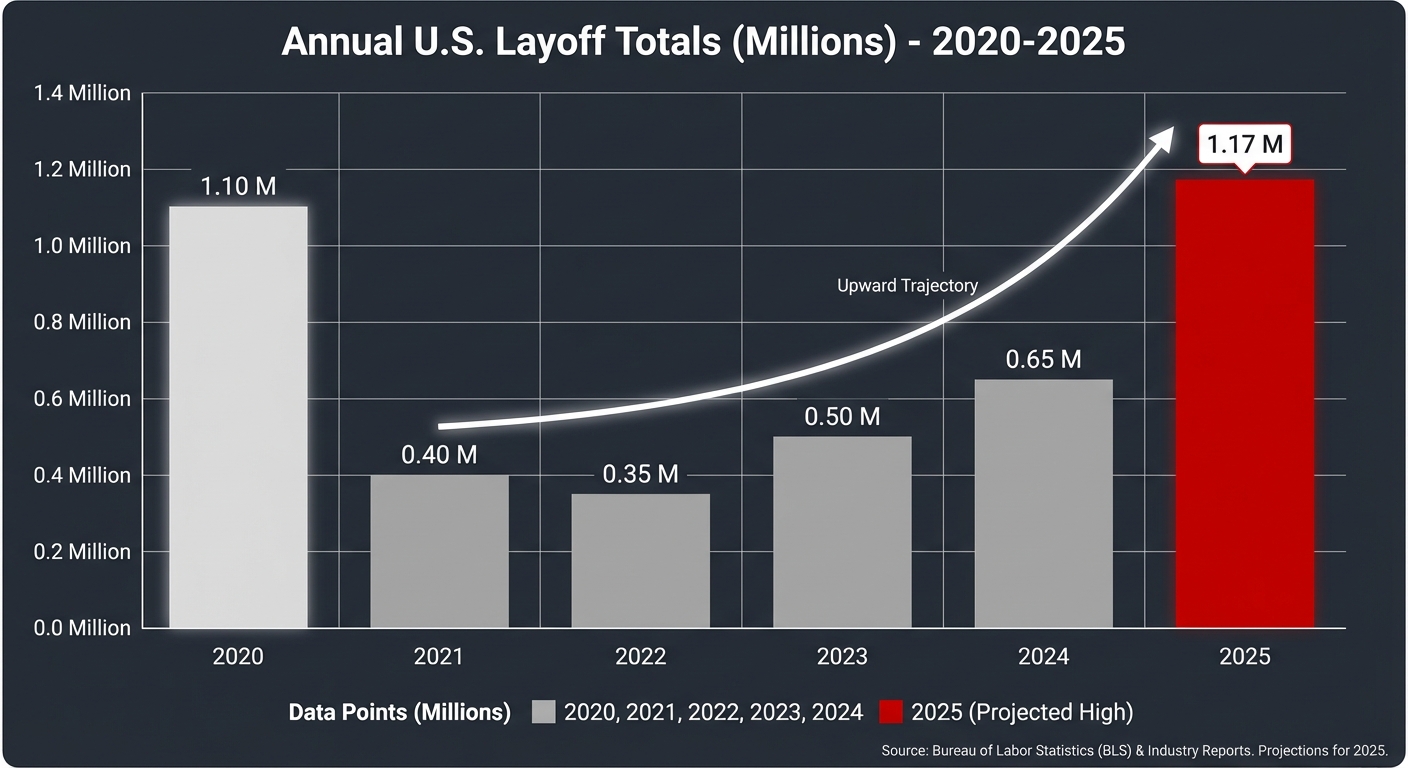

Here’s a number that should make you uncomfortable: 1,170,821.

That’s how many jobs U.S. employers have announced cutting so far in 2025, according to outplacement firm Challenger, Gray & Christmas. It’s a 54% increase from the same period last year and the highest total since the first year of the pandemic, when COVID-19 shut down entire sectors of the economy overnight.

But here’s what makes 2025 different from 2020: there’s no pandemic. There’s no sudden external shock that explains why more than a million Americans received layoff notices this year. Instead, what we’re witnessing is something economists are calling “forever layoffs,” a structural shift in how companies approach workforce management that treats job cuts not as crisis response but as routine optimization.

If you’ve felt like layoff announcements have become constant background noise in 2025, that’s because they have. And the data suggests this isn’t a temporary spike, it’s the new normal.

The Numbers Behind the Crisis

The scale of 2025’s job losses puts this year in sobering historical company. According to CNBC’s analysis, this is only the sixth year since 1993 in which announced layoffs through November have topped 1.1 million. The others? 2001, 2002, 2003, 2009, and 2020. Every single one of those years was marked by either a major recession or a once-in-a-generation economic shock.

November alone saw 71,321 job cuts announced, a 24% increase from the same month last year and the highest November total since 2022. Verizon’s announcement that it would slash more than 13,000 positions drove much of that month’s total, but the pain was spread across sectors.

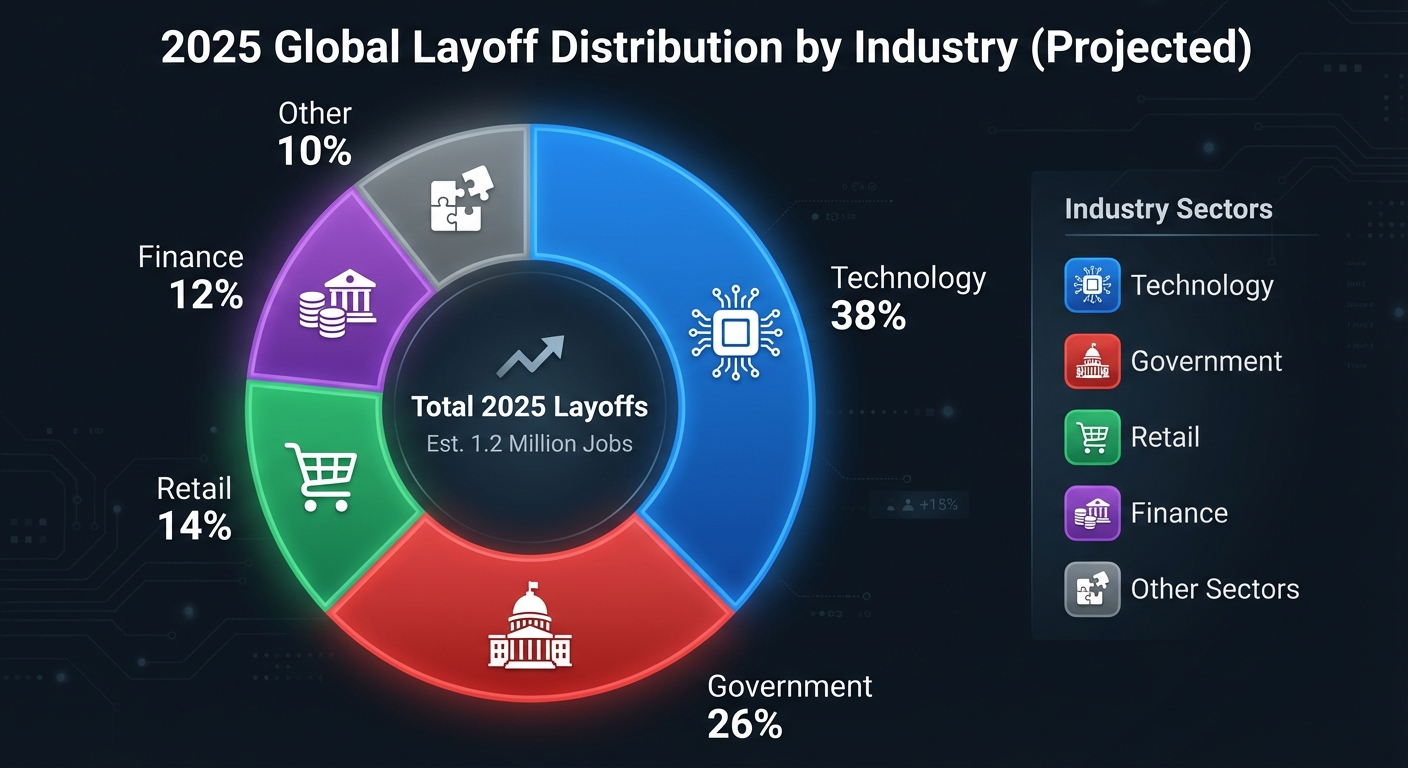

Two industries have borne the heaviest burden. Government layoffs, many stemming from cuts initiated by the Department of Government Efficiency during Elon Musk’s tenure, account for a massive portion of the losses. But technology remains the hardest-hit private sector, with more than 150,000 announced cuts this year. TechCrunch’s running tally shows at least 126,101 workers at U.S.-based tech companies have lost their jobs in mass layoffs since January.

What’s driving tech cuts in a year when AI investment is breaking records? Paradoxically, AI itself. Companies cited artificial intelligence for 54,694 layoffs this year, using automation capabilities to eliminate positions while redirecting investment toward machine learning infrastructure. Even as big tech pours billions into AI development, the workers building these systems find themselves increasingly disposable.

The Structural Shift

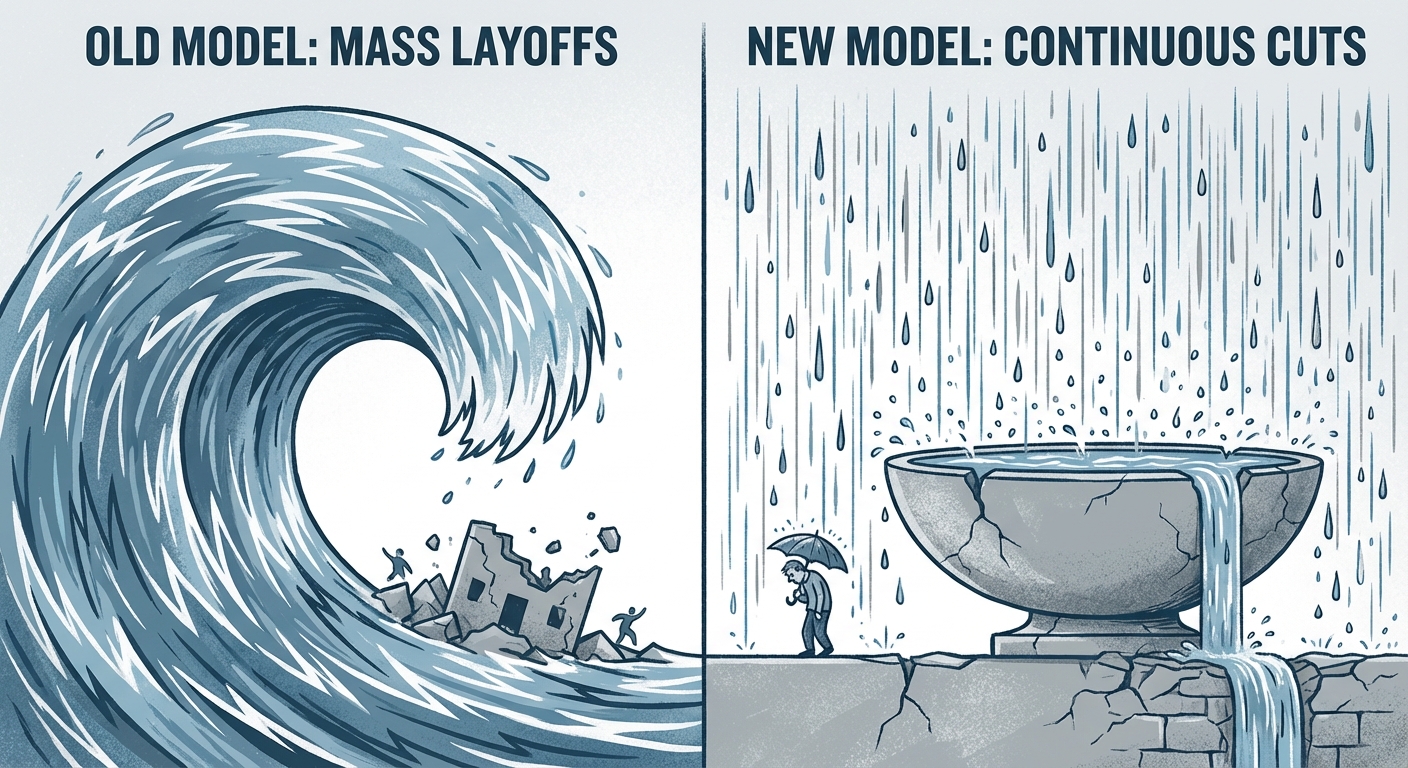

The most troubling aspect of 2025’s layoffs isn’t the total number, it’s the pattern.

Glassdoor’s 2026 Worklife Trends analysis, reported by Fortune, identifies a fundamental change in corporate behavior. Where layoffs once came in large, dramatic waves tied to specific business crises, companies have shifted to frequent, smaller cuts affecting fewer than 50 workers at a time. These “forever layoffs” now account for the majority of workforce reductions, with the share of small layoffs rising from well under half in the mid-2010s to more than half by 2025.

This shift has profound implications for workers. Traditional mass layoffs, while devastating, were events you could see coming and prepare for. They triggered support systems: severance packages, extended health coverage, job placement services. They generated media attention and sometimes political response.

The forever layoffs model operates differently. When a company cuts 40 workers every few weeks rather than 2,000 workers once, each individual reduction falls below the threshold that triggers news coverage or regulatory notice. Severance packages tend to be smaller. The affected workers disappear into the job market without the visibility that might galvanize support or policy response.

“We’re seeing a normalization of workforce volatility that we haven’t seen before,” Andrew Challenger, senior vice president at Challenger, Gray & Christmas, told The Hill. “Companies have learned they can continuously right-size without the reputational damage that used to come with big layoff announcements.”

Who’s Being Cut and Why

The composition of 2025’s layoffs reveals important patterns about which workers are most vulnerable.

White-collar and knowledge workers have been hit disproportionately hard. The ADP employment report showed a surprise drop of 32,000 roles in November, with professional services bearing significant losses. This represents a departure from historical patterns where manufacturing and retail absorbed most recessionary job losses.

According to Visual Capitalist’s sector breakdown, the pattern reflects several overlapping trends. AI adoption is eliminating middle-management and administrative positions that once seemed secure. Remote work restructuring has prompted companies to consolidate geographic footprints. And the government efficiency initiatives have sent ripples through both public sector employment and the contractor ecosystem that depends on federal spending.

The result is what economists call a “K-shaped” recovery, where some segments of the economy thrive while others struggle. Service workers in hospitality and healthcare face labor shortages and rising wages. But the professional class, particularly those in their 40s and 50s with higher salaries, find themselves competing for fewer positions.

The Fed’s Complicated Dance

The Federal Reserve finds itself in an unusual position. On one hand, the unemployment rate remains historically low by traditional measures. On the other, the pace of layoffs suggests an economy that isn’t as healthy as headline numbers indicate.

Fed Chair Jerome Powell acknowledged the tension in recent comments. “Gradual cooling in the labor market has continued,” Powell said after the December rate cut, noting that surveys show “declining supply and demand for workers.” The Fed cut rates for the third time this year, bringing the federal funds rate to 3.50%-3.75%, but signaled caution about future reductions.

The challenge is that traditional metrics don’t fully capture the forever layoffs phenomenon. Unemployment claims, which measure people actively seeking work, don’t reflect discouraged workers who’ve left the labor force or those who’ve taken significant pay cuts to remain employed. The workforce participation rate for prime-age workers has improved but remains below pre-pandemic levels for certain demographics.

For workers wondering whether rate cuts will help, the answer is complicated. Lower borrowing costs may encourage business investment and hiring, but they won’t reverse the structural shift toward continuous workforce optimization.

What This Means for Workers

If you’re employed, the data suggests some practical considerations. Job security, even in traditionally stable roles, has become more contingent. The average tenure at a single employer continues to decline, and the expectation of long-term employment at a single company increasingly belongs to an earlier era.

Financial advisors recommend maintaining larger emergency funds than conventional wisdom once suggested. The traditional three-to-six-month buffer may be insufficient when job searches in competitive fields routinely extend beyond six months. Continuous skill development, particularly in areas adjacent to AI implementation rather than vulnerable to AI replacement, has become essential. Some companies are experimenting with alternative work arrangements like the four-day workweek, though these remain the exception rather than the rule.

For those currently job searching, the market presents a paradox. Hiring continues in many sectors, unemployment remains relatively low, and wages have generally kept pace with inflation. But competition for desirable positions has intensified as previously laid-off workers flood the market.

The Bottom Line

The 1.17 million layoffs announced in 2025 represent more than a bad year. They signal a permanent change in the employment contract between American companies and workers. The forever layoffs era means continuous uncertainty rather than periodic crises, smaller cuts that fly under the radar rather than visible events that generate support, and a labor market where even prosperity feels precarious.

Companies have optimized workforce management the same way they optimized supply chains: for flexibility, efficiency, and the ability to respond quickly to changing conditions. The workers who make up those workforces have become, in economic terms, just-in-time inventory.

For workers, the response requires adaptation. Build skills that remain valuable in an AI-augmented economy. Maintain financial buffers that assume employment disruption is when, not if. And recognize that the employment relationship has fundamentally changed, regardless of what any particular job listing promises.

The good news, if there is any, is that awareness is the first step toward preparation. The forever layoffs era rewards those who plan for discontinuity rather than assuming stability. In a job market where 1.17 million cuts became the new normal, resilience isn’t optional.

It’s survival.

Sources: CNBC, TechCrunch, Fortune, The Hill, Visual Capitalist, Challenger, Gray & Christmas.