Databricks is reportedly in talks to raise around $5 billion in new capital at a valuation of roughly $134 billion. If the round closes as expected, it would make the San Francisco-based data and AI company one of the most valuable private tech firms in the world, and it would signal something important about where the real money in AI is flowing.

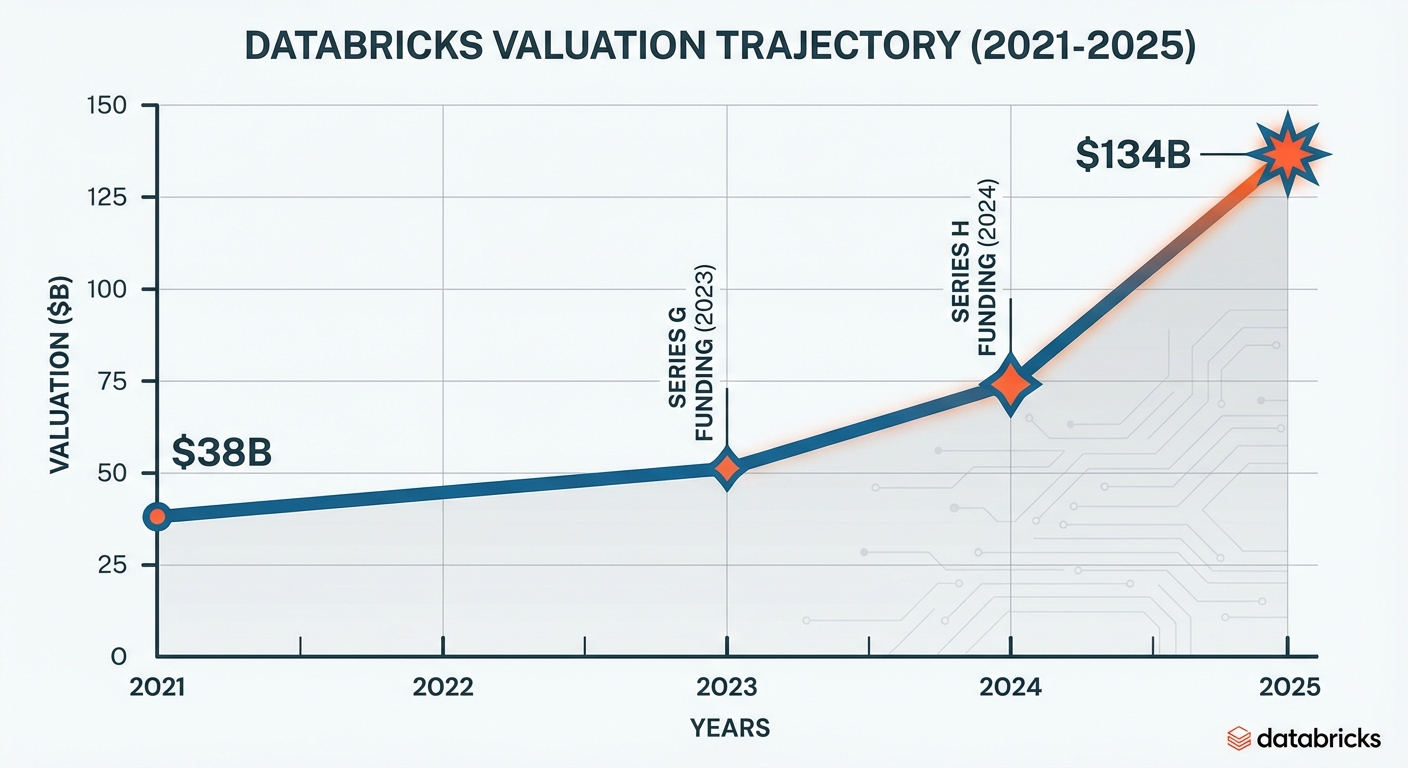

The valuation represents approximately 32 times Databricks’ expected 2025 revenue of around $4.1 billion, according to sources familiar with the discussions. That’s a premium multiple even by enterprise software standards, reflecting investor confidence that the company sits at the intersection of two trends that aren’t slowing down: the explosion of enterprise data and the race to deploy AI across business operations.

Why Databricks, Why Now

If you’ve followed the AI investment surge over the past two years, you’ve probably noticed a pattern. The flashiest headlines go to companies building foundation models and consumer-facing AI products. But increasingly, the largest checks are going to infrastructure companies, the platforms that enterprises actually need to make AI work at scale.

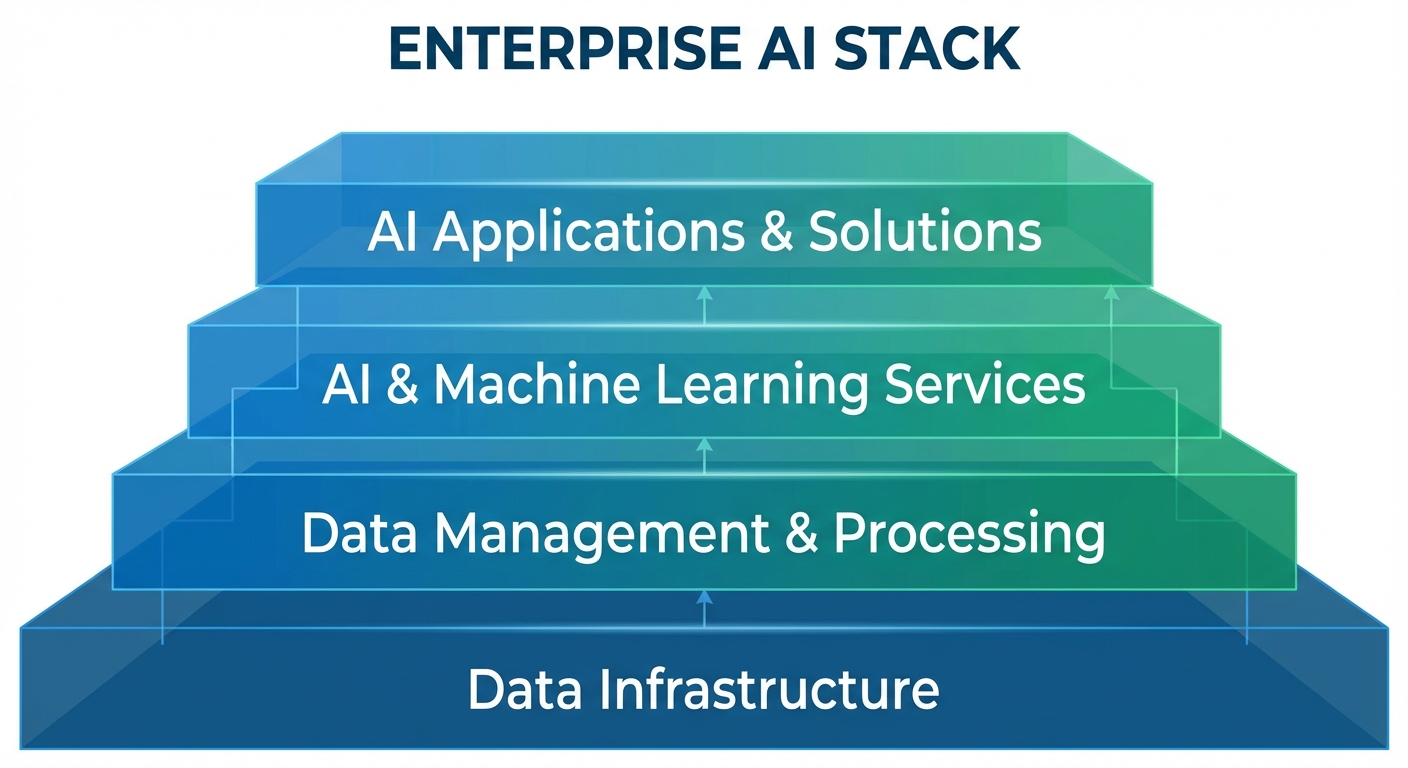

Databricks fits squarely in this category. The company’s Lakehouse Platform combines data warehousing, data lakes, and AI/ML capabilities into a unified system. In practical terms, it helps large organizations manage the massive datasets required to train and deploy AI models, then integrate those models into actual business processes.

The timing matters. After two years of AI experimentation, enterprises are moving from proof-of-concept projects to production deployments. That transition requires robust data infrastructure. You can’t deploy AI at scale if your data is scattered across incompatible systems, poorly labeled, or inaccessible to the teams that need it. Databricks has positioned itself as the solution to exactly that problem.

The Numbers in Context

A $134 billion valuation would place Databricks among the most valuable private companies globally. For context, that’s larger than the market caps of established public companies like Dell Technologies or General Motors. It’s roughly triple the valuation Databricks achieved in its 2021 funding round, when it raised $1.6 billion at a $38 billion valuation.

The growth trajectory reflects both the company’s revenue expansion and the market’s appetite for AI infrastructure bets. Databricks has reportedly grown revenue at approximately 50% year-over-year, reaching the $4 billion annual revenue mark in 2025. That growth rate, combined with the company’s positioning in enterprise AI, justifies the premium multiple in investors’ eyes.

The round also reflects the current state of private markets. With IPO windows remaining relatively narrow, late-stage private companies are raising larger rounds at higher valuations rather than testing public markets. For investors, these mega-rounds represent an opportunity to deploy significant capital into companies with proven business models before they go public.

What This Means for the AI Market

The Databricks round arrives alongside other major AI infrastructure investments announced the same week. Black Forest Labs, a German AI startup focused on image generation, raised $300 million at a $3.25 billion valuation. Reports also surfaced that banks are in discussions to provide $38 billion in financing for OpenAI-related data center construction.

The pattern is clear: while consumer AI applications capture headlines, the largest capital deployments are flowing into infrastructure. The same dynamic is reshaping enterprise leadership with Chief AI Officers becoming essential roles. Data centers, specialized chips, enterprise platforms, and the data systems that make it all work. These bets reflect a view that AI’s economic impact will primarily materialize through enterprise adoption, which requires massive investments in underlying infrastructure.

For startups and investors focused on AI applications, this has implications. The infrastructure layer is getting funded at scale, which should eventually make building on top of it easier. But it also means competing for talent and resources against companies with access to unprecedented capital.

The Bottom Line

Databricks’ potential $134 billion valuation isn’t just a milestone for one company. It’s a signal about where the AI investment cycle is heading. The foundation model wars will continue, and consumer applications will keep grabbing attention. But the serious money is flowing to the companies building the infrastructure that enterprises need to actually deploy AI at scale. Databricks has positioned itself at the center of that infrastructure, and investors are betting billions that position will pay off.

Sources: Databricks, The Wall Street Journal, TechCrunch.