Wall Street just kicked off its third consecutive year of double-digit gains, and the market’s message is clear: bet on AI, and specifically, bet on the companies making the chips that power it. Semiconductor stocks surged in the first trading days of 2026, with Micron Technology and ASML jumping 10% and 9% respectively. The broader market edged higher too, with the S&P 500 adding to a 16.4% gain in 2025.

The question on every investor’s mind isn’t whether AI is transforming the economy. At this point, that’s obvious. The question is whether three years of spectacular gains have created a bubble waiting to pop, or whether we’re still in the early innings of a generational technology shift. The answer will determine fortunes in 2026.

The Chip Rally That Won’t Quit

The semiconductor sector has been the clearest winner of the AI era, and the first week of 2026 showed no sign of that changing. The VanEck Semiconductor ETF rallied about 4% to kick off the year, building on a nearly 49% gain in 2025. That’s the sector’s third straight year of massive returns, following its best year ever in 2023 when it gained more than 72%.

The individual stock moves were even more dramatic. Beyond Micron and ASML’s double-digit jumps, Lam Research and Intel rallied more than 6% each. Marvell Technology rose 5%, while AMD and NVIDIA gained 4% and 1% respectively. When the entire sector moves together like this, it signals institutional investors placing big bets on the AI infrastructure build-out continuing.

What’s driving the confidence? The fundamentals actually support the enthusiasm, at least for now. Bank of America analyst Vivek Arya forecasts a 30% year-over-year surge in global semiconductor sales that will finally push the sector past a historic $1 trillion annual sales milestone in 2026. That’s not speculative hope. It’s based on order books, supply contracts, and the massive capital expenditure plans announced by cloud providers and AI companies.

Why Micron Is the Analyst Favorite

If you had to pick one stock that captures the 2026 AI thesis, Morgan Stanley says it’s Micron Technology. The bank named Micron its top semiconductor pick for 2026, arguing that the ongoing AI buildout has created the most severe DRAM and NAND memory shortage in the last three decades.

That shortage is driving prices higher across the memory industry, and Micron is positioned to benefit more than competitors. The company gained 10 percentage points of market share in HBM (High Bandwidth Memory) over the past year, and HBM is the crucial memory technology that sits inside AI accelerators. Every NVIDIA H100 or Blackwell chip needs massive amounts of HBM to function, and Micron is now a major supplier.

This is the supply chain logic that drives AI investing: NVIDIA gets the headlines, but the entire ecosystem benefits. Memory makers, chip manufacturing equipment companies like ASML and Lam Research, and even the companies designing chip software all participate in the boom. Kioxia’s 540% gain made it the best-performing stock of 2025, and that pattern of picks-and-shovels plays outperforming could continue in 2026.

The Broader Market Picture

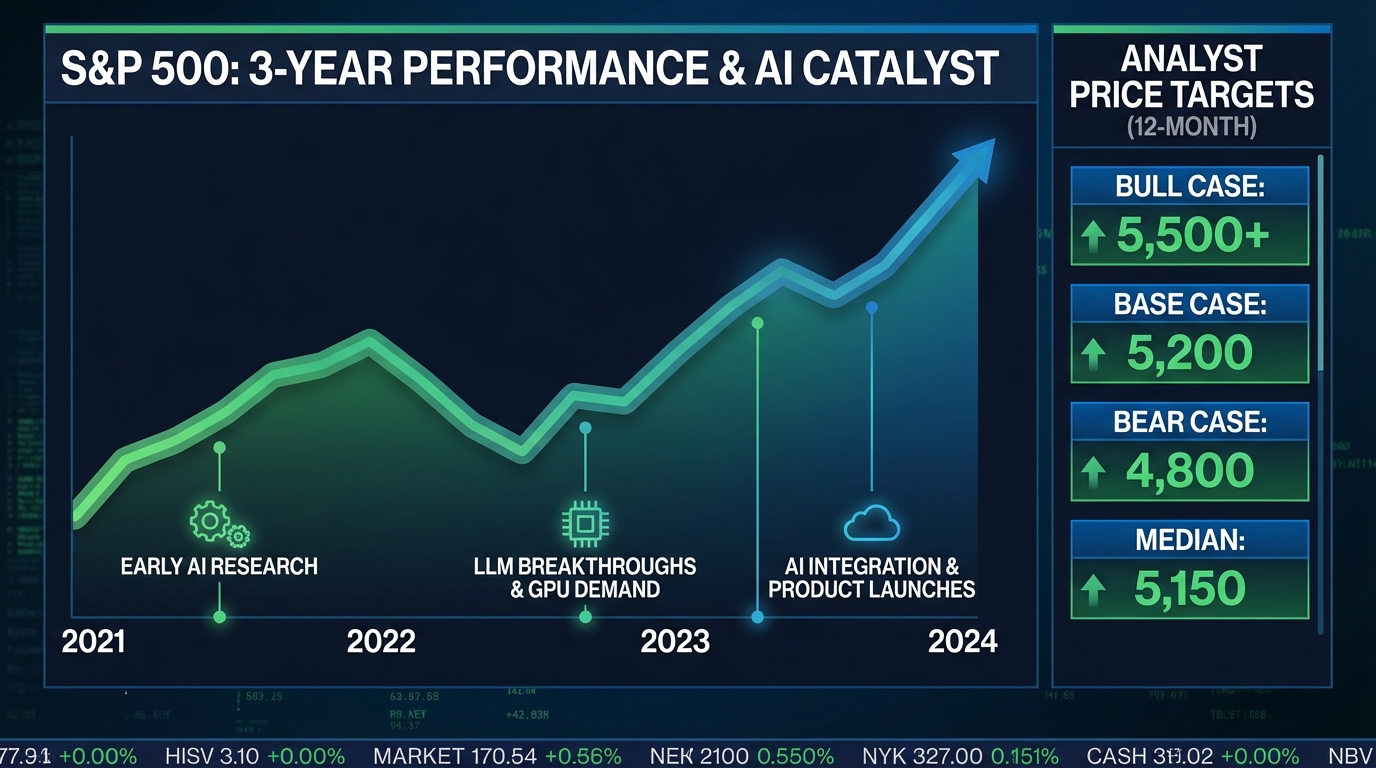

Beyond semiconductors, Wall Street enters 2026 with a cautiously optimistic outlook. The S&P 500 is coming off three consecutive years of double-digit percentage gains, a streak that’s historically rare but not unprecedented. Most strategist forecasts for year-end 2026 S&P 500 levels cluster around 7,500 to 8,000, with optimistic calls reaching approximately 8,200 from firms like Oppenheimer and Deutsche Bank. With the index hovering near 6,800, that implies significant potential upside.

Fidelity International calls AI “the defining theme for equity markets” in 2026, while the BlackRock Investment Institute says the technology will likely “keep trumping tariffs and traditional macro drivers.” That’s a remarkable statement from institutions managing trillions in assets. They’re essentially saying that AI is now more important than trade policy, interest rates, or economic cycles for determining stock market direction.

But not everyone is buying the narrative. Bank of America strategist Savita Subramanian noted that the S&P 500 has “never been more expensive” when looking at a variety of valuation metrics. She added that “risks to the index abound in 2026,” pointing to the possibility that AI investments might not generate returns quickly enough to justify current spending levels.

The Bear Case: Is This 1999 Again?

The most prominent AI skeptic right now is Michael Burry, the investor made famous by “The Big Short” for betting against the housing market before the 2008 financial crisis. In November, Burry revealed short positions in both NVIDIA and Palantir, two of the biggest AI winners. His track record demands attention, even if his timing has been off before.

The bull-versus-bear debate on AI comes down to one fundamental question: Is this a technology revolution comparable to the internet, or is it a speculative bubble comparable to the late-1990s dot-com era? The honest answer is that both precedents offer useful lessons.

The internet bears of 1999 were right that valuations were unsustainable and that most dot-com companies would fail. But they were wrong about the underlying technology, which went on to reshape every industry exactly as promised, just on a longer timeline and with different winners than the market expected. Amazon traded at $106 in December 1999, crashed to $6 in 2001, and today trades above $200. The transformation was real; the path to profits was just longer than investors anticipated.

AI could follow a similar pattern. The technology is clearly transformative, and the current leaders have real revenues and profits, unlike most dot-com companies. But valuations assume continued exponential growth, and that growth requires AI applications to generate economic value beyond just building more AI infrastructure. At some point, the actual return on investment for enterprise AI deployments has to materialize.

The Fed Factor

Adding complexity to the 2026 outlook is the Federal Reserve’s uncertain path. After several rate cuts brought the federal funds rate to the 3.50% to 3.75% range, officials and market forecasts suggest a pause early in the year. Most traders expect the Fed to hold steady at the January meeting, with bets more split for March.

President Trump has promised to appoint a new Fed chair to replace Jerome Powell, adding political uncertainty to monetary policy. The December 2025 rate cut was likely the last under Powell’s leadership, and markets will be watching closely to see whether Trump’s appointee maintains the current approach or shifts toward the more aggressive easing the president has repeatedly demanded.

Interest rates matter for tech stocks because higher rates reduce the present value of future earnings, which hits growth stocks hardest. The 2022 tech crash coincided with the Fed’s aggressive rate hiking cycle. If rates stay higher for longer in 2026, AI stocks could face valuation pressure even if the underlying technology continues advancing.

The IPO Pipeline

One signal to watch in 2026 is the IPO market. After a relatively quiet 2024, the pipeline for 2026 includes some of the biggest private companies in technology. SpaceX, Anthropic, Databricks, Cerebras, and potentially even OpenAI are all rumored to be considering public offerings.

If these IPOs proceed successfully, it would validate the current AI investment thesis and provide new vehicles for investor enthusiasm. If they’re delayed or priced below expectations, it could signal that the private market is ahead of what public investors are willing to pay. Databricks’ recent $13.4 billion valuation in private markets sets a high bar for any eventual public offering.

What to Watch This Week

CES 2026 will set the near-term narrative for AI investing. NVIDIA CEO Jensen Huang’s keynote today at 4 PM ET will be closely watched for any signals about demand, supply chains, or the competitive landscape. AMD’s Lisa Su follows with her own presentation, and Intel’s Jim Johnson will provide updates on the company’s turnaround efforts.

Beyond CES, the market outlook that experts laid out for 2026 will be tested against reality in the coming months. Earnings season begins later this month, and the big tech companies will either validate or challenge the assumption that AI spending continues accelerating.

The Bottom Line

Three years of gains have trained investors to buy every dip in AI stocks. That strategy worked brilliantly through 2025, and the early signals from 2026 suggest the momentum continues. The semiconductor sector’s opening-week surge, the optimistic Wall Street forecasts, and the massive infrastructure investments all point to another strong year for AI-linked equities.

But the valuation concerns are real, the historical parallels to previous bubbles are uncomfortable, and the timeline for AI to generate actual economic returns remains uncertain. The market is pricing in a future where AI transforms every industry and the current leaders capture most of that value. If that future arrives, today’s prices will look cheap. If it doesn’t arrive on schedule, the correction could be severe.

For investors, the practical question isn’t whether to believe in AI but how much risk to take on that belief. The first week of 2026 suggests Wall Street is still all-in. Whether that confidence is rewarded will be one of the defining stories of the year.

Sources

- CNBC: Chip Stocks Rally to Start 2026

- Seeking Alpha: Micron, Intel, AMD Lead Chip Stocks Higher

- Yahoo Finance: 6 Stocks to Lead the $1 Trillion Chip Surge

- CNN Business: What to Expect From Stocks in 2026

- Bloomberg: Wall Street’s 2026 Forecasts for Markets

- Charles Schwab: 2026 US Stocks and Economy Outlook