Amazon is doing something it rarely does: investing heavily in a company it doesn’t control. According to The Information and confirmed by Bloomberg, the e-commerce giant is in preliminary discussions to pour at least $10 billion into OpenAI, a deal that would value the ChatGPT maker at north of $500 billion. But this isn’t just about cash changing hands. The agreement would see OpenAI adopt Amazon’s custom Trainium AI chips, a move that could fundamentally alter the power dynamics in the AI infrastructure wars.

The timing tells you everything you need to know about where OpenAI’s head is at. Just two months ago, the company completed a major restructuring that loosened Microsoft’s grip on its operations. Under the old arrangement, Microsoft had right of first refusal to be OpenAI’s exclusive compute provider. That’s gone now. OpenAI is shopping around, and Amazon answered the call.

What the Deal Actually Looks Like

The contours of the negotiation, while still fluid, paint a picture of mutual desperation dressed up as strategic vision. Amazon would contribute at least $10 billion in capital, potentially pushing OpenAI’s valuation past the half-trillion mark. In return, OpenAI would commit to using Amazon’s Trainium chips, which AWS unveiled earlier this month, for a significant portion of its AI training and inference workloads.

For context on just how massive this valuation is: OpenAI raised money at a $157 billion valuation just three months ago. We’re talking about more than a tripling of value in a quarter. This comes amid an AI funding frenzy that has sent valuations soaring across the industry. Either OpenAI has discovered something transformative in the basement, or we’re watching a valuation bubble inflate in real-time. Probably both.

The discussions also include the possibility of OpenAI helping Amazon with its online marketplace, according to CNBC, mirroring deals the AI company has struck with Etsy, Shopify, and Instacart. Imagine ChatGPT-powered product recommendations, seller tools, or customer service across Amazon’s platform. The integration possibilities are significant.

Why Amazon Is Betting on Both Horses

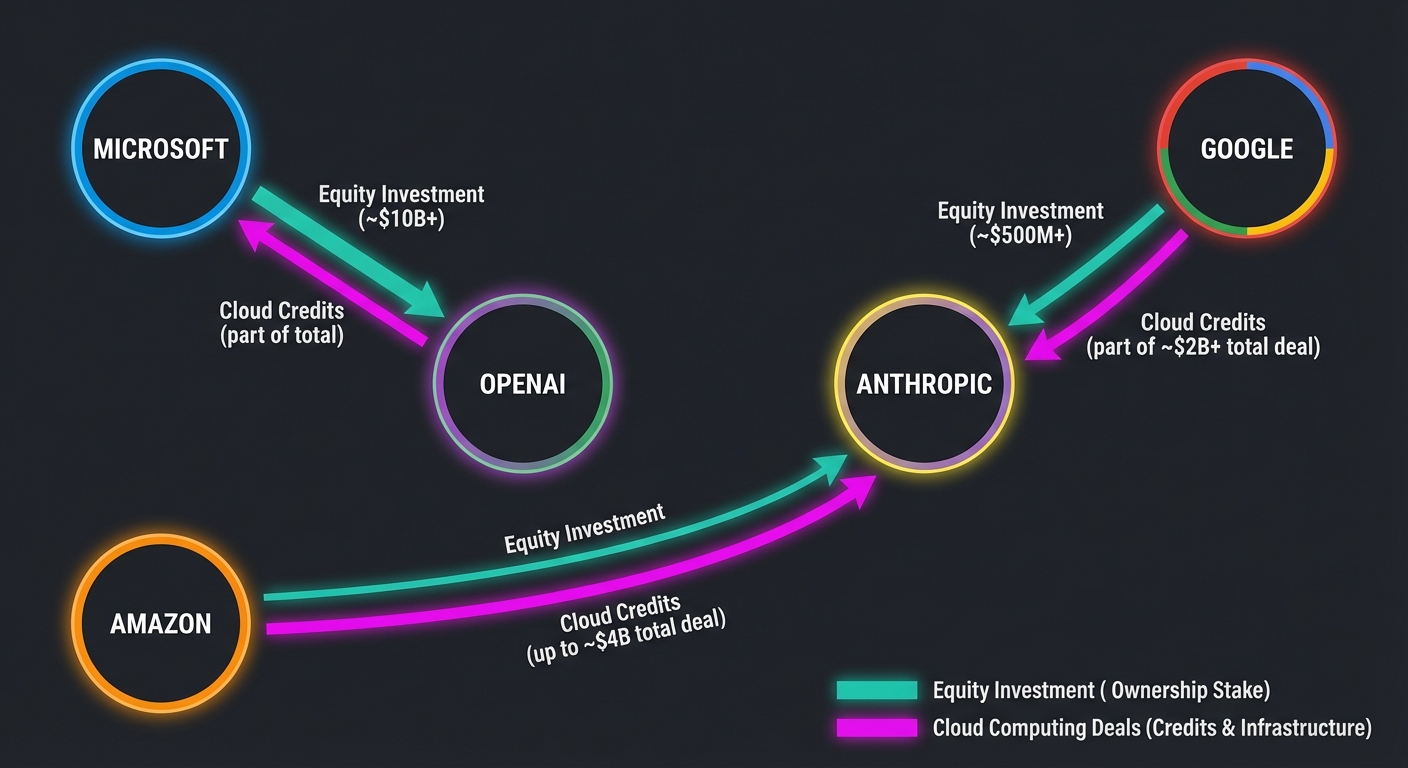

Here’s where it gets interesting. Amazon has already invested $8 billion in Anthropic, OpenAI’s biggest rival and a company founded by former OpenAI employees who left over safety concerns. Now Amazon is positioning itself to back OpenAI too. It’s the Switzerland strategy: stay neutral, sell arms to everyone, and profit regardless of who wins.

Dan Ives, a tech analyst at Wedbush Securities who has followed these AI infrastructure plays closely, told Bloomberg that Amazon is “positioning itself as the arms dealer of the AI revolution.” That framing is apt. AWS remains the largest cloud infrastructure provider in the world, but it has struggled to maintain that dominance among AI-native companies who have flocked to Microsoft Azure, largely because of Microsoft’s OpenAI integration.

This deal would give Amazon a foot in both camps. If Anthropic’s Claude becomes the industry standard, Amazon wins. If OpenAI’s GPT models dominate, Amazon also wins. The only scenario where Amazon loses is if both companies fail, and that seems increasingly unlikely given the trajectory of AI adoption, including massive investments flowing into India’s AI infrastructure.

The Chip Game Gets Complicated

The Trainium component of this deal deserves special attention. Amazon Web Services has been designing custom AI chips since around 2015, and the latest generation of Trainium chips, announced earlier this month, represents Amazon’s best attempt yet to break Nvidia’s stranglehold on AI hardware.

Nvidia currently dominates the AI chip market with an estimated 80-90% share. Every major AI model you’ve heard of, from GPT-4 to Claude to Gemini, was trained primarily on Nvidia hardware. Amazon’s pitch is straightforward: Trainium offers comparable performance at lower cost. Whether that claim holds up under the intense computational demands of frontier AI training remains to be seen.

For OpenAI, diversifying away from Nvidia makes strategic sense. The company has made more than $1.4 trillion in infrastructure commitments in recent months, including deals with Nvidia, AMD, and Broadcom. Relying too heavily on any single chip supplier creates concentration risk, especially as Nvidia struggles to meet global demand for its H100 and upcoming B200 chips.

The Circular Revenue Problem

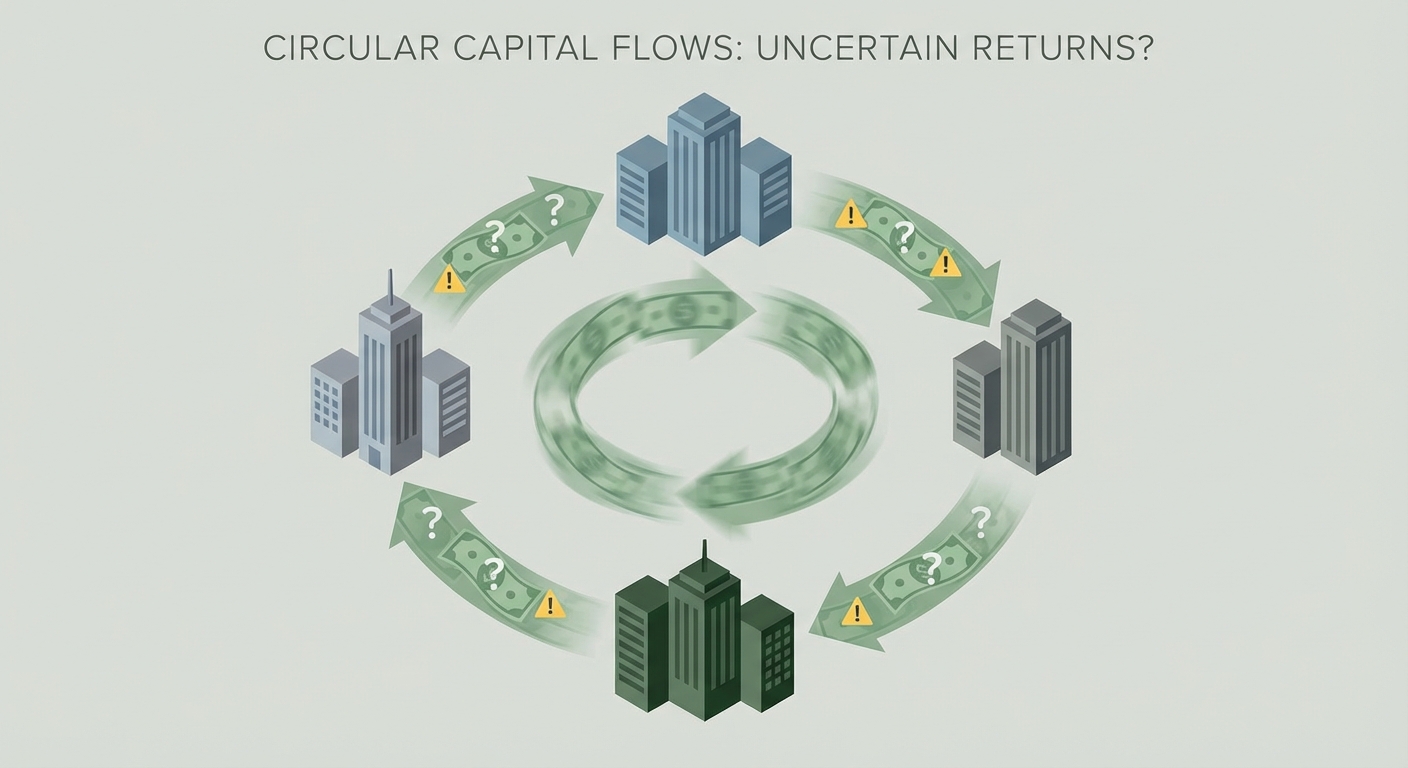

Not everyone is cheering. A Bernstein analyst cited by TechCrunch warned that this deal “will clearly fuel circular concerns.” The math is uncomfortable: Amazon invests $10 billion in OpenAI, and a significant chunk of that money immediately flows back to Amazon as cloud computing fees.

This isn’t unique to Amazon. Microsoft has poured over $13 billion into OpenAI while simultaneously collecting billions in Azure fees as OpenAI’s primary cloud provider. Google invested in Anthropic while Anthropic runs primarily on Google Cloud. The AI boom has created a peculiar ecosystem where big tech companies effectively subsidize AI startups that then pay that money back for infrastructure.

Last month, OpenAI signed a $38 billion deal to buy capacity from AWS, its first major contract with Amazon’s cloud division. If the $10 billion investment goes through, you could argue Amazon is simply pre-paying for services it will receive anyway. Whether this represents genuine investment or elaborate accounting depends on your perspective.

What This Means for Microsoft

Microsoft executives are probably having complicated feelings right now. The company has invested over $13 billion in OpenAI and built significant portions of its AI strategy around the partnership. Under the restructured deal announced in October, Microsoft retains exclusive rights to market OpenAI’s most advanced models through Azure until the 2030s, so the Amazon deal won’t directly threaten that revenue stream.

But the strategic implications are substantial. OpenAI spreading its infrastructure across multiple cloud providers reduces Microsoft’s leverage and makes OpenAI less dependent on Azure’s continued success. Microsoft positioned itself as OpenAI’s indispensable partner; now it’s one of several suitors.

The Bottom Line

This potential deal reveals something important about where AI is heading: the era of exclusive partnerships may be ending. OpenAI is no longer content to be Microsoft’s AI division in all but name. It’s building relationships across the tech ecosystem, diversifying its funding sources, and reducing single points of failure in its infrastructure.

For investors, the deal raises as many questions as it answers. Is a $500 billion valuation justified for a company that, despite remarkable products, remains unprofitable and faces intensifying competition? Is the circular flow of investment dollars between big tech and AI startups sustainable, or are we watching an elaborate shell game?

The talks remain preliminary, and terms could still change. But if this deal closes anywhere near the reported parameters, it marks a significant shift in AI’s corporate power structure. Amazon becomes a genuine player in the AI model race, OpenAI gains leverage against Microsoft, and the Nvidia chip monopoly faces its most serious challenge yet. Whether any of that translates to better AI products for consumers remains to be seen, but the chess pieces are definitely moving.

Sources: The Information, Bloomberg, CNBC, TechCrunch, Engadget, PYMNTS.