President Trump confirmed Sunday that he has decided who will be his nominee for the next Federal Reserve chair, setting up what could be one of the most consequential economic appointments of his second term. Speaking to reporters aboard Air Force One, Trump didn’t reveal the name but made his expectations clear: he wants lower interest rates.

“I know who I am going to pick, yeah,” Trump told reporters, adding that he expects his nominee to deliver rate cuts. The statement alone moved markets, as investors recalibrated expectations for monetary policy under new Fed leadership.

Kevin Hassett, currently serving as director of the National Economic Council, has emerged as the frontrunner according to multiple reports. If nominated and confirmed, Hassett would replace Jerome Powell, whose term as chair runs until May 2026. The nomination would not remove Powell from the Fed entirely, as his term as a board member extends until 2028, but it would end his role leading the institution.

Why This Matters for Your Wallet

The Federal Reserve’s decisions on interest rates touch nearly every aspect of economic life. Just as AI funding is reshaping enterprise valuations, Fed policy ripples through every sector of the economy. Mortgage rates, credit card interest, auto loans, business lending, and savings account yields all respond to the Fed’s policy choices. A Fed chair aligned with the president’s preference for lower rates could mean cheaper borrowing costs, but it could also mean higher inflation if rates are cut too aggressively.

The timing is significant. The Fed’s next policy meeting is scheduled for December 17-18, where markets currently expect a quarter-point rate cut. More than 85% of market bets favor a reduction, according to CME FedWatch data. But the longer-term trajectory of rates depends heavily on who leads the institution.

Powell has maintained the Fed’s independence from political pressure throughout his tenure, raising rates aggressively in 2022 and 2023 to combat inflation despite White House criticism. The question now is whether Trump’s nominee would take a similar approach or prove more responsive to presidential preferences.

Who Is Kevin Hassett?

If the reports are accurate, Hassett brings a different background than typical Fed chairs. An economist by training, he served as chair of the Council of Economic Advisers during Trump’s first term from 2017 to 2019. He’s currently running the National Economic Council, coordinating economic policy across the administration.

Hassett is known for supply-side economic views, generally favoring tax cuts and deregulation as drivers of growth. He was a key architect of the 2017 Tax Cuts and Jobs Act and has publicly supported lower interest rates as a tool for economic expansion. That alignment with Trump’s stated preferences is likely part of his appeal as a nominee.

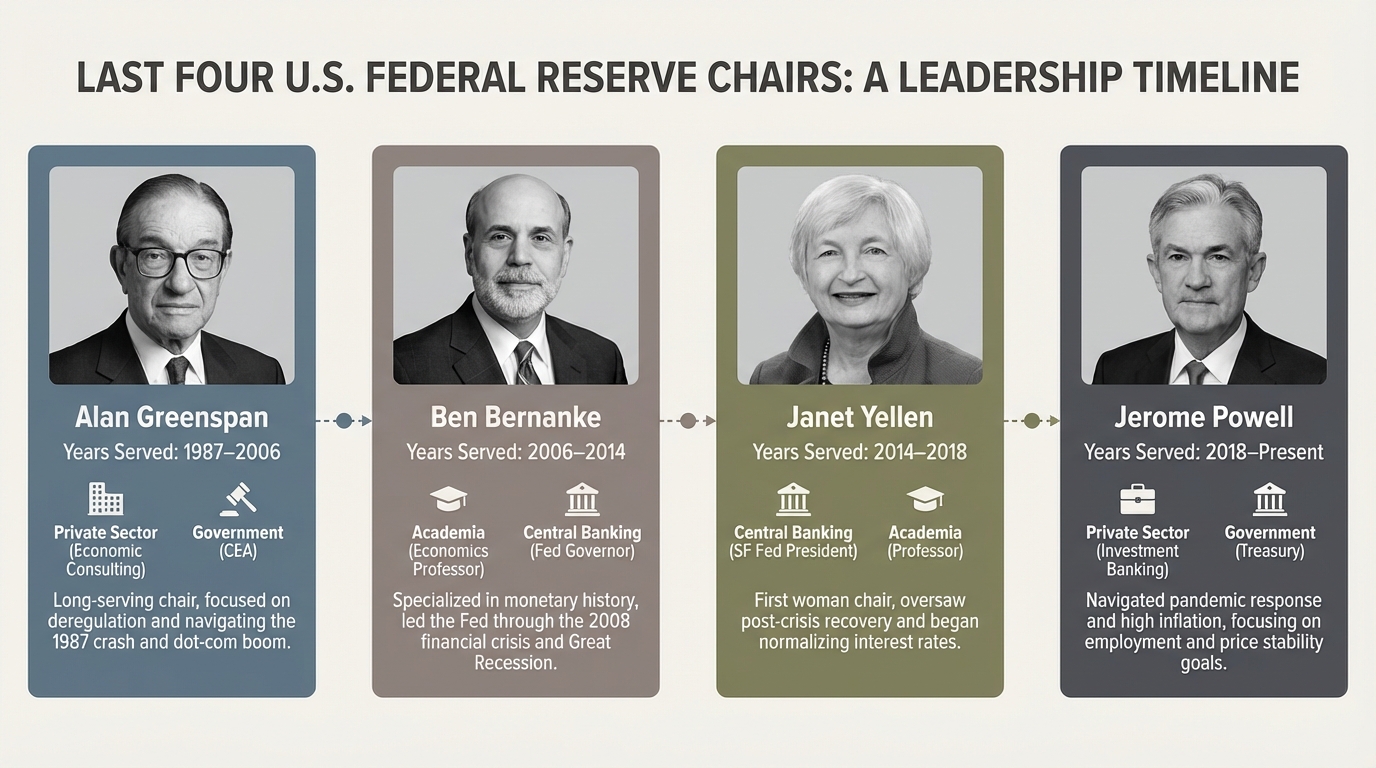

However, Hassett lacks the central banking experience that previous Fed chairs have typically brought to the role. Powell came from private equity but had served on the Fed board before becoming chair. Janet Yellen had spent years as a Fed governor and president of the San Francisco Fed. The nomination of someone without that institutional background would represent a departure from recent precedent.

Markets React to Uncertainty

Monday’s trading session reflected the uncertainty. The Dow Jones Industrial Average dropped 427 points, or 0.9%, to close at 47,289. The S&P 500 fell 0.53% while the Nasdaq shed 0.38%, snapping five-day winning streaks for all three indexes.

While multiple factors contributed to the selloff, including a sharp drop in cryptocurrency prices, analysts noted that uncertainty about Fed leadership was weighing on sentiment. Bond markets showed particular sensitivity, with yields fluctuating as traders assessed the likelihood of a more dovish Fed under new leadership.

The reaction highlights a central tension in markets. Lower interest rates are generally positive for stocks and borrowing costs, but a Fed perceived as politically compromised could undermine confidence in monetary policy stability. Investors are trying to price both possibilities simultaneously.

What Happens Next

The formal nomination process will take time. Even if Trump announces his pick this week, Senate confirmation hearings and a floor vote would follow. That process could extend into early 2026, potentially overlapping with Powell’s remaining months as chair.

In the meantime, markets will parse every statement from both the administration and the Fed for signals about future policy direction. The IPO market’s recovery depends significantly on rate expectations. The December meeting will proceed under Powell’s leadership, but the shadow of transition will hang over subsequent decisions.

The Bottom Line

Trump’s confirmation that he’s chosen a Fed chair nominee opens a new chapter in the relationship between the White House and the central bank. Whether that means meaningfully lower interest rates depends on who gets the job and how they balance presidential preferences against the Fed’s mandate to manage inflation. For now, the only certainty is uncertainty, and markets are pricing accordingly.

Sources: CME FedWatch, Federal Reserve.