Gold hit another record this week, topping $4,500 per ounce for the first time in history. Silver crossed $75. Platinum joined the party with its own new highs. If you’ve been watching precious metals in 2025, you’ve witnessed one of the most remarkable rallies in market history, and the year isn’t even over yet.

Gold has surged 67% this year. Silver has more than doubled, up 130% since January. These aren’t normal moves for assets often characterized as boring stores of value. Something fundamental has shifted in how investors view precious metals, and understanding why matters whether you own gold or not.

The rally tells a story about the global economy that goes beyond commodity prices. It’s a story about dollar weakness, geopolitical instability, central bank behavior, and growing skepticism about sovereign debt. Here’s what you need to know.

The Numbers Behind the Rally

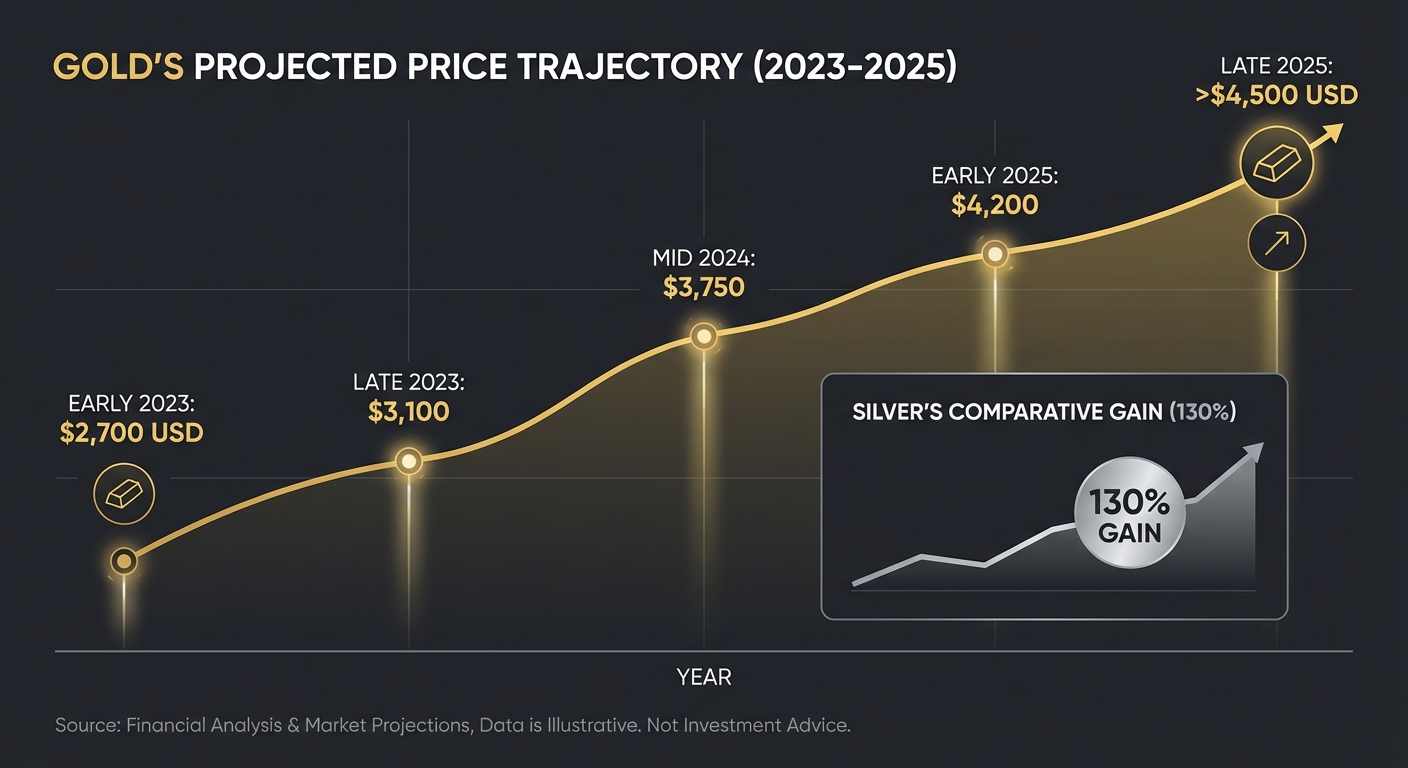

Gold futures for February delivery hit an intraday high of $4,530.80 this week, with spot gold touching $4,497.55. These prices would have seemed fantastical even a year ago when gold was trading around $2,700. The yellow metal has now posted its 54th record close of 2025, an unprecedented streak of new highs.

Silver’s performance is even more dramatic. The white metal topped $75 per ounce, up from around $32 at the start of the year. Silver has historically traded at a ratio of 50-80 ounces per ounce of gold. That ratio had stretched to nearly 90 in early 2025, suggesting silver was undervalued relative to gold. Investors noticed, and silver’s catch-up trade has been ferocious.

The drivers of this rally are multiple and reinforcing. No single factor explains a 67% move in an asset as liquid and heavily traded as gold. Instead, several forces have converged to create perfect conditions for precious metals.

Why Gold Is Surging: The Dollar’s Decline

The U.S. dollar’s weakness is the most straightforward explanation. Gold is priced in dollars, so when the dollar falls, gold becomes cheaper for foreign buyers and tends to rise. But the magnitude of dollar weakness in 2025 has been exceptional.

According to Morgan Stanley, the dollar’s value against other major currencies plunged about 11% over the first half of 2025, the biggest decline in more than 50 years. That’s not a normal fluctuation. That’s a structural reassessment of the world’s reserve currency.

Several factors contributed to dollar weakness. The Federal Reserve’s interest rate policy has been accommodative compared to other major central banks. The U.S. fiscal deficit has continued to grow, with debt-to-GDP ratios reaching levels that make some investors uncomfortable. And the weaponization of the dollar through sanctions, particularly against Russia, has prompted some countries to seek alternatives.

Central banks have responded by diversifying their reserves away from dollars and into gold. This buying, particularly from China, Russia, and other countries seeking to reduce dollar exposure, has provided consistent demand that supports prices.

The Geopolitical Fear Premium

Gold’s traditional role as a safe haven has rarely been more relevant. The list of geopolitical flashpoints in 2025 reads like a catalog of investor anxieties: the ongoing war in Ukraine, tensions between China and Taiwan, conflict in the Middle East, China’s growing trade surplus, instability in Venezuela, and now U.S. military action in Nigeria.

Each of these situations creates uncertainty, and uncertainty drives demand for assets that have proven their value over millennia. Gold has been money for 5,000 years. That track record provides comfort when paper currencies feel fragile and political systems seem unstable.

The Trump administration’s approach to international relations has added to the uncertainty. Aggressive tariff policies, confrontational rhetoric toward allies and adversaries alike, and unpredictable foreign policy have created an environment where investors want insurance. Gold provides that insurance.

Traders are also watching Japan-China tensions and monitoring developments in Venezuela, where a partial U.S. blockade of crude shipments has supported oil prices and added to the general sense of geopolitical instability driving safe-haven demand.

The Debasement Trade

Beyond immediate geopolitical concerns lies a deeper anxiety: the fear that governments are debasing their currencies through excessive debt and money printing. This “debasement trade” has become a major theme in financial markets.

The logic is straightforward. Governments around the world, particularly in developed economies, are running persistent fiscal deficits. To finance these deficits, they issue bonds. When debt levels become unsustainable, the temptation is to inflate away the burden, effectively transferring wealth from bondholders to debtors. Precious metals offer protection against this scenario because they can’t be printed or debased.

This argument has been made for decades, often prematurely. But the combination of pandemic-era stimulus spending, rising interest costs on existing debt, and political unwillingness to address fiscal imbalances has given the debasement thesis new credibility. Whether or not inflation actually erodes currency values, the fear that it might is enough to drive gold demand.

What the Experts Say About 2026

With gold already at record highs, the obvious question is: can the rally continue? Most major banks think yes.

J.P. Morgan expects gold prices to push toward $5,000 per ounce by the end of 2026. Goldman Sachs has issued a base-case scenario of $4,900 an ounce with risks to the upside. The consensus view is that the factors driving the current rally, including dollar weakness, central bank buying, and geopolitical uncertainty, are likely to persist.

Traders also expect the Federal Reserve to cut interest rates twice in 2026. The recent Fed rate cuts have already supported precious metals prices. Lower rates are typically a tailwind for precious metals, which don’t pay interest and therefore become more attractive relative to bonds and savings accounts when rates fall.

The bull case for silver is even more aggressive than for gold. Silver has industrial applications in electronics, solar panels, and electric vehicles that gold lacks. As the energy transition accelerates, demand for silver in green technologies should grow, providing fundamental support beyond purely monetary demand.

The Risks to the Rally

No rally lasts forever, and there are scenarios where precious metals could decline. A resolution to major geopolitical conflicts would reduce safe-haven demand. A resurgent dollar, perhaps driven by stronger U.S. economic performance relative to other major economies, would create headwinds. And if inflation proves more persistent than expected, the Fed might raise rates rather than cut them, making gold less attractive.

There’s also the simple reality of stretched valuations. At $4,500, gold is trading at levels that seemed impossible just a few years ago. Some mean reversion is always possible, particularly if the catalysts driving the rally fade.

For retail investors, the question is whether to chase a rally that’s already delivered extraordinary gains or wait for a pullback that may never come. The answer depends on why you’d buy gold in the first place. As a long-term hedge against currency debasement and geopolitical risk, the fundamental case remains intact regardless of short-term price movements. As a speculative trade hoping for further gains, the risk-reward is less clear.

The Bottom Line

Gold and silver’s 2025 rally reflects a world where investors are increasingly nervous about traditional assets. The dollar’s decline, central bank buying, geopolitical instability, and fears about government debt have combined to create perfect conditions for precious metals.

Whether you own gold or not, the rally matters. It signals something about investor confidence in governments, currencies, and the global financial system. When the oldest form of money in human history is outperforming stocks, bonds, and real estate, that’s a message worth understanding.

The question for 2026 isn’t whether gold will hit new records. It’s whether the conditions driving this rally represent a temporary surge of anxiety or a lasting shift in how investors think about preserving wealth. Major banks are betting on the latter. They see $5,000 gold as increasingly likely. If they’re right, we’re not at the end of this rally. We’re in the middle of it.

Sources: Morgan Stanley, J.P. Morgan, Goldman Sachs, Reuters, Bloomberg.