Something strange happened in technology this year. The same companies announcing record investments in artificial intelligence were simultaneously cutting thousands of jobs. Microsoft eliminated 15,000 positions while pledging to spend over $80 billion on AI infrastructure. Amazon laid off 14,000 corporate workers while its AWS division scaled up AI capacity at unprecedented rates. The contradiction isn’t actually contradictory once you understand what’s happening: Big Tech is undergoing a fundamental restructuring, and the workforce of yesterday isn’t the workforce these companies believe they need for tomorrow.

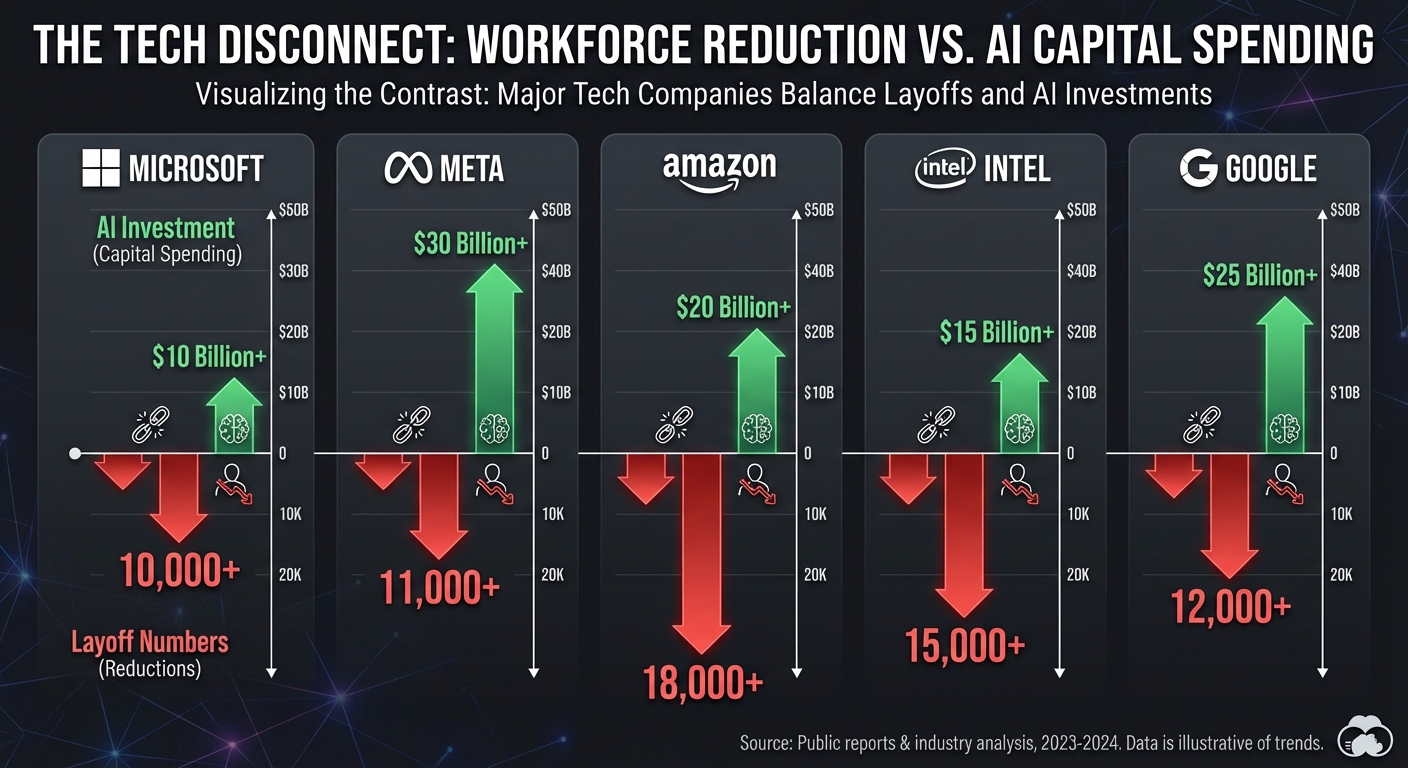

As 2025 closes, the numbers tell a story of transformation that goes far beyond routine cost-cutting. Meta, Amazon, Microsoft, Intel, HP, and dozens of smaller companies shed more than 50,000 employees collectively. Yet these same companies poured approximately $380 billion into data centers, AI chips, and the infrastructure required to power the next generation of technology products. The money isn’t disappearing; it’s flowing in a different direction.

The question hanging over the industry as we enter 2026 isn’t whether the layoffs will continue, but whether the bet on AI will pay off quickly enough to justify the human cost.

The Numbers: Who Cut and Why

Microsoft’s reductions were among the largest and most telling. The company eliminated roughly 15,000 positions throughout 2025, including 9,000 in July alone. Leadership framed the cuts as necessary to “reimagine” operations for an AI-driven future. Translation: roles that existed to support legacy products and manual processes are being eliminated as automation takes over functions that previously required human labor.

Meta followed a similar pattern, cutting approximately 3,600 employees, about 5% of its workforce, in January. CEO Mark Zuckerberg characterized the departures as performance-based, but the timing coincided with aggressive AI investments across the company’s platforms. More telling was the leaked news that metaverse-related initiatives could see budget cuts of up to 30% in 2026. The company that once staked its future on virtual reality is now betting on artificial intelligence instead.

Amazon’s cuts targeted corporate roles specifically. The company eliminated 14,000 positions in October, then followed with another 370 jobs at its European headquarters in Luxembourg in December. Warehouse and logistics workers weren’t the targets; the reductions hit the managerial and administrative layers that had expanded during the pandemic hiring boom. The message was clear: fulfillment centers need humans to pick and pack boxes, but corporate overhead is expendable.

Intel’s situation was more dire. The chipmaker cut over 3,000 jobs through the year, including 669 workers in Oregon in November, representing a 15% reduction in total workforce. Unlike the AI-focused companies, Intel’s layoffs reflected genuine competitive pressure. The company has struggled to compete with NVIDIA in AI chips and with AMD and TSMC in traditional processors. Intel isn’t trimming fat; it’s fighting for survival.

The AI Contradiction Explained

The apparent contradiction between layoffs and investment dissolves once you understand what these companies are actually building. The $380 billion in combined capital expenditure from the major tech firms isn’t going toward hiring more engineers, marketers, or project managers. It’s purchasing land, constructing buildings, buying chips, and paying electricity bills for data centers that will increasingly operate with minimal human oversight.

Consider what a modern AI data center actually requires. The physical infrastructure, the servers, cooling systems, and networking equipment, needs construction workers and electricians to build, but relatively few permanent staff to operate. The software running on that infrastructure requires specialized AI researchers and engineers, a relatively small number of extremely well-compensated individuals. The middle layers of the traditional tech workforce, the program managers, the middle managers, the support staff, simply aren’t needed in the same numbers.

This restructuring explains why the layoffs hit specific functions harder than others. Google cut over 100 design positions in October, recognizing that AI tools are increasingly capable of handling tasks that once required human designers. Microsoft’s July cuts targeted teams working on products that AI could potentially replace or significantly automate. The companies aren’t just reducing headcount randomly; they’re strategically eliminating roles they believe AI will make obsolete.

The humans still being hired tell the same story from a different angle. AI researchers command salaries that would have seemed absurd five years ago, often exceeding $1 million annually for top talent. Data center construction managers, power systems engineers, and AI chip specialists are in acute demand. The workforce is shifting, not shrinking in aggregate, but the skills required for the new roles bear little resemblance to those that defined tech employment for the past two decades.

The Human Cost

Behind the numbers are real consequences that aggregate statistics obscure. Tech workers who built careers around roles that no longer exist face challenging transitions. A forty-year-old program manager at Microsoft doesn’t easily become an AI researcher, regardless of willingness to learn. The skills that made someone valuable in 2020 may be precisely the skills that AI systems are replacing in 2025.

The geographic concentration of tech employment amplifies these effects. The San Francisco Bay Area, Seattle, and Austin saw thousands of high-income workers lose positions simultaneously, affecting local economies dependent on their spending. Real estate markets in these regions showed the impact, with rental prices in San Francisco declining for the first time in years as displaced workers relocated or downsized.

The ripple effects extend beyond the directly affected employees. Restaurants near tech campuses saw reduced traffic. Childcare facilities lost clients. The service economy that grew up around affluent tech workers is now adjusting to a workforce that’s either smaller or more distributed than before.

Yet the picture isn’t uniformly bleak. Many laid-off workers found new positions relatively quickly, particularly those with skills transferable to AI-adjacent roles. The unemployment rate for tech workers, while elevated compared to recent years, remained lower than the overall national average. The industry’s fundamental health, measured by revenue growth and profitability, remained strong even as individual workers suffered.

What 2026 Holds

The trends that defined 2025’s layoffs show no signs of reversing. If anything, the pace of AI investment is accelerating as companies race to establish positions in what they believe will be transformative technology. The capital flowing into AI infrastructure will continue to dwarf the savings from workforce reductions, suggesting the reductions are about strategic repositioning rather than financial necessity.

Several factors could amplify or moderate the layoff trajectory. If AI delivers on its promise quickly, companies may need fewer workers even faster than currently projected. If AI underperforms expectations, the billions invested in infrastructure could become write-offs, potentially triggering even more severe cuts. The most likely scenario falls somewhere between: steady progress that justifies continued investment while gradually reducing the need for traditional tech roles.

For workers, the implications are stark. Skills in AI, machine learning, data engineering, and infrastructure remain in high demand. Traditional software development, while still employable, faces growing competition from AI coding assistants that can produce functional code in seconds. The workers best positioned for 2026 are those who can work alongside AI systems rather than compete against them.

The Bottom Line

Tech’s 2025 was defined by a transition that looked like contradiction but was actually consistency. The same forces driving record AI investment, the belief that artificial intelligence will transform how software is built and deployed, are driving the workforce reductions. Companies are shedding the employees suited for the old paradigm while building infrastructure for the new one.

The over 50,000 workers who lost jobs this year aren’t casualties of corporate greed or short-term thinking. They’re the human cost of a bet that AI will fundamentally change what technology companies do and how they do it. Whether that bet proves correct, and whether the benefits ultimately outweigh the costs, remain open questions that 2026 may begin to answer.

For those still employed in tech, the message from 2025 is clear: the skills and roles that existed yesterday aren’t guaranteed to exist tomorrow. Adaptation isn’t optional. The companies that laid off tens of thousands of workers aren’t struggling; they’re among the most valuable in history. They’re simply convinced that the future requires different capabilities than the past.

That conviction may prove correct. The hundreds of billions flowing into AI infrastructure suggest the industry’s leaders believe it strongly enough to stake their companies on it. For the workers caught in this transition, the challenge is finding a place in that future before it fully arrives.

Sources: TrendForce, NPR, CNBC, PBS NewsHour