnight, physical infrastructure is defensible.

The “rollup strategy” is creating fortunes. Entrepreneurs buy fragmented small businesses in pest control, plumbing, or junk removal. They consolidate them under one brand, improve operations with modern software and training, and sell to private equity for multiples of the original value. It’s not about inventing something new, it’s about professionalizing something old.

Success Stories That Work

Take Marcus, who bought a laundromat for $175,000. He added card readers, better lighting, and reliable cleaning. The cash flow allowed him to buy 13 more locations. He now nets $850,000 annually with mostly passive oversight.

Or Sarah, who started a porta-potty rental with $40,000. By focusing on cleanliness and reliability (showing up when promised), she built a $3.5 million business in three years. Her competitive advantage was literally just doing what she said she would do.

These aren’t outliers. They’re the result of applying basic business competence to neglected industries. The barrier to entry isn’t technical skill, it’s willingness to do unglamorous work.

The Math That Actually Works

The economics work because of capital efficiency. You can buy a cash-flowing business with an SBA loan for 10-20% down. The debt services itself from day one. There’s no “burn rate” hoping for future profitability like tech startups building AI infrastructure.

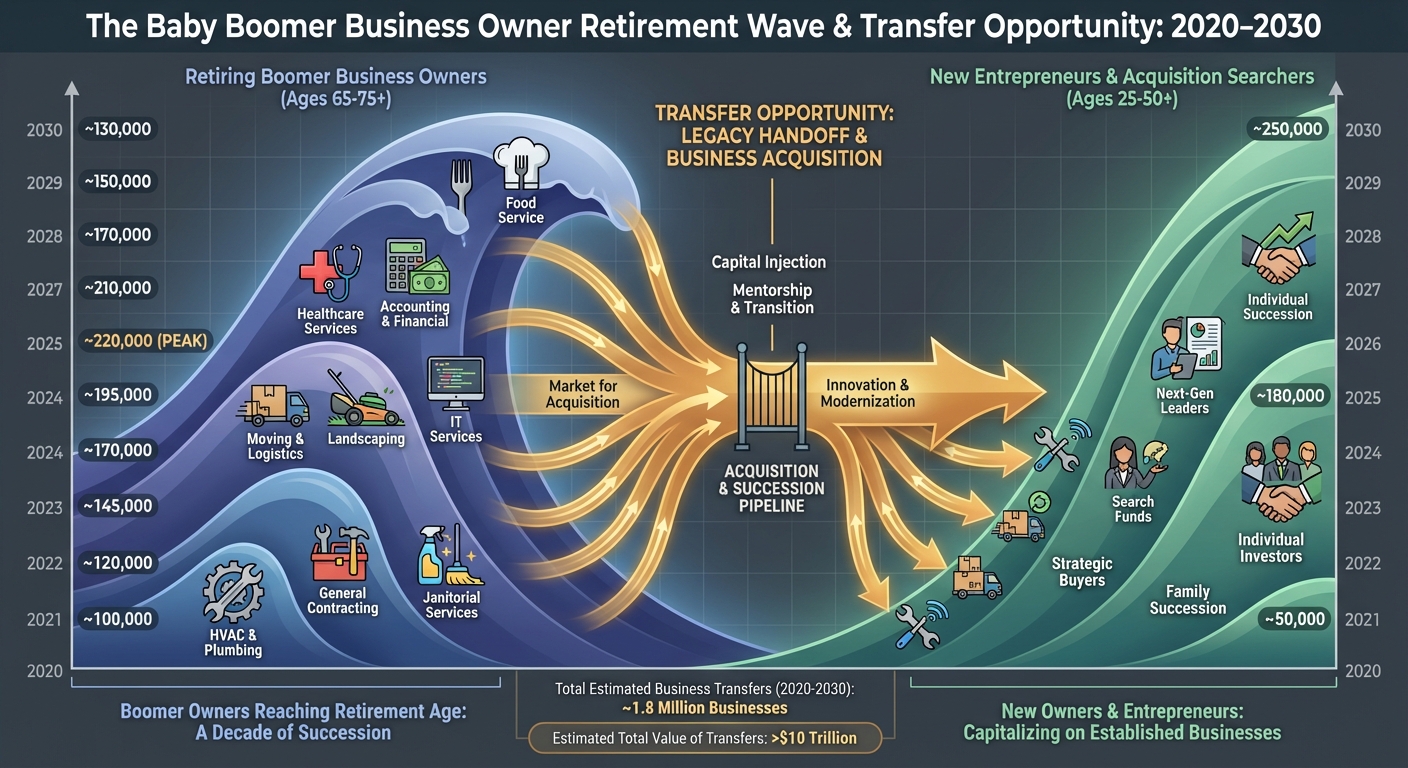

The demographic opportunity is massive. 10,000 Baby Boomers retire daily, many owning service businesses with no one to take over. They’re motivated sellers. This transfer of wealth is the biggest opportunity for young entrepreneurs today. Private equity firms are already consolidating these industries, but there’s still room for individual operators.

The Reality Check

It’s not passive income. Managing blue-collar teams, dealing with physical logistics, and solving unglamorous problems requires real work. There’s a 2am phone call when equipment breaks. There’s managing employees who might not show up. There’s the physical reality of trucks, inventory, and scheduling.

It lacks prestige. Your friends at Google won’t be impressed until they see your bank account. Nobody writes TechCrunch articles about innovative HVAC rollup strategies. But for those willing to trade status for equity, it’s the surest path to wealth available to most people without significant capital.

The Bottom Line

The richest person you know might not work in tech. They might own the HVAC company that services your office building. They might own the laundromat chain across three counties. They might rent porta-potties to construction sites.

Boring is beautiful when it compounds. These businesses won’t change the world, but they will change your bank account. And in an era where even major retailers are rethinking their strategies, the fundamentals of providing essential services remain constant.

If you can get over the prestige problem, there’s a fortune waiting in the least sexy corners of the economy.

Sources: SBA business survival statistics, private equity acquisition data, demographic retirement projections.