For three decades, Japan was the land of free money. The Bank of Japan kept interest rates at or near zero while the rest of the world’s central banks raised and lowered borrowing costs through economic cycles. That era is officially over. Today the BOJ raised its benchmark rate by 25 basis points to 0.75%, the highest level since 1995, and the ripple effects are already spreading across global financial markets.

The decision, approved unanimously by the BOJ’s nine-member policy board, reflects growing confidence that Japan has finally escaped the deflationary trap that has plagued its economy since the 1990s. Inflation is running at 3%, well above the central bank’s 2% target. Wages are rising. And the “virtuous cycle” of higher prices leading to higher wages leading to even higher prices, long sought by Japanese policymakers, appears to be taking hold.

Why This Rate Hike Is Different

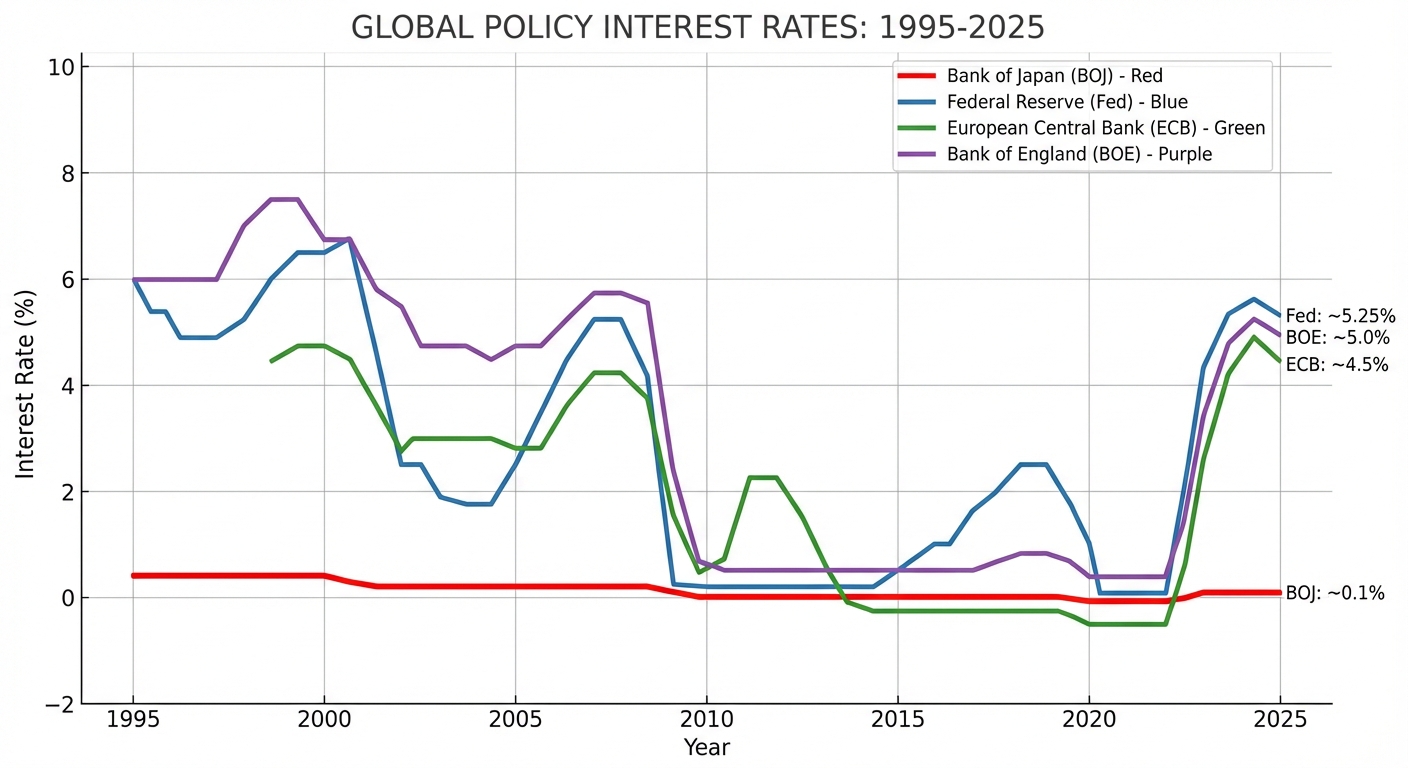

Central banks around the world raise and lower interest rates all the time. The Federal Reserve just cut rates; the European Central Bank has been easing policy. But Japan is different because it’s been stuck at zero for so long. The BOJ has been the global outlier, maintaining ultra-loose policy while every other major central bank normalized.

This created what traders call the “carry trade.” Investors could borrow money in Japan at nearly zero interest, convert it to dollars or other currencies, and invest it in higher-yielding assets elsewhere. The spread between Japanese rates and rates in other countries meant this was essentially free money. According to Bloomberg, estimates suggest trillions of dollars have been deployed in carry trades over the past decade.

As Japan raises rates, that trade becomes less profitable. The spread narrows, the incentive to borrow yen diminishes, and some of that capital starts flowing back home. Previous BOJ rate signals have triggered violent market reactions, including the August 2024 crash when a surprise policy shift sent global stocks tumbling. Today’s move was well-telegraphed, limiting the immediate damage, but the longer-term implications remain significant.

The Numbers Behind the Decision

Japan’s economy presents a paradox. Inflation is too high, running at 3% when the central bank targets 2%. But growth is weak. GDP contracted 0.6% quarter-over-quarter in the third quarter, or 2.3% annualized. According to CNBC, the BOJ is hiking rates into economic weakness, betting that persistent inflation requires a policy response even if growth is soft.

The wage picture is more encouraging. Japan’s annual spring wage negotiations have produced the largest increases in decades, and the BOJ cited “solid wage growth momentum” as a key factor in its decision. The hope is that higher wages will allow consumers to absorb higher interest rates without significantly cutting spending.

Following the decision, the yen actually weakened, falling as much as 1.2% to 157.48 against the dollar, a four-week low. As reported by Yahoo Finance, traders were disappointed by the lack of clear guidance on when the BOJ might hike again. Markets had priced in this increase but hoped for signals about future moves. Instead, Governor Kazuo Ueda was characteristically vague, leaving investors uncertain about the pace of future tightening.

The Debt Bomb Waiting to Explode

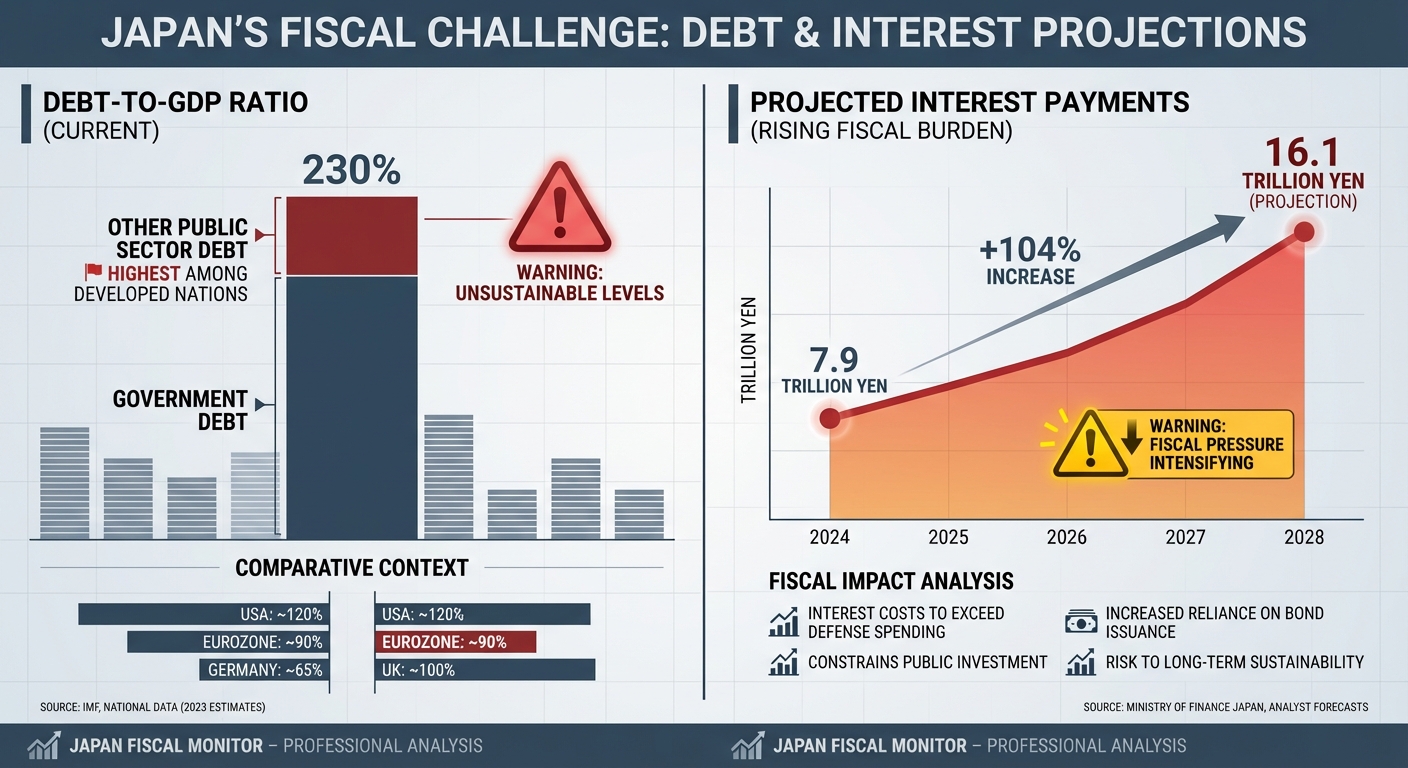

Here’s where things get concerning. Japan has the highest debt-to-GDP ratio of any major economy, approaching 230%. As long as interest rates stayed near zero, servicing that debt was manageable. The government could roll over maturing bonds at minimal cost, keeping interest payments relatively low despite the enormous principal.

Higher rates change that equation dramatically. According to Japan Times analysis, if 10-year JGB yields reach 2.5%, interest payments for the Japanese government would jump to 16.1 trillion yen in fiscal 2028, compared to 7.9 trillion yen in fiscal 2024. That’s more than a doubling in just four years.

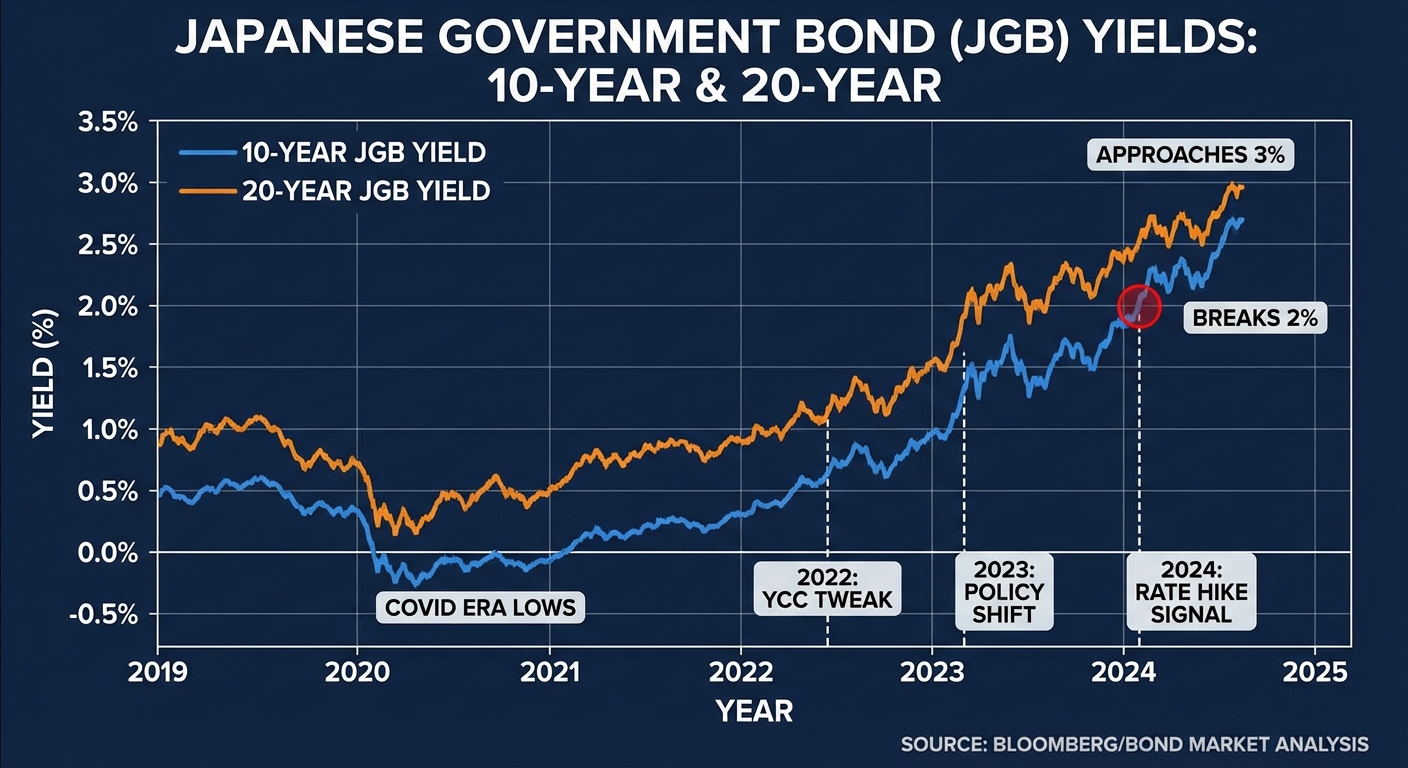

Today’s rate hike pushed 10-year JGB yields above 2% for the first time since 1999. The 20-year yield climbed to 2.975%, also a multi-decade high. These are still low by global standards, but the trajectory matters. If the BOJ continues tightening, government finances could come under severe pressure, forcing difficult choices between debt reduction, tax increases, or currency devaluation.

What This Means for the Global Economy

Japan’s economy, the world’s fourth-largest, matters beyond its borders, particularly as China’s massive trade surplus reshapes global commerce. Japanese investors hold massive amounts of foreign assets, including U.S. Treasury bonds, European corporate debt, and emerging market securities. When Japanese rates rise, some of that capital comes home, potentially pushing up borrowing costs for everyone else.

The yen’s behavior after today’s announcement hints at the complexity. Despite higher rates, which normally strengthen a currency, the yen fell. According to analysts quoted by FXStreet, the weak response reflects uncertainty about whether the BOJ will continue raising rates or pause here. The yen has lost more than 2.5% since Prime Minister Sanae Takaichi, who has been skeptical of aggressive monetary tightening, took office in October.

For American investors, the implications are mixed. Higher Japanese rates could put upward pressure on U.S. bond yields if Japanese investors reduce their Treasury holdings. But a weaker yen makes Japanese exports more competitive against American goods, potentially benefiting Japanese automakers and electronics companies at the expense of their U.S. rivals.

The Road Ahead

Where does the BOJ go from here? Oxford Economics forecasts that the central bank will likely raise rates again in mid-2026, eventually reaching a terminal rate of 1%. Bank of America is more aggressive, predicting a June 2026 hike and a terminal rate of 1.5% by end of 2027.

Even at 1.5%, Japanese rates would remain well below those in the United States, Europe, or most of the developed world, a reality that continues to concern markets watching global demographic shifts. The gap that enabled carry trades won’t disappear entirely. But it will narrow, reducing the artificial support that ultra-low Japanese rates have provided to global asset prices for decades.

The “easy money” of the yen carry trade is ending, as one analyst told CNBC. What replaces it will likely be a more nuanced approach focused on the relative performance of Japanese versus other economies. That’s a less dramatic story than infinite free money, but it’s also a more sustainable one.

The Bottom Line

Japan’s rate hike to 0.75% sounds modest by any global standard. But for an economy that has been stuck at zero for three decades, it represents a fundamental shift. The Bank of Japan is betting that Japan has finally broken free from deflation, that wages will keep rising, and that the economy can handle higher borrowing costs despite already weak growth.

The stakes extend far beyond Japan. Carry trades unwinding, government debt costs rising, currency markets repricing: today’s decision will ripple through portfolios and economies around the world for months, maybe years, to come.

For anyone with investments, a mortgage, or retirement savings, Japan suddenly matters again. The land of free money just got a little more expensive, and everyone is going to feel it.

Sources: CNBC, Bloomberg, Japan Times, Yahoo Finance, ABC News, FXStreet.