Your health insurance is about to get a lot more expensive, and there’s almost nothing you can do about it. House Speaker Mike Johnson announced this week that Republicans won’t hold a vote to extend the enhanced premium subsidies that have kept Affordable Care Act coverage affordable for nearly 22 million Americans. Those subsidies expire on December 31st, and absent a legislative miracle in the next two weeks, premiums will more than double for millions of families starting January 1st.

The math is brutal, arriving at a particularly difficult time as the Federal Reserve continues adjusting interest rates in response to economic conditions. According to analysis from the Kaiser Family Foundation, the average subsidized enrollee currently pays $888 per year for marketplace coverage. In 2026, that same coverage will cost $1,904, a 114% increase. For a family of four earning $60,000 a year, the difference could mean choosing between health insurance and other essentials.

How We Got Here

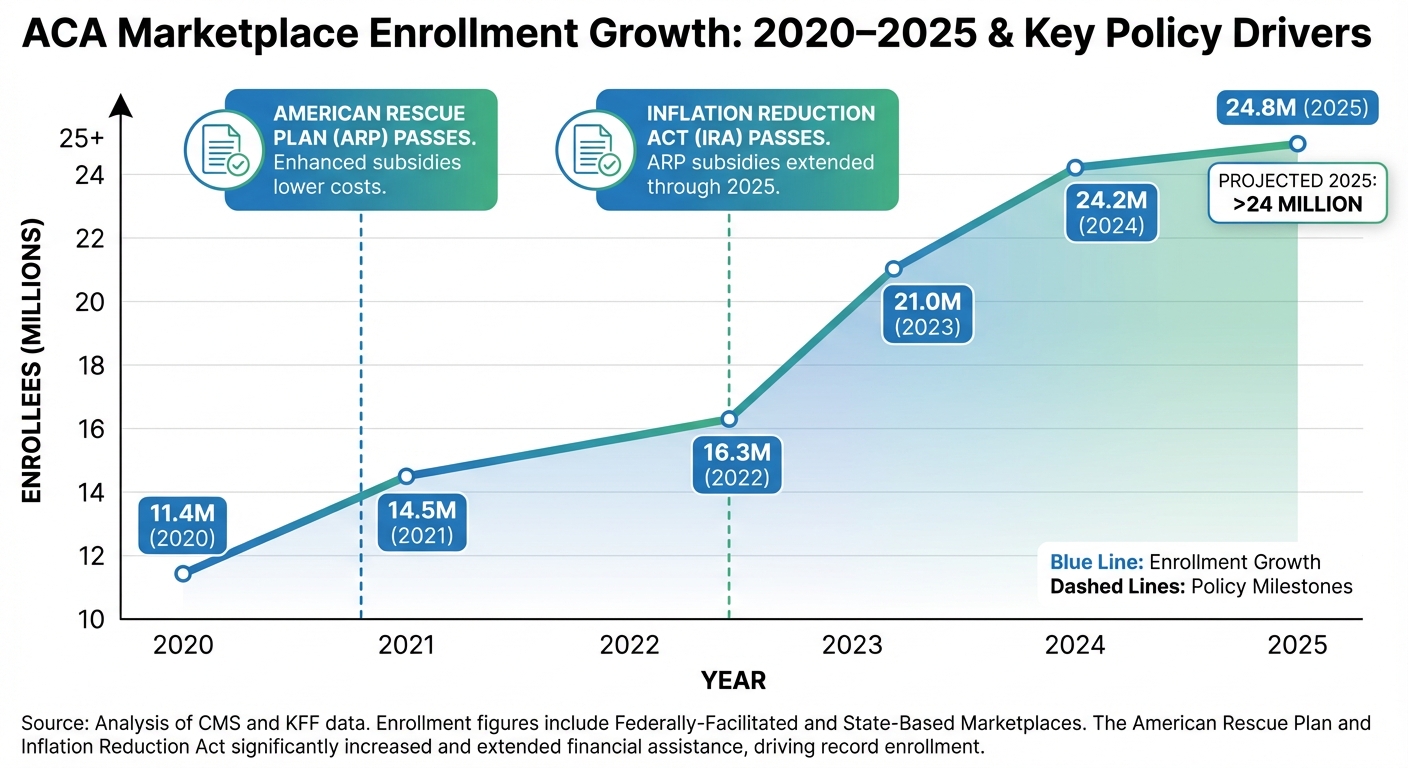

The enhanced premium tax credits were a pandemic-era policy that became unexpectedly popular. Congress first introduced them in 2021 through the American Rescue Plan, then extended them through the Inflation Reduction Act until the end of 2025. The subsidies worked by increasing financial assistance for people already eligible for help while making middle-income households newly eligible for support.

The results were dramatic. Marketplace enrollment more than doubled, from about 11 million people before the enhanced credits to over 24 million today. The vast majority of those new enrollees receive subsidies, and many would not have been able to afford coverage otherwise. The policy achieved something rare in American healthcare: it actually expanded coverage while making insurance more affordable.

So why is Congress letting it die? The answer involves familiar Washington dysfunction, ideological disagreements about the role of government in healthcare, and a price tag that makes fiscal conservatives nervous. Extending the subsidies for three years would cost approximately $335 billion according to Congressional Budget Office estimates. In a Congress fighting over deficit reduction, that’s a hard sell.

The Political Theater That Went Nowhere

Both parties took votes last week, and both failed spectacularly. Senate Democrats pushed a clean three-year extension of the existing subsidies. It went down 51-48, though notably four Republicans crossed party lines: Susan Collins of Maine, Josh Hawley of Missouri, and both Alaska senators Lisa Murkowski and Dan Sullivan. That bipartisan crack suggests some Republicans recognize the political danger of millions of constituents losing affordable coverage.

Senate Republicans countered with an alternative approach centered on Health Savings Accounts. The Cassidy-Crapo proposal would redirect subsidy money into HSAs for people enrolled in “catastrophic” or bronze-level plans. The theory is that giving people more control over healthcare spending, combined with lower-premium high-deductible plans, would bring costs down. Democrats rejected it as insufficient, and it also failed.

The most telling comment came from Representative Mike Lawler, a Republican from New York, who pointed out to reporters that “three-quarters of people on Obamacare are in states Donald Trump won.” He’s right, and it highlights the awkward political reality: the constituents most likely to lose coverage are disproportionately Republican voters in red states.

Who Gets Hurt the Most

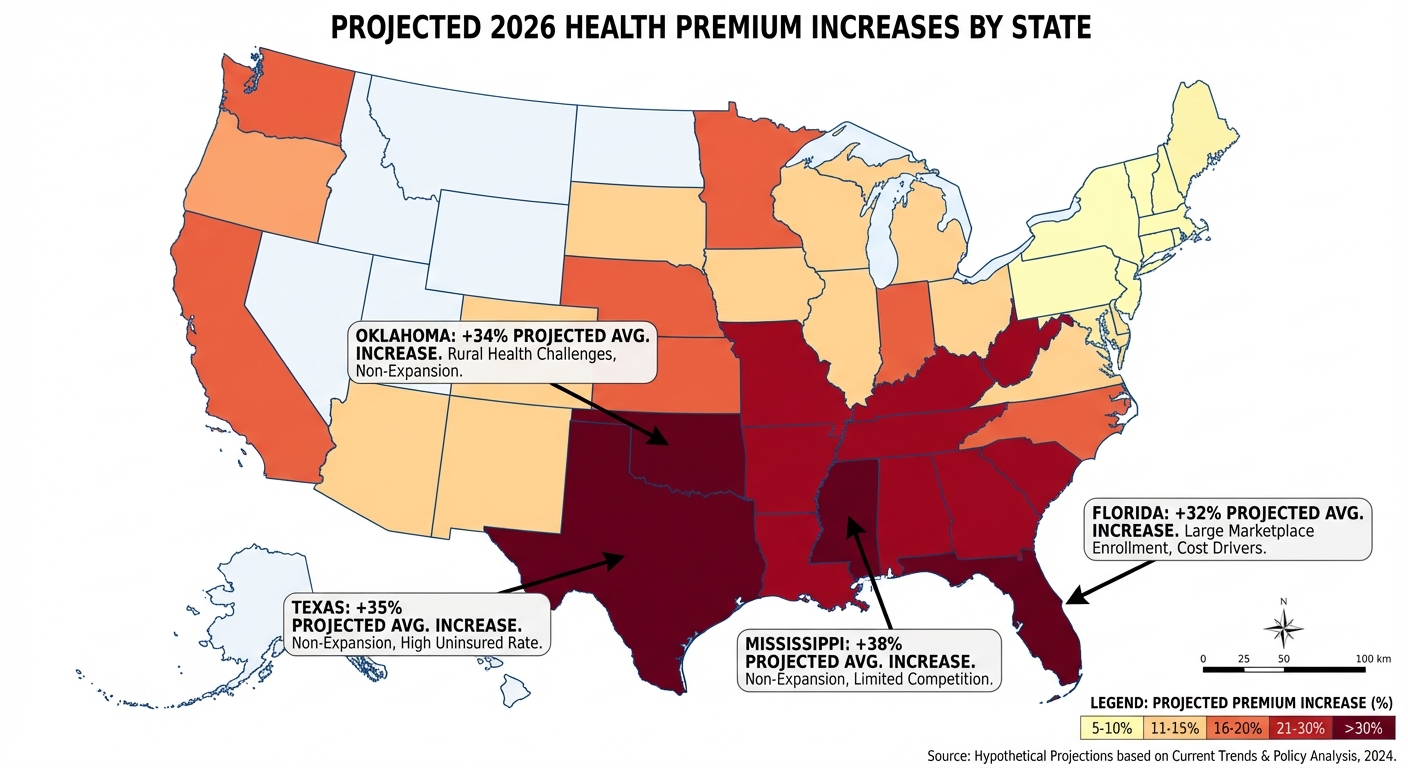

The geographic distribution of pain is stark. According to analysis from MoneyGeek and the Peterson-KFF Health System Tracker, Southern states face the largest premium increases. These are overwhelmingly states that declined to expand Medicaid under the ACA and lack state-level reinsurance programs that would cushion the blow. The South is seeing average premium growth around 29%, compared to roughly 9% in the Northeast.

Florida takes the hardest hit in absolute numbers. The state has the highest ACA marketplace enrollment in the country, and the Commonwealth Fund estimates it could lose nearly 50,000 jobs, over $300 million in tax revenue, and more than $5.5 billion in state GDP from the healthcare sector fallout. These potential job losses would add to what has already been a brutal year for American workers facing layoffs. Texas and California follow close behind, with combined projections of over 3 million people potentially losing coverage.

The Center on Budget and Policy Priorities warns of a potential death spiral. When subsidies disappear and premiums spike, healthier people tend to drop coverage first because they’re gambling that they won’t need it. That leaves a sicker, more expensive risk pool, which drives premiums even higher, causing more people to drop out. Insurers have already priced this expectation into their 2026 rates, adding an average of 4 percentage points to premiums just based on anticipated coverage losses.

The Early Warning Signs Are Already Here

Open enrollment data from several states suggests the exodus has already begun. Colorado reports enrollment running about 5% below last year at this point in the sign-up period. More concerning, many enrollees who previously held Gold or Silver plans are downgrading to Bronze-level coverage with higher deductibles and worse benefits. They’re trying to stay insured, but they’re accepting less protection to do it.

New York, Pennsylvania, Idaho, and California are seeing similar patterns. People are making rational calculations: if my premium is going to double, maybe I’ll take the plan with the $8,000 deductible instead of the one with full coverage. The result is a workforce that’s technically insured but functionally underinsured, one medical emergency away from financial catastrophe.

What Happens Now

Unless something dramatic changes, the enhanced subsidies will expire on January 1st. Congressional leaders could theoretically negotiate a last-minute deal as part of year-end legislative negotiations, but no serious talks are underway. Some advocates hold out hope for action in early 2026 that could retroactively restore benefits, but that would require political will that doesn’t appear to exist.

For the 22 million people currently receiving enhanced subsidies, the advice from healthcare navigators is simple but unsatisfying: shop carefully during open enrollment, consider all your options, and prepare for higher costs. Some people may qualify for Medicaid if their income drops. Others might access employer coverage they previously declined. But for many, the choice will come down to paying significantly more or going without.

The Bottom Line

The expiration of ACA premium subsidies represents the largest single reduction in health coverage since the law’s passage in 2010. It’s happening not because of a deliberate policy choice to eliminate the subsidies, but because Congress couldn’t agree on how to extend them. The political irony is that the pain will fall disproportionately on Republican voters in Republican states, and yet Republican leadership has decided this is a fight not worth having.

What comes next depends on whether the political consequences materialize. If millions of people lose coverage and blame their representatives, we might see retroactive action. If the issue fades from the news cycle, the subsidies may be gone for good. Either way, for the families watching their premiums double next month, the policy debate is academic. The bills will arrive regardless.

Sources: NPR, NBC News, Kaiser Family Foundation, PBS News, CBPP, TIME.