Jensen Huang is about to take the stage at CES 2026, and the tech world is watching with a level of attention usually reserved for Apple product launches or Fed interest rate decisions. When the CEO of the world’s most valuable public company speaks, markets move, competitors scramble, and the entire AI industry takes notes.

NVIDIA’s 90-minute keynote begins at 4 PM ET today from the Michelob Ultra Arena in Las Vegas. The company has promised to “light up CES 2026 with the power of AI,” and given NVIDIA’s track record of delivering on hype, that’s worth taking seriously. Here’s what we’re expecting to hear, why it matters, and how to watch.

The Stakes: Why This Keynote Matters

NVIDIA enters CES 2026 in a position that would have seemed impossible just a few years ago. The company’s market capitalization has swelled to approximately $4.6 trillion, making it the most valuable publicly traded company in the world. That valuation is built almost entirely on one bet: that artificial intelligence will transform every industry, and that NVIDIA will provide the chips that power that transformation.

So far, that bet has paid off spectacularly. Analysts project NVIDIA’s quarterly revenue will hit $65 billion by the end of fiscal year 2026, with the Data Center segment accounting for roughly 85% to 90% of total earnings. The company’s GPUs power the vast majority of AI training workloads at companies from OpenAI to Google to Meta. Every major tech company is racing to secure NVIDIA hardware, and supply still can’t keep up with demand.

But $4.6 trillion in market cap creates $4.6 trillion worth of expectations. Investors want to see the roadmap that justifies those valuations. Competitors want to find weaknesses they can exploit. And the broader tech industry wants to understand where AI is heading in the next 12 to 24 months.

Physical AI: The Next Frontier

The most significant theme of NVIDIA’s CES 2026 presence is what the company calls “Physical AI,” a term that describes AI systems capable of perceiving and interacting with the real world rather than just processing text and images on servers.

This represents NVIDIA’s strategic pivot from being the company that powers chatbots to being the company that powers robots, autonomous vehicles, drones, and smart industrial systems. According to Vikram Taneja, head of AT&T Ventures, “Physical AI will hit the mainstream in 2026 as new categories of AI-powered devices, including robotics, AVs, drones, and wearables start to enter the market.”

NVIDIA has scheduled a major CES session called “Physical AI and the Big Bang of Robotics and Autonomous Vehicles” featuring Amit Goel, the company’s Head of Robotics Ecosystem, alongside partners from Accenture and Waabi. The company’s booth at the Fontainebleau promises over 20 hands-on demos showcasing “cutting-edge AI, robotics, simulation, gaming, and content creation.”

The focus on physical AI makes strategic sense. The data center AI market, while still growing, is increasingly competitive. AMD, Intel, Amazon, Google, and Microsoft are all developing competing chips. Amazon’s Trainium3 chips and NVIDIA’s own strategic investments in chip design software show how the battle lines are forming. Physical AI represents a new frontier where NVIDIA can establish dominance before competitors catch up.

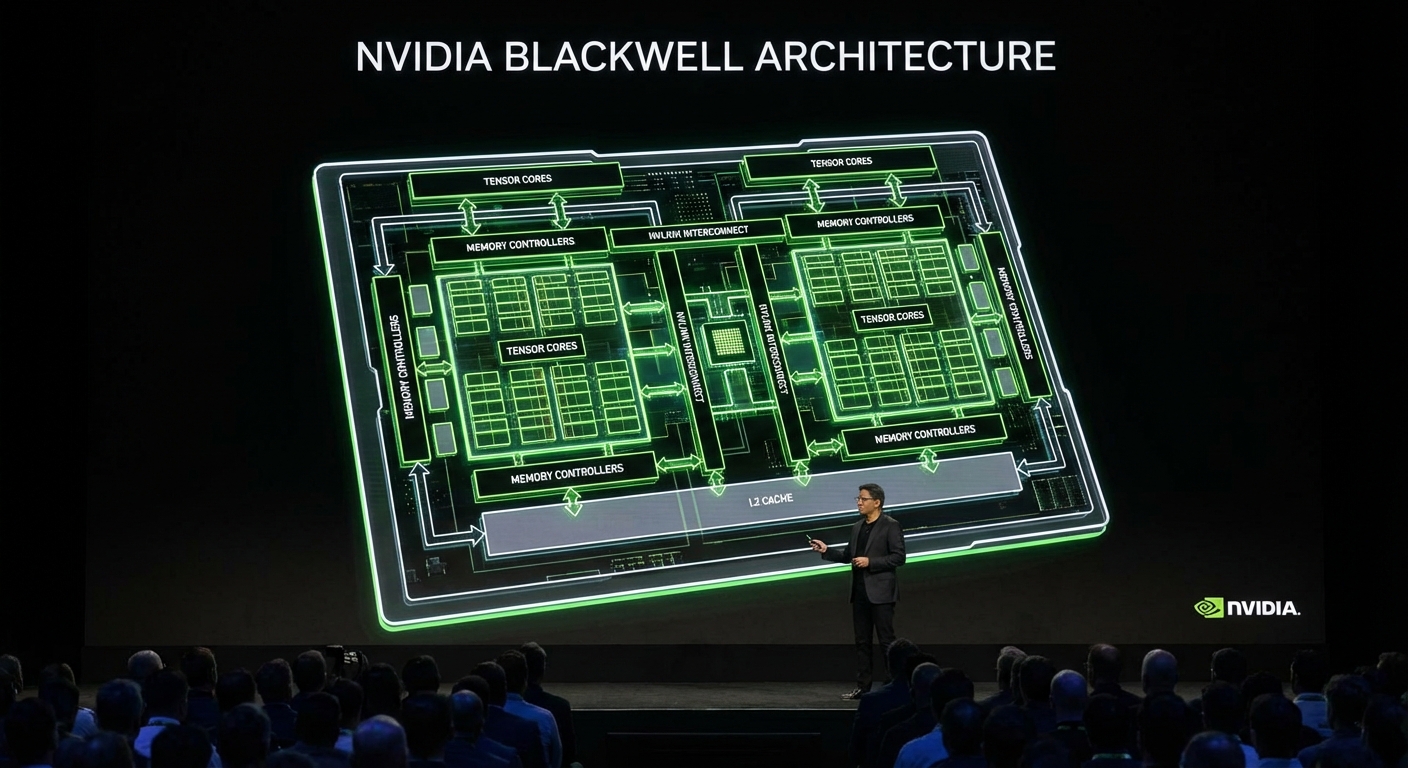

The Chip Roadmap: Blackwell Ultra and Beyond

Don’t expect major consumer GPU announcements today. The RTX 50 series launched at CES 2025, and the RTX 5090 is already in the market with about 0.60% Steam user share as of December 2025. MSI is reviving its Lightning series with a premium RTX 5090 variant, but that’s partner news, not NVIDIA news.

The more significant chip discussion will center on NVIDIA’s data center roadmap. The company is expected to provide updates on the Blackwell Ultra ramp-up, which has been the workhorse of the current AI infrastructure build-out, as well as hints about the upcoming Vera Rubin architecture.

Rubin, named after astronomer Vera Rubin, promises ten times the throughput per megawatt compared to previous generations. That efficiency metric matters enormously as data centers consume increasingly massive amounts of power. However, analysts caution that NVIDIA typically saves its biggest architectural reveals for the GTC conference in March, so today’s hints may be more about setting expectations than delivering specifications.

The data center business is where NVIDIA’s valuation lives or dies. With 85% to 90% of revenue coming from this segment, any details about supply chains, customer deployments, or next-generation capabilities will move the stock.

Gaming and Consumer Updates

While data center AI dominates NVIDIA’s business, the company hasn’t abandoned its roots in gaming. Expect some updates on DLSS 4, NVIDIA’s AI-powered upscaling technology that uses machine learning to generate frames and improve game performance. Neural rendering capabilities continue to advance, and NVIDIA has been positioning its RTX cards as the only way to experience cutting-edge game graphics.

The company may also announce expanded availability for GeForce NOW, its cloud gaming service, potentially with RTX 5080-powered tiers and more international markets. The AI NPCs enabled by NVIDIA ACE (Avatar Cloud Engine) could see new game partnerships, bringing AI-driven characters that can hold actual conversations with players.

These gaming updates won’t move the needle financially, but they matter for NVIDIA’s brand and for maintaining the enthusiast community that has supported the company for decades. The GeForce brand carries cultural cachet that pure enterprise companies lack.

The Competitive Landscape

NVIDIA’s dominance isn’t going unchallenged. AMD’s Lisa Su takes the stage at 6:30 PM PT today with her own keynote, and you can expect her to highlight areas where AMD is competitive or catching up. Intel’s Jim Johnson will provide updates on Panther Lake chips, the first to use Intel’s 18A process technology as part of the company’s turnaround effort.

Beyond the chip wars, cloud providers are increasingly developing their own AI accelerators. Amazon’s Trainium, Google’s TPUs, and Microsoft’s Maia chips all represent alternatives to NVIDIA for certain workloads. The fact that NVIDIA’s biggest customers are also developing competing products is a tension that will define the AI hardware market for years to come.

Yet NVIDIA’s moat remains formidable. The company’s CUDA software ecosystem has become the default platform for AI development, creating switching costs that go far beyond hardware specifications. Developers, researchers, and enterprises have invested years in CUDA-optimized code. That investment doesn’t disappear because a competitor offers a slightly faster chip.

How to Watch and What to Watch For

NVIDIA’s keynote streams live at 4 PM ET (1 PM PT) on NVIDIA’s website and YouTube channel. The presentation typically runs about 90 minutes, with Huang known for detailed technical deep-dives interspersed with dramatic product reveals.

Watch for these key signals: Any details on Rubin architecture timelines could move the stock significantly. Customer deployment numbers for Blackwell would validate the current revenue trajectory. Partnerships in robotics or autonomous vehicles could signal where the next growth phase is coming from. And any mention of supply constraints, either easing or persisting, will shape how investors think about 2026 revenue projections.

The gaming and consumer announcements will generate the most social media buzz, but the data center details will drive the financial coverage. That split audience reflects NVIDIA’s unusual position as both a consumer brand and an enterprise infrastructure company.

The Bigger Picture

Time’s selection of AI architects as 2025’s Person of the Year reflected how central this technology has become to the global economy. NVIDIA sits at the center of that transformation, selling the picks and shovels in what may be the biggest gold rush in technology history.

Today’s keynote won’t resolve whether NVIDIA’s $4.6 trillion valuation is justified or whether AI will deliver on its transformative promises. Those questions will play out over years, not hours. But Huang’s 90 minutes on stage will set the narrative for how the tech industry thinks about AI in 2026, what applications are ready for prime time, and where the limits of current technology lie.

For anyone trying to understand where technology is heading, that’s worth watching.