China’s trade surplus just crossed $1 trillion for the first time in history, and it happened despite the most aggressive effort in decades to contain Chinese exports. If you’re wondering whether tariffs and trade wars are working as intended, here’s your answer.

Customs data released Monday shows China’s exports grew 5.9% in November compared to a year earlier, bouncing back from an unexpected decline in October. Meanwhile, imports crawled up just 1.9%. That divergence pushed November’s trade surplus alone to $111.68 billion, blowing past the $84 billion economists had predicted.

For the first 11 months of 2025, China’s cumulative trade surplus hit $1.076 trillion, up 21.6% from the same period last year. That’s already higher than the $992 billion surplus for all of 2024, with another month still to go.

The US Trade Collapse

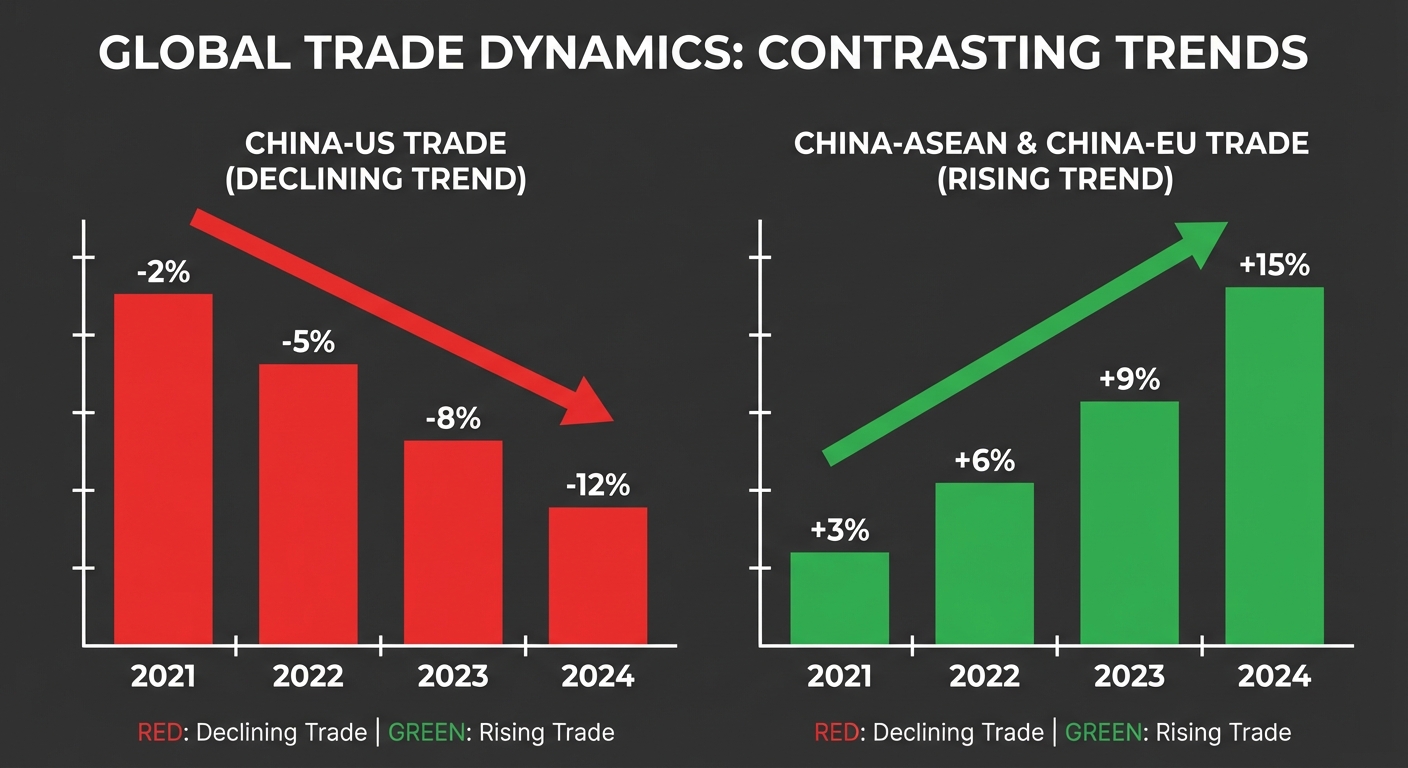

Here’s where things get interesting. Exports to the United States plunged 28.6% in November, marking the eighth consecutive month of double-digit declines in shipments to the world’s largest consumer market. For the year so far, China’s exports to the US have fallen 18.9%.

So how does a country post record trade surpluses while losing nearly a third of its business with its biggest customer? By finding new customers, and fast.

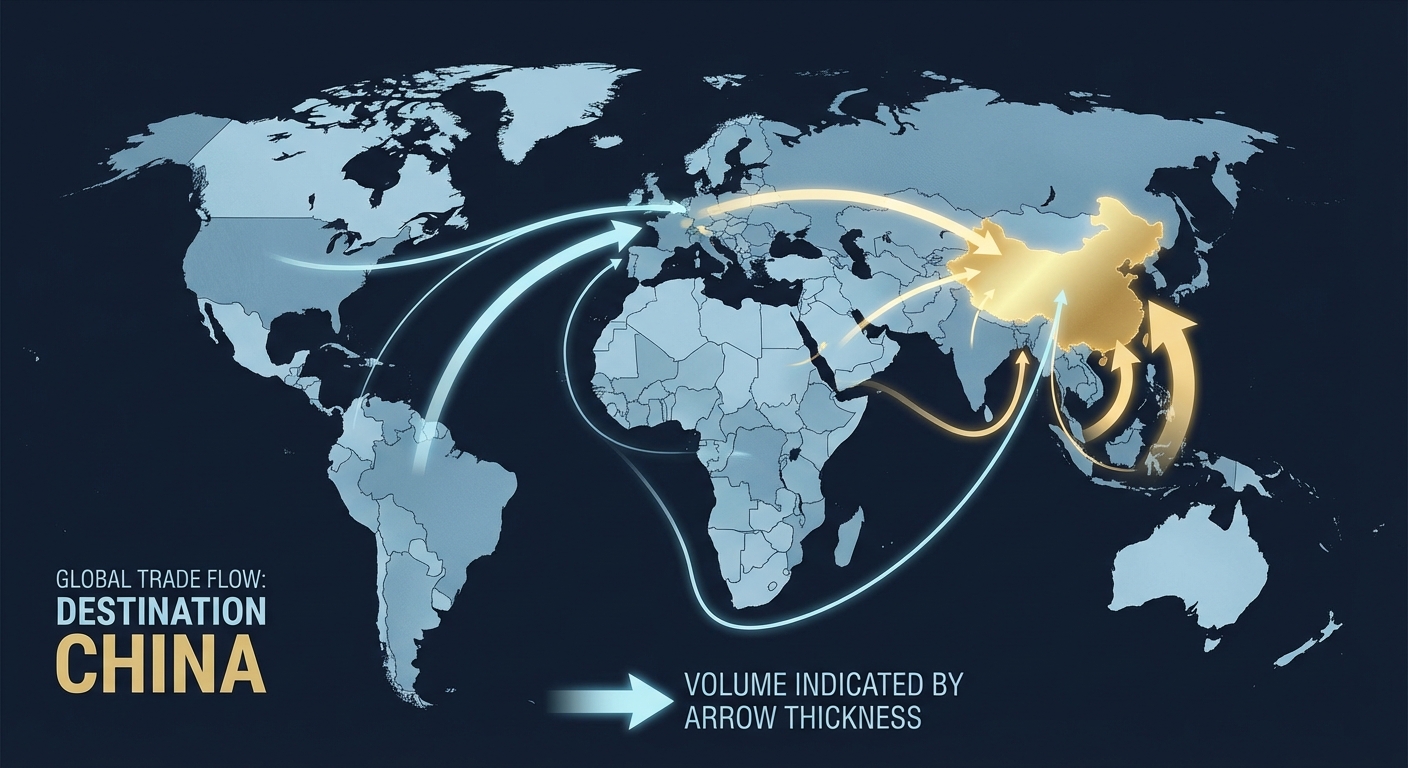

China’s exports to ASEAN nations rose over 8% this year. Exports to the European Union jumped nearly 15%. The country has systematically diversified across Southeast Asia, Africa, and Latin America, reducing its dependence on American consumers even as those consumers continue to indirectly purchase Chinese goods through intermediary countries and supply chains.

Why This Matters for the Global Economy

A $1 trillion trade surplus isn’t just a number. It represents a massive flow of wealth from the rest of the world into China, and it’s becoming a major source of tension with trading partners beyond just the United States.

French President Emmanuel Macron has recently threatened action if the trade imbalance isn’t addressed. European officials are growing increasingly vocal about what they see as unfair competition from Chinese manufacturers who benefit from state subsidies and lower labor costs.

The underlying dynamic is straightforward, and it reflects the same global demographic shifts reshaping economies worldwide. Chinese factories produce goods more cheaply than competitors in most categories. When domestic Chinese consumers aren’t buying enough (due to the ongoing property crisis and weak consumer confidence), those goods flood export markets. Other countries buy more from China than China buys from them, and the surplus grows.

For China, exports have become an economic lifeline. The country’s massive property sector remains mired in debt, and domestic spending hasn’t recovered to pre-pandemic levels. Without strong export revenue, China’s economy would be in significantly worse shape.

The Tariff Paradox

The Trump administration’s tariffs on Chinese goods were explicitly designed to reduce the trade deficit with China. The numbers suggest that strategy has worked for direct US-China trade, which has plummeted. But the overall trade surplus hitting record highs reveals a more complicated picture.

Chinese manufacturers have adapted by routing goods through third countries, establishing production in Southeast Asian nations, and finding buyers in markets where American tariffs don’t apply. The trade has shifted, but it hasn’t shrunk.

This creates an awkward situation for policymakers. Tariffs have clearly changed where Chinese goods go, but they haven’t fundamentally altered China’s position as the world’s dominant exporter. The trade surplus suggests that for every door that closes, Chinese manufacturers are finding windows.

The Bottom Line

China’s $1 trillion trade surplus milestone arrives at a particularly charged moment in global trade relations. The US is preparing another potential round of tariff increases. Europe is debating its own protective measures. And China continues to demonstrate that its export machine can adapt faster than other economies can erect barriers.

November’s numbers show a country that’s doubling down on manufacturing while its competitors debate how to respond. The IPO market’s revival depends partly on global trade stability. Exports grew 5.9% in a month where shipments to America fell nearly 29%. That math only works if you’re aggressively winning business everywhere else.

The trillion-dollar question now is what happens next. China’s trading partners face a choice between escalating restrictions that may prove ineffective and accepting a permanent restructuring of global trade flows that favors Chinese manufacturers. Neither option is particularly appealing, but the status quo of watching surpluses grow clearly isn’t sustainable either.

For now, the containers keep shipping, the surplus keeps growing, and the world keeps adjusting to an economic reality that isn’t going away anytime soon.

Sources: China Customs.