The IPO market froze in late 2022 and stayed frozen through 2023. Venture-backed startups shelved their plans as interest rates soared and valuations plummeted. The pipeline of companies waiting to go public grew to over 500, while actual listings dropped to levels not seen since the 2009 financial crisis.

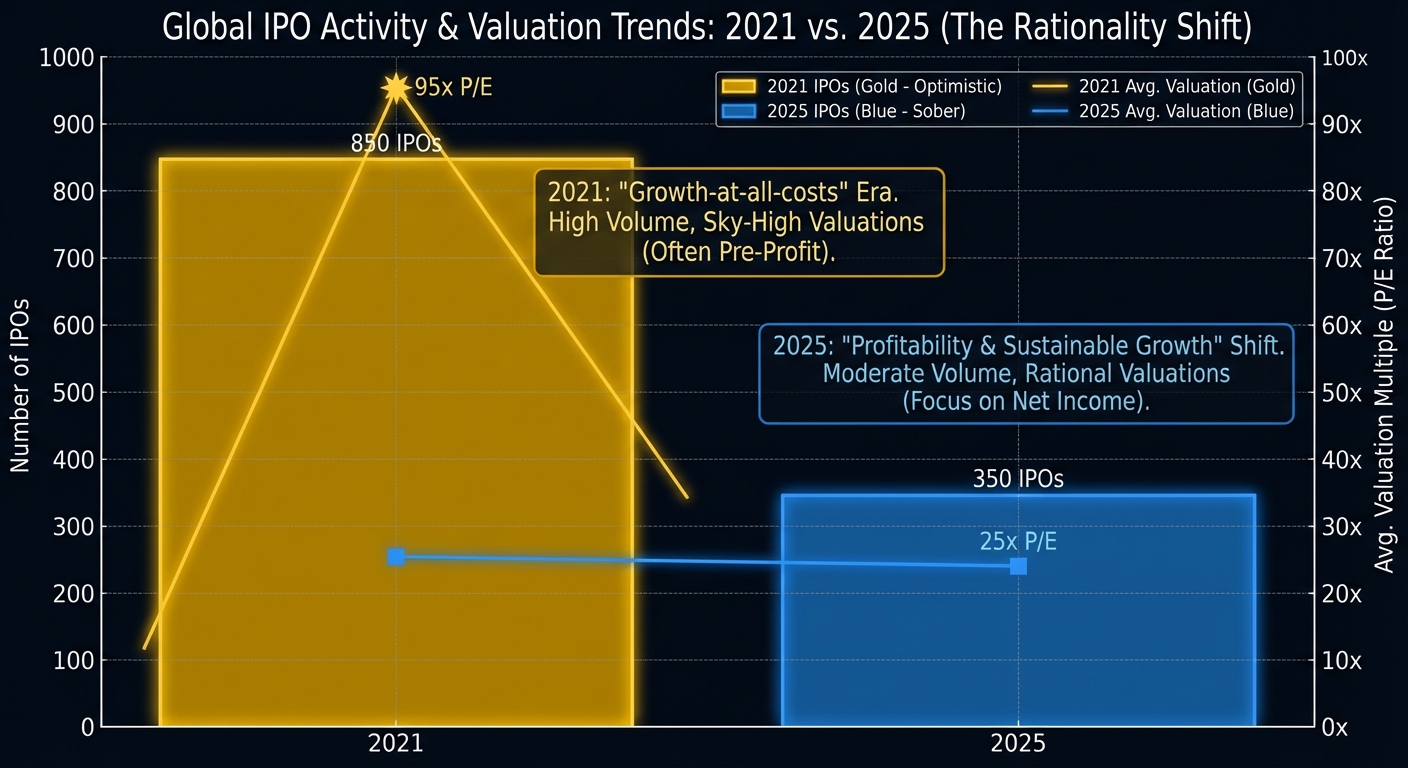

Now, in 2025, the ice is breaking. Companies are going public again, but the landscape has fundamentally changed. The mania of the SPAC era is gone, replaced by a disciplined, skeptical market that demands profitability over growth. The “Wild West” days of free money are over, and reality has set in.

The New Rules of the Road

The primary shift is the requirement for profitability. In 2021, investors rewarded “growth at all costs,” pouring money into companies burning billions with no clear path to profit. Today, they punish it. Companies like Stripe, Reddit, and Databricks waited until they could show consistent positive earnings or a clear, immediate path to profitability before testing the public markets.

The loss-making growth story that fueled the unicorn boom is dead. Investors want to see actual business models, not just user growth and total addressable market slides. This is a fundamental change in how companies prepare for public markets.

Valuations have also reset dramatically. Companies are accepting 30-50% lower valuations than they would have commanded a few years ago. This adjustment is painful for late-stage investors and employees holding options, but it reflects the new economic reality of 5% interest rates. When risk-free Treasury bonds yield 5%, speculative tech stocks need to offer significantly more to justify the risk.

The Death of SPACs and Easy Money

The collapse of the SPAC (Special Purpose Acquisition Company) market was a major factor in this reset. In 2020-2021, over 600 SPACs went public, offering a shortcut to listing that bypassed traditional scrutiny. Companies with minimal revenue and questionable business models went public through SPAC mergers, promising future profitability that rarely materialized.

By 2024, most SPACs were trading below their initial offering price. Many companies that went public via SPAC have since been delisted or acquired at fire-sale prices. Investors who got burned by speculative, revenue-free companies are now demanding rigorous due diligence. The easy money pipeline that funded everything from AI infrastructure to consumer apps has dried up.

The traditional IPO process, with its roadshows, SEC scrutiny, and underwriter due diligence, is back in favor. It’s slower and more expensive, but it filters out companies that aren’t ready for public market accountability.

Companies Staying Private Longer

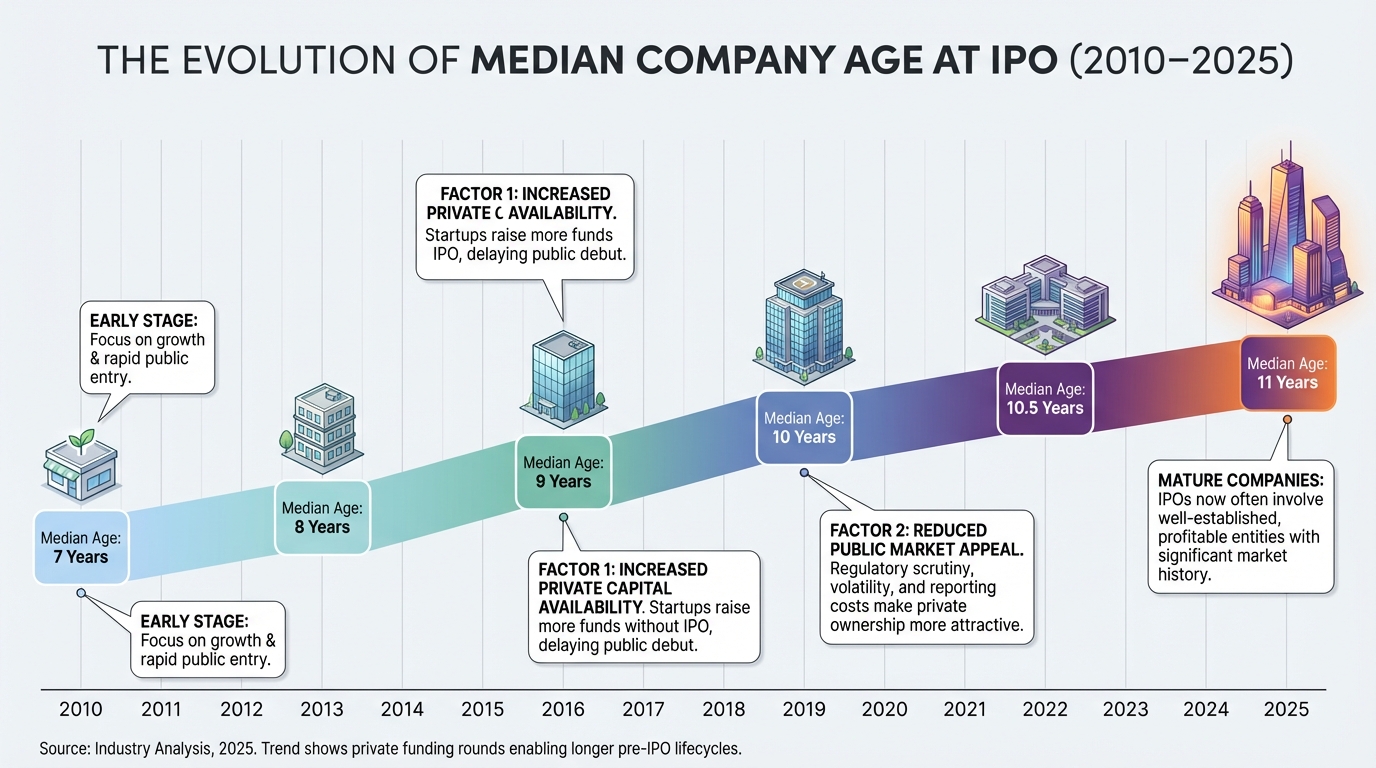

Companies are staying private longer than ever. The median age at IPO is now 11 years, up from 7 years in 2010. Private markets have enough capital to support them, allowing founders to avoid the scrutiny of quarterly earnings until they’re truly ready.

This has created a two-tier system. Elite companies with strong fundamentals stay private indefinitely, accessing growth capital from private equity and sovereign wealth funds. They only go public when they’re mature, profitable, and ready for public markets. Meanwhile, weaker companies that can’t raise privately are forced to go public earlier or die quietly.

What It Means for Investors

For public market investors, this is actually good news. The companies going public now are generally stronger, more mature, and more likely to deliver returns than the speculative bets of 2021. The bar is higher, which means the quality is better.

However, the massive gains from getting in early are increasingly captured by private investors, not public ones. By the time a company like Stripe or SpaceX goes public, much of the value creation has already happened. Public market investors get a mature company with less explosive growth potential.

This creates a wealth inequality issue where sophisticated private investors capture the best returns, while regular retail investors are limited to buying after the big gains are already realized. It’s a structural shift that favors the already-wealthy.

The Bottom Line

The IPO market is back, but it’s a different animal. Companies need real profits, reasonable valuations, and sustainable business models. The SPAC era taught investors a painful lesson about due diligence, and they’re not forgetting it anytime soon.

This is healthier for markets long-term, even if it’s less exciting. The days of unprofitable companies going public at absurd valuations are over. What we have now is a return to fundamentals: companies go public when they’re ready, at prices that reflect actual value, not speculative hype.

For entrepreneurs, the message is clear: build a real business, get to profitability, and then consider going public. For investors, the message is equally clear: the easy money has been made. What’s left requires actual analysis.

Sources: U.S. Securities and Exchange Commission, PitchBook, Renaissance Capital.