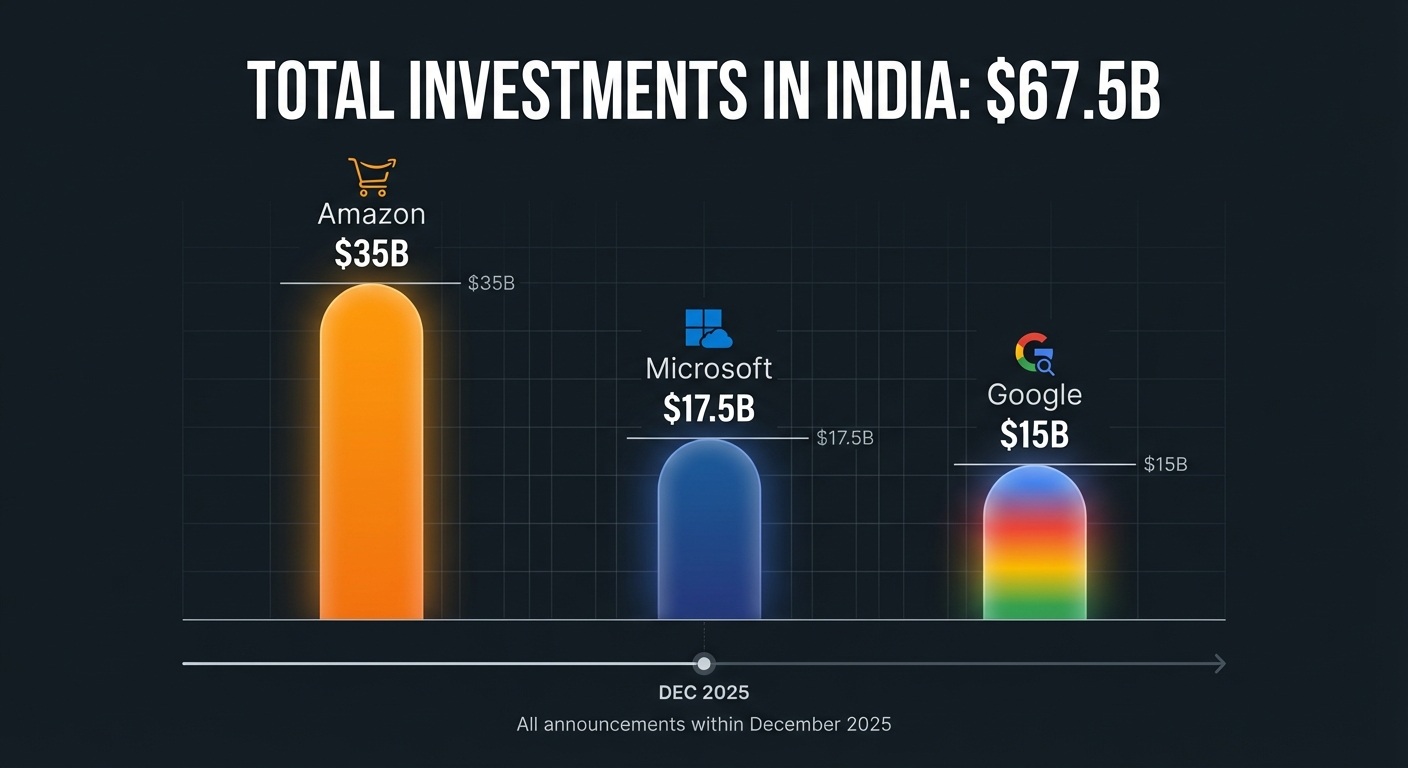

In the span of 72 hours this week, three of the world’s most valuable companies committed more than $67 billion to a single country’s AI future. Amazon announced plans to invest over $35 billion in India by 2030. Microsoft pledged $17.5 billion for AI and cloud infrastructure. Google committed $15 billion for AI data centers. The message from Silicon Valley couldn’t be clearer: whoever wins India wins the next decade of artificial intelligence.

This isn’t just another round of corporate expansion announcements. What we’re witnessing is a fundamental shift in where the world’s AI infrastructure will be built, trained, and deployed. India, with its 1.4 billion people and rapidly digitizing economy, has become the most contested territory in the global AI race, and Big Tech is betting that controlling this market will determine who leads the industry for the next generation.

The Stakes Behind the Numbers

The raw dollar figures are staggering, but they only tell part of the story. Amazon’s $35 billion commitment represents the company’s largest international investment announcement ever, dwarfing its previous expansion plans in any single market outside the United States. The funds will go toward AI capabilities, upgraded logistics networks, small-business support programs, and job creation across the country, according to Amazon’s announcement on December 10.

What makes this particularly significant is the timing. Amazon’s announcement came just one day after Microsoft pledged $17.5 billion for AI and cloud infrastructure in India, and both followed Google’s commitment of $15 billion for AI data centers announced earlier in the week. This wasn’t coincidence. These companies are engaged in a coordinated race where being second means being irrelevant, part of the same competitive dynamics driving record AI valuations across the industry.

The strategic calculus is straightforward. India graduates more STEM students annually than any country except China. It has the world’s fastest-growing major economy. Its digital payments infrastructure, built around the government’s Unified Payments Interface (UPI), processes more real-time transactions than any system on Earth. And critically, it’s a democracy with strong legal protections for intellectual property, making it a far more attractive destination for AI development than China, which has increasingly hostile relations with Western tech companies.

Why India, Why Now

The convergence of investment announcements this week wasn’t random. India has spent the past decade building exactly the kind of digital infrastructure that AI companies need to scale. The country’s fiber optic network now reaches more than 600 million people. Mobile data costs are among the lowest in the world, at roughly $0.17 per gigabyte compared to $6 in the United States. And the government has signaled consistent support for foreign technology investment through regulatory reforms and tax incentives.

But the more immediate catalyst is competition with China. As geopolitical tensions have made it increasingly difficult for American companies to operate in or source talent from China, India has emerged as the obvious alternative. The country has a massive English-speaking workforce, a legal system based on common law, and increasingly sophisticated semiconductor manufacturing ambitions that align with America’s own chip-building incentives.

For Amazon specifically, India represents something even more valuable: a testing ground for AI at population scale, particularly as the company develops custom Trainium AI chips to compete with Nvidia. The company’s India operations already serve as a laboratory for features that later roll out globally. Alexa’s Hindi and regional language capabilities were developed in India before being adapted for other multilingual markets. The same pattern is now emerging with generative AI, where Amazon can train models on Indian languages and use cases before deploying them worldwide.

The AI Price War Has Already Started

Perhaps the most telling signal of how seriously these companies are taking India came from Google on the same day as Amazon’s announcement. The company launched AI Plus, a new subscription tier priced at just 199 Indian rupees, roughly $2.21, for the first six months. This is Google’s direct response to OpenAI’s ChatGPT Go subscription, which launched in India earlier this year at similarly aggressive pricing.

The subscription price war is significant because it reveals how these companies view the Indian market. Rather than treating it as a premium destination where wealthy urban consumers will pay Western prices, they’re competing for mass adoption at price points that make AI accessible to hundreds of millions of users. This is a bet on volume over margins, a strategy that only makes sense if you believe India will be a decisive AI market for decades to come.

For context, Google’s standard AI Plus subscription costs $19.99 per month in the United States. The India price represents a discount of roughly 90 percent, a subsidy that Google is clearly willing to absorb to establish market dominance. Microsoft and Amazon are pursuing similar strategies with their own AI services, creating a race to the bottom on pricing that will ultimately determine which company’s AI ecosystem becomes the default for India’s next billion internet users.

What This Means for Global AI Development

The implications of this investment surge extend far beyond India’s borders. When Amazon, Microsoft, and Google collectively commit $67 billion to AI infrastructure in a single country, they’re not just building data centers. They’re creating the physical and human infrastructure that will shape how AI develops globally.

Consider the data advantage. AI models are only as good as the data they’re trained on, and India offers something no other market can match: massive volumes of data in dozens of languages, across wildly diverse use cases, from rural agricultural applications to cutting-edge financial services. The models trained on Indian data will be inherently more capable of handling linguistic diversity, economic variability, and cultural nuance than models trained primarily on English-language Western data.

There’s also the talent pipeline to consider. All three companies have announced plans to hire tens of thousands of workers in India, including AI researchers, data scientists, and software engineers. This isn’t just about labor arbitrage. India’s top engineering schools now produce researchers who are competitive with graduates from MIT, Stanford, and Tsinghua. By establishing major AI operations in India, these companies gain access to a talent pool that would be impossible to replicate in the United States, where immigration restrictions limit the number of skilled workers companies can hire.

The Risks and What Could Go Wrong

For all the bullish signals, significant risks remain. India’s infrastructure, while improving rapidly, still struggles with reliability issues. Power outages, while less common than a decade ago, still occur in many regions. The country’s bureaucracy, despite reform efforts, can still slow major projects. And regulatory uncertainty around data localization requirements has caused headaches for foreign tech companies in the past.

There’s also the question of whether these investments will actually benefit Indian citizens or primarily serve as extraction mechanisms for American corporations. Critics have argued that Big Tech’s presence in India has historically focused on capturing consumer data and market share while providing relatively little in terms of high-value jobs or technology transfer. The companies’ announcements emphasize job creation and small-business support, but skeptics point out that similar promises in other markets haven’t always materialized.

The geopolitical dimension adds another layer of complexity. India has its own strategic ambitions in AI and may not be content to serve as a subsidiary of American tech interests indefinitely. The government has launched multiple initiatives to build domestic AI capabilities, including a new degree program in “embodied intelligence” that rivals similar efforts in China, and tensions could emerge if foreign companies are seen as crowding out Indian startups or dominating critical infrastructure.

The Bottom Line

What happened this week in India represents a inflection point in the global AI industry. The combined $67 billion commitment from Amazon, Microsoft, and Google isn’t just the largest coordinated tech investment in a single emerging market. It’s a declaration that the future of AI will not be built exclusively in Silicon Valley, Seattle, or Beijing.

For consumers and businesses in India, this investment surge promises faster AI services, lower prices, and more locally relevant applications than would otherwise be possible. For the global tech industry, it signals that the center of gravity in AI development is shifting, with India emerging as a critical hub that will influence how artificial intelligence evolves for the next decade.

The question now is whether India can absorb this investment effectively, whether the infrastructure will be built, the talent developed, and the regulatory environment maintained to justify these enormous bets. The next few years will determine whether this week’s announcements mark the beginning of India’s AI ascendancy, or whether they become another case of corporate ambitions outpacing on-the-ground reality. Based on the urgency with which Big Tech is moving, they’re betting heavily on the former.